Pound Sterling Underpinned by "Stubborn Bid" Against Dollar and Euro

- Written by: James Skinner

Image © Adobe Images

The Pound was an underperformer in the final week of the year but it also appeared to benefit when a stubborn bid kept it buoyant above 1.20 against the Dollar and roughly 1.13 relative to the Euro, suggesting some in the market may perceive Sterling as offering value around those levels.

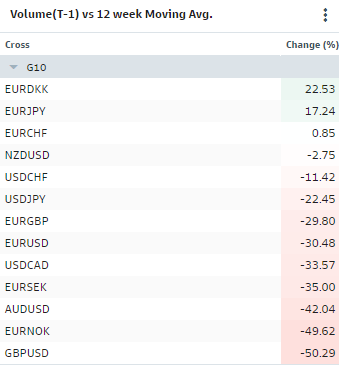

Interbank trading activity was notably lower this week while the Dollar, Sterling, Japanese Yen and Norwegian Krone were underperformers at the end of a turbulent year for financial markets in which a metaphorical curtain has appeared to be drawn on the era of inflation scarcity within developed markets.

While it's not yet clear whether washing away the period of inflation scarcity will also culminate in an end to the era of low and stable inflation, this year's ruptures between countries and across the global economy have made the latter a genuine prospect.

"EUR/USD and GBP/USD have both been swinging around in a range the past few days as month end / year-end flows tend to dominate the London morning and NY 11am fixing times," says Brad Bechtel, global head of FX at Jefferies.

"GBP/USD continues to hold 1.2000 on the downside as there remains a stubborn bid down there for now. Seems a matter of time before that gives way, and we test down to 1.1900 again," Bechtel writes in Thursday commentary.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of late September recovery indicating possible areas of technical support for Sterling and shown alongside Pound to Euro rate. Includes 200-day moving-average for GBP/USD. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of late September recovery indicating possible areas of technical support for Sterling and shown alongside Pound to Euro rate. Includes 200-day moving-average for GBP/USD. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

While inflation had already risen to above-target levels in many developed market economies before the Russian military crossed into Ukraine in February, the war has brought tragedy to people and peoples around the world while potentially marking a watershed moment for the global inflation outlook.

It's possible, if not somewhat likely, that how and when the war ends will be decisive in the determination of whether the above-referenced era of low and stable inflation can be preserved, making it an important influence on the global economic outlook across all possible time horizons.

The future of inflation will also remain an important influence on the outlook for currencies including Pound Sterling, which has been afflicted by one of the highest inflation rates in the developed world this year and remained at risk from some of the bleakest economic forecasts going into year-end.

High inflation in the UK is among the factors to have made the Pound one of the biggest fallers among major currencies for 2022 with losses of more than ten percent against the U.S. Dollar and almost five percent relative to the Euro.

"The EUR/GBP cross holding at elevated levels, and we need close above 0.8870 {GBP/EUR below 1.1273] area to really confirm a break higher and potential run at 0.9000 {GBP/EUR: 1.1111]," Jefferies' Bechtel said Thursday.

Above: Changes in interbank trading activity on Wednesday 29 December based on FX spot turnover on EBS and RUT trading platforms. Click each image for closer inspection. Source: Goldman Sachs Marquee.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes