Hedge Funds Bet on a Pound Sterling Rebound

- Written by: Gary Howes

Image © Adobe Images

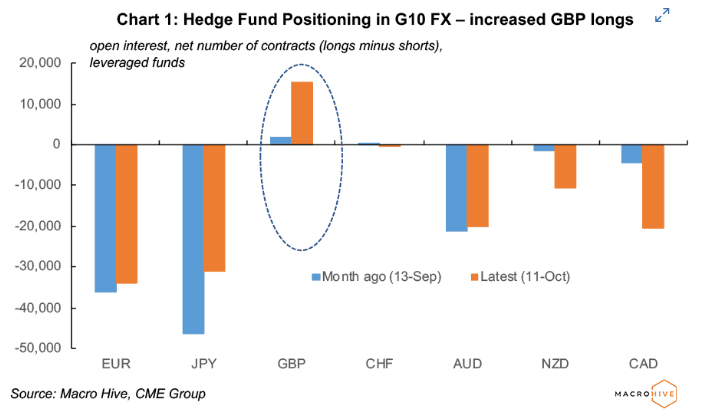

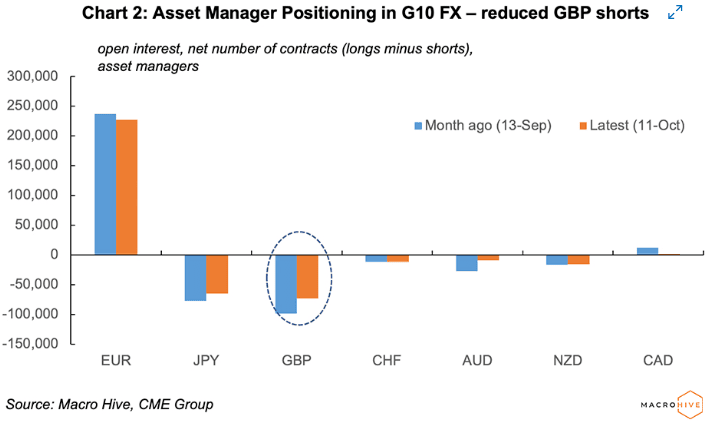

Analysis of positioning data shows hedge funds have raised bets for a recovery in the British Pound, while asset managers have reduced their 'shorts' against the currency.

These are the findings of independent research providers Macro Hive who have analysed the latest set of CME FX futures and options contracts.

The data is the largest and most reliable indicator of investor positioning available to analyst and provides crucial insights into how foreign exchange market sentiment is evolving.

"We find that despite the volatility in UK bond markets, hedge funds have steadily increased their net-long positions in GBP," says Bilal Hafeez, CEO and Head of Research at Macro Hive.

"Meanwhile, asset managers have reduced their net GBP shorts. Therefore, investors appear to be less nervous about GBP than it would first appear," he adds.

The British Pound rallied in October as investors cheered the removal of former Prime Minister Liz Truss and her Chancellor, Kwasi Kwarteng.

The pair's ill-fated mini-budget destabilised financial markets and investor sentiment towards the UK owing to the unfunded tax cuts proposed.

The Pound fell sharply but ultimately recovered when Kwarteng was replaced by Jeremy Hunt, who reversed Kwarteng's budget.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Further confidence was restored when Truss resigned and was replaced by Rishi Sunak, who had warned Truss' plans would result in financial market chaos during the Conservative Party leadership election campaign.

"Over the past month, hedge funds increased their net-long GBP positions and it remains their only long among the major G10 currencies," says Hafeez.

The Pound to Dollar exchange rate rose 2.75% in October, the Pound to Euro exchange rate rose 1.86%.

"Comparing hedge fund and asset manager positioning, we find both are net-short JPY, net-short AUD, and net-short NZD. But they notably disagree on GBP – hedge funds are net-long, while asset managers are net-short," says Hafeez.

Can the improvement in sentiment towards the Pound continue?

"With the U-turn in UK fiscal policy, we think much of the good news on the UK has likely been priced. We would consequently side with asset managers in being bearish GBP," says Hafeez.

Regarding the other major currencies, Macro Hive are looking for further underperformance in the Euro.

"We continue to think the Euro-area faces downside risks as we enter the winter months and so agree with hedge funds in being bearish EUR," says Hafeez.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes