Bailey Pulls the Plug: Pound Sterling Dumped as Bank of England Readies to Walk Away from Emergency Support Programme

- Written by: Gary Howes

- GBP falls by over a percent

- After BoE's Bailey says ready to exit emergency gilt support programme

- But some pension funds aren't ready for support to be pulled

- Expect gilts to come under pressure midweek

- GBP could see further significant declines as speculators pounce on UK assets

Image © Pound Sterling Live, Still Courtesy of Bloomberg TV.

The British Pound fell sharply late in U.S. trade after Bank of England Governor Andrew Bailey said the Bank would end its emergency support to pension companies on Friday, as planned.

Speaking in Washington DC Bailey said:

"The rebalancing must be done and my message to the funds involved and all the firms involved managing those funds: you've got three days left now. You've got to get this done."

The Bank of England has been backstopping the long-dated gilt market by buying up gilts, thereby keeping their yields lower.

This has in turn provided stability to a significant portion of the pensions industry that had come under pressure amidst a recent surge in bond yields following the UK government's 'mini budget'.

The action by the Bank has also supported Pound exchange rates.

The scheme is scheduled to end on Friday, but the Pound's reaction to Bailey's comments suggests the market was prepared to call the Bank of England's bluff, expecting the programme to be extended.

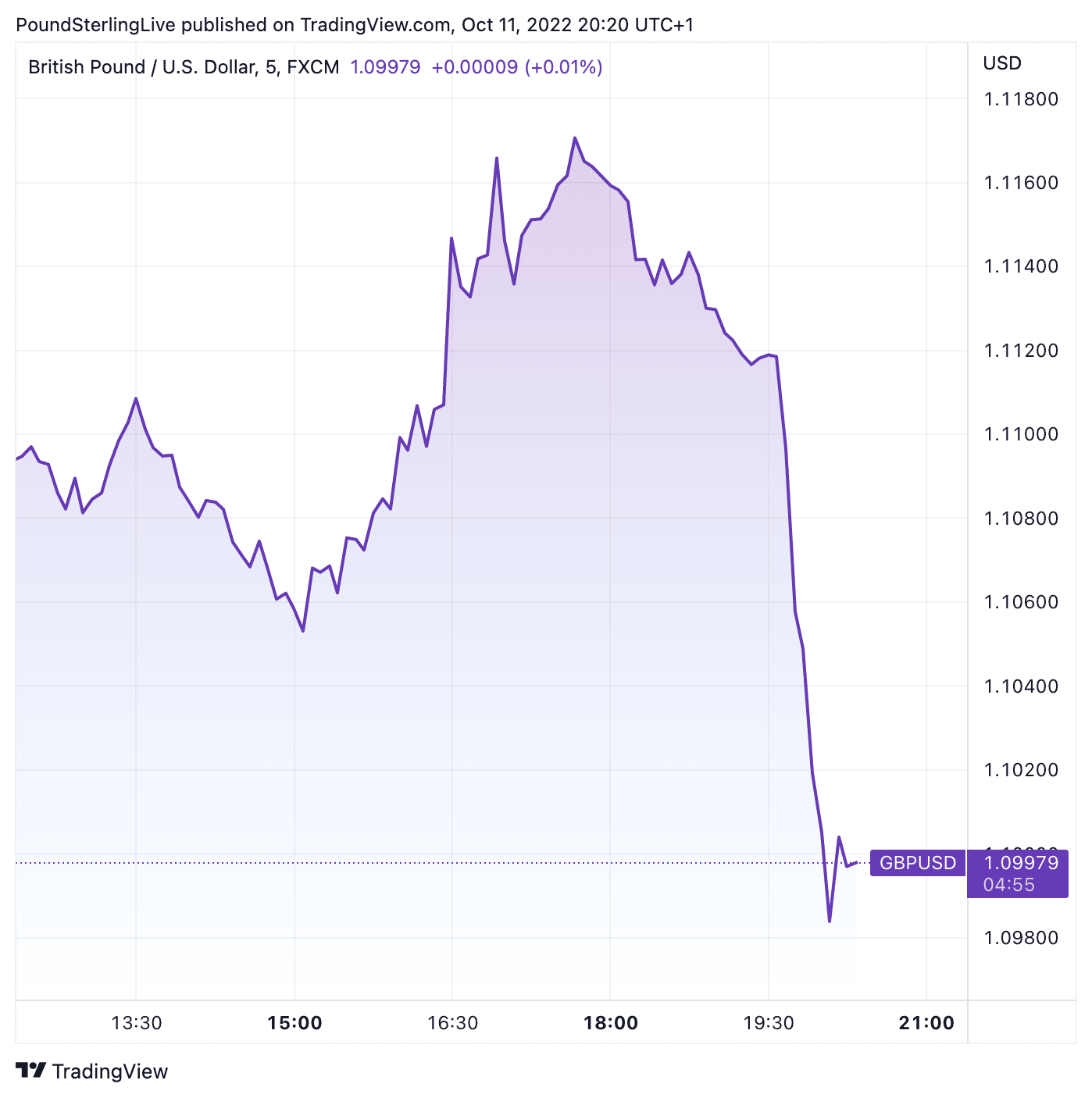

Above: GBP/USD at five-minute intervals showing a sharp sell-off in Sterling following Bailey's comments. To better time your payment requirements, consider setting a free FX rate alert here.

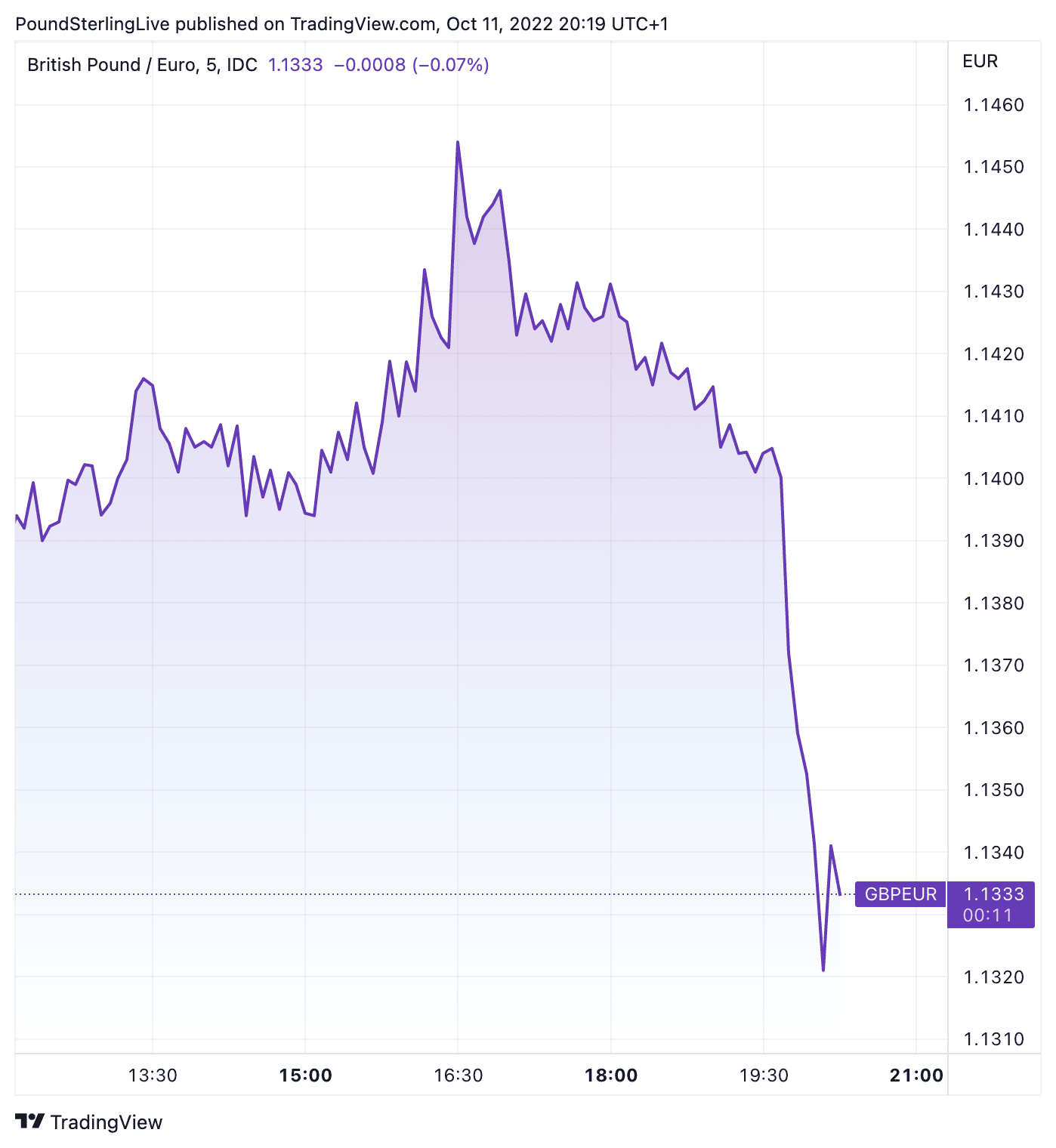

The Pound fell sharply against the Euro, Dollar and other currencies, suggesting investors are seeing financial risks in the UK rise sharply again.

UK bond markets are likely to see significant moves when they open for trading Wednesday with gilts likely to be sold heavily.

The Pound to Euro exchange rate dipped 1.20% in the hour following Bailey's comments, quoting at 1.0978 at the time of writing.

The Pound to Dollar exchange rate fell by a similar degree, landing at 1.0973.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: GBP/EUR at five-minute intervals showing the post-Bailey selloff.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Despite Bailey's strident warning, all is not well in the UK gilt market and reports suggest the pensions industry is by no means ready for the Bank of England to withdraw support.

Some pension funds are reportedly wanting the Bank to continue its intervention in gilt markets beyond its scheduled October 14 deadline, according to the Pensions and Lifetime Savings Association (PLSA).

The PLSA said in a statement it believed that most funds had used liability-driven investments "in a prudent manner".

But, "a key concern of pension funds since the BoE’s intervention has been that the period of purchasing should not be ended too soon," said the PLSA.

"Many feel it should be extended to the next fiscal event on October 31 and possibly beyond, or if purchasing is ended, that additional measures should be put in place to manage market volatility," it adds.

Speculators are likely to put the market to the test and we could see some heavy betting against UK gilts.

This could mean significant stresses for the Pound, given it has shown itself highly vulnerable to market stresses.

"We continue to see downside risks for the pound, as levels around 1.10 do not mirror the fragility of the UK bond market. Cable is pressing the 1.1000 support as we speak: we expect a decisive break below this level today or in the coming days, and currently target the 1.00-1.05 area for the pair into year-end," says Francesco Pesole, FX strategist at ING Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes