Pound Sterling Extends Gains against Euro and Dollar on post-Fed Relief

- Written by: Gary Howes

Above: File image ofFederal Reserve Chairman Jerome Powell. Image © Federal Reserve.

The British Pound extended its weekly advance against the Euro and Dollar amidst a positive market reaction following the Federal Reserve's decision to raise interest rates a further 75 basis points.

The Fed decision was always going to be this week's major market event and has proven supportive for Pound Sterling which is currently trading according to global factors.

A dearth of domestic news and data ahead of next week's Bank of England policy update leaves the Pound subject to broader risk trends, as we predicted here.

The Fed's decision to raise interest rates was expected but markets reacted positively to guidance that there would not be any acceleration in the pace the Fed intends to hike.

"Risk assets are now showing signs of relief that the Fed did not double down on inflation as some may have feared. The market was keen to classify this meeting one way or the other, but in truth there was a lot of balance to the 75bp hike. The slightly more dovish elements added to the statement were counteracted by Powell beginning the press conference with an inflation focus," says Peter McCallum, Rates Strategist at Mizuho Securities.

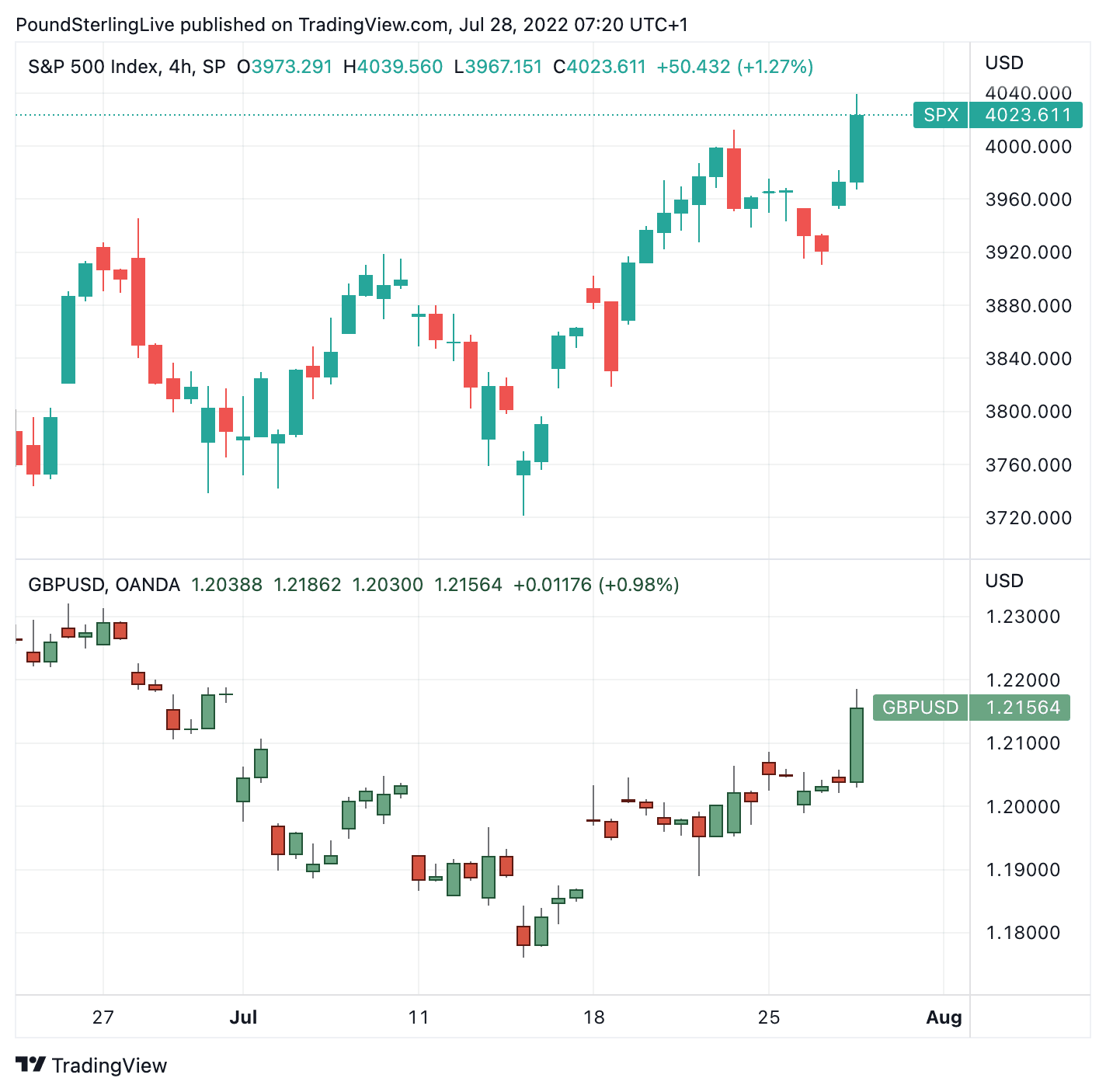

Above: S&P 500 (top) and GBP/USD (bottom), highlighting the Pound's positive correlation to global sentiment.

The relief is reflected in stock markets as investors look forward to the time the Fed's hiking cycle ultimately ends.

At the same time it is a negative for the Dollar which has trended higher over recent months in anticipation of further hikes, gaining further ground as investors sought its safety amidst falling stock markets.

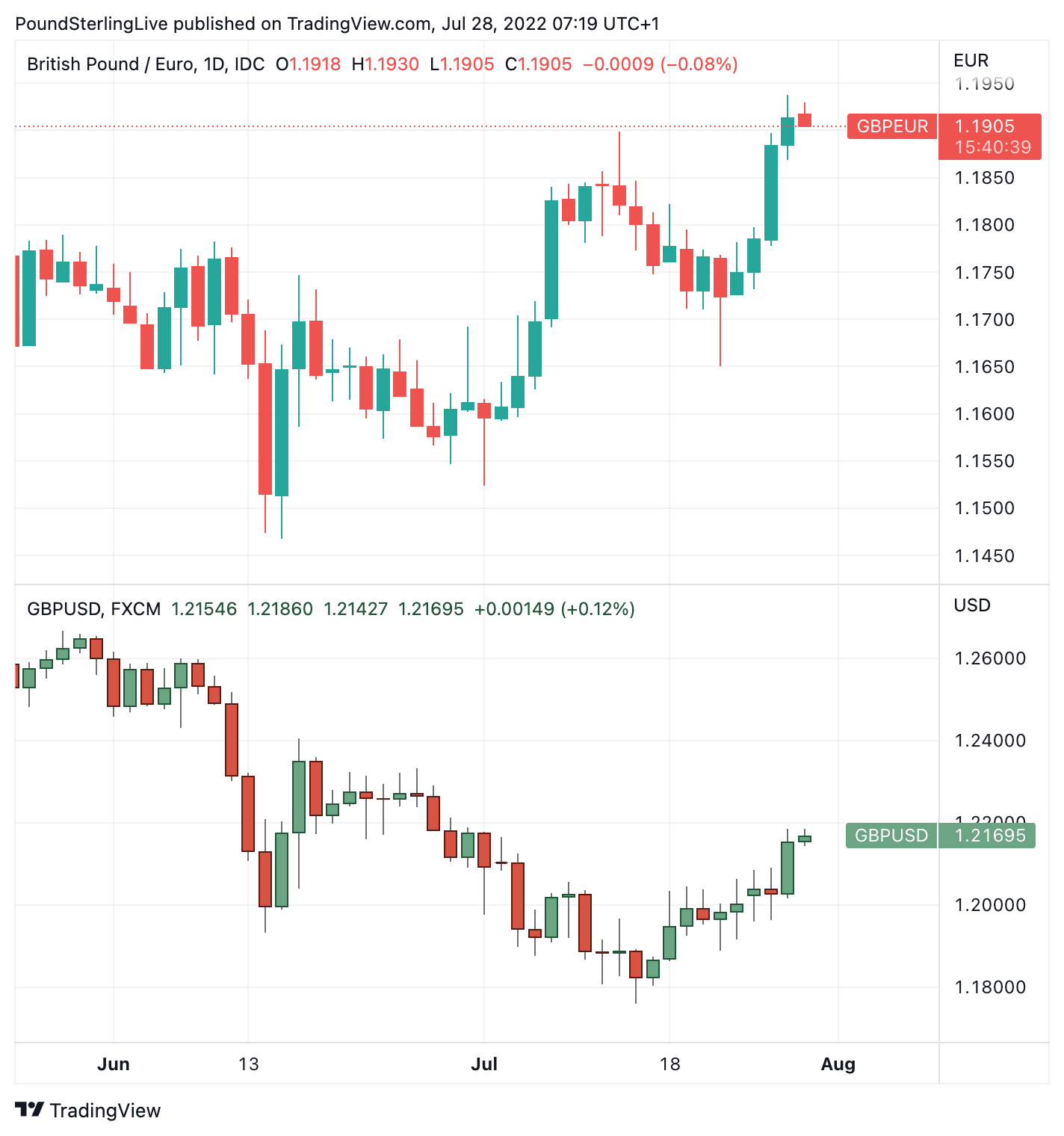

"The pound has strengthened further against the euro and has climbed around 1.5% against the dollar due to a combination of the US Federal Reserve’s latest interest rate decision and gas worries in the eurozone," says Alex Bennett, Managing Director at Smart Currency Business.

The Pound to Dollar exchange rate rose a percent on Wednesday and is trading higher again on Thursday at 1.2173, bank accounts are offering in the region of 1.1933 for dollar payments while independent FX providers are offering around 1.2140.

The Pound to Euro exchange rate advanced beyond 1.19 to trade as high as 1.1931, having completed four successive days of gains. Bank accounts are offering in the region of 1.1663 for euro payments while independent FX providers are offering around 1.1860.

The Pound is a 'high beta' currency, meaning pairs such as GBP/USD and GBP/EUR have a positive correlation with stock markets, therefore it could find further support if the current pro-risk investor sentiment extends over coming weeks.

"A currency is referred to as "high-beta" if it is sensitive to global risk appetite," says Kamal Sharma, currency strategist at Bank of America.

"GBP's sensitivity to world equity market has risen... about 35% of the currency's fluctuation can be explained by changes to the equity index," he adds.

Above: GBP/EUR (top) and GBP/USD (bottom) at daily intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes