British Pound Drubbed as Perfect Storm for Sterling Assets Swells

- Written by: James Skinner

“Article 18 of the Protocol contains what is known as ‘the democratic consent mechanism. This is a vote by the Northern Ireland Assembly on Articles 5 to 10 of the Protocol – these are the parts of the Protocol under which Northern Ireland applies regulations relating to the EU single market…If the Assembly votes against the motion, Articles 5 to 10 shall stop applying after two years,” Northern Ireland Assembly.

Image © Adobe Images

The Pound came under heavy and widespread pressure on Tuesday as global stock and bond markets took a drubbing while events in Westminster elicited ill founded speculation about the UK and EU trade relationship, whipping up a perfect storm for Sterling assets in the process.

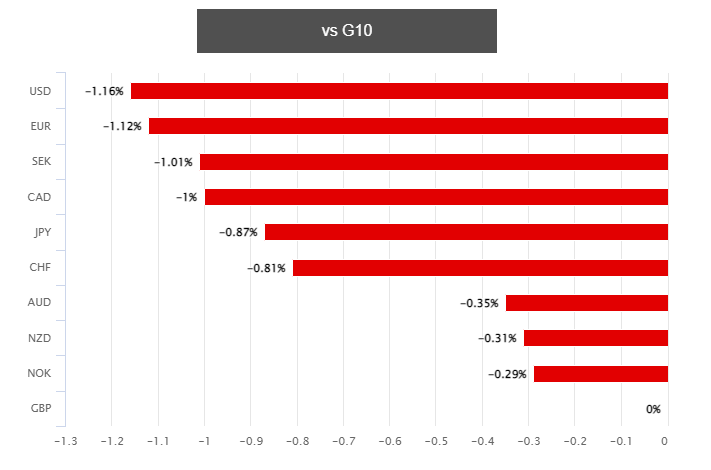

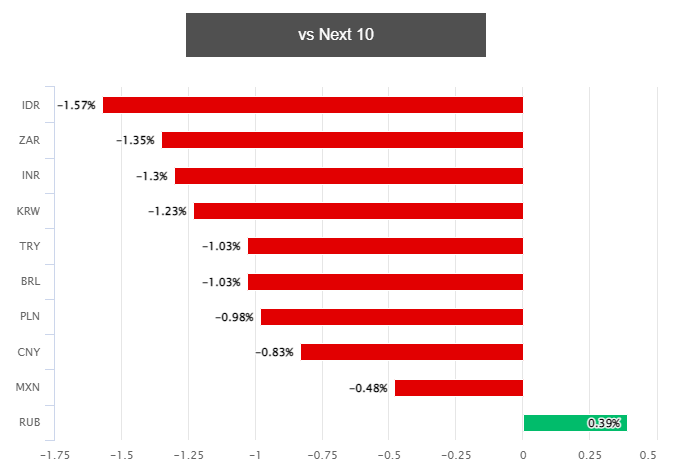

Pound Sterling fell to the bottom of the major currency bucket on Tuesday with its heaviest losses sustained at the hands of the Indonesian Rupiah, South African Rand, Indian Rupee and Korean Won but with the U.S. Dollar and Euro following closely behind in precisely that order.

Losses came alongside declines for stocks and bonds but were also steep and widespread enough to be indicative of a domestic influence at work on Sterling.

“The tentative evidence that the recent weakening in economic activity is filtering through into a slightly looser labour market may push the Bank of England a little closer to raising interest rates by 25bps on Thursday rather than by 50bps,” says Paul Dales, chief UK economist at Capital Economics.

“But with the Fed seemingly on the cusp of announcing a blockbuster 75bps hike tonight and the pound having already weakened to $1.22, we’re sticking to our forecast of a 50bps hike from 1.00% to 1.50%,” he adds.

Above: Pound Sterling relative to G10 counterparts on Tuesday. Source: Pound Sterling Live.

Above: Pound Sterling relative to G10 counterparts on Tuesday. Source: Pound Sterling Live.

Sterling’s losses escalated following the North American open on Tuesday but had been building since the morning hours when Office for National Statistics (ONS) figures suggested the job market may be cooling faster than the Bank of England (BoE) and other forecasters had anticipated.

Unemployment ticked higher from a multi-decade low of 3.7% in March to 3.8% in April while ONS measures of wage and salary growth came in lower than economists had expected barely a day after other data suggested the economy may be slowing faster than many had anticipated.

These figures followed behind others released back in May that showed UK inflation rising to 9% in April, which was a multi-decade high for price growth but also one that was below the 9.1% forecast of the BoE, which now finds itself in an awkward position ahead of Thursday’s interest rate decision.

“It’s going to be mighty close,” Capital Economics’ Dales said on Tuesday.

All recent data from the UK has been suggestive of ebbing economic demand and there is a risk that because of this the BoE will feel tempted to raise Bank Rate by only 0.25% on Thursday, which would be in defiance of market expectations that have most lately leaned toward a larger 0.50% move.

The above is one significant reason for why the Pound underperformed on Tuesday, although it’s relevant that these losses came in the wake of the government setting out domestic legislation to address the Northern Ireland Protocol and the risks it poses to stability in the province.

Above: Pound Sterling relative to other G20 counterparts on Tuesday. Source: Pound Sterling Live.

Above: Pound Sterling relative to other G20 counterparts on Tuesday. Source: Pound Sterling Live.

This protocol device was formerly known as the ‘Northern Irish Backstop’ and is something that is widely misreported upon as well as poorly understood in the media and across financial markets, meaning it could have been a contributing driver of the Pound’s losses on Tuesday.

“This is a reasonable, practical solution to the problems facing Northern Ireland. It will safeguard the EU Single Market and ensure there is no hard border on the island of Ireland. We are ready to deliver this through talks with the EU. But we can only make progress through negotiations if the EU are willing to change the Protocol itself – at the moment they aren’t,” Foreign Secretary Liz Truss said.

The UK government has set out to make changes to the Northern Ireland Protocol under Article 16 following 18-months of unproductive discussions with the European Commission and members of the EU bloc.

“Renegotiating the Protocol is unrealistic. No workable alternative solution has been found to this delicate, long-negotiated balance. Any renegotiation would simply bring further legal uncertainty for people and businesses in Northern Ireland. For these reasons, the European Union will not renegotiate the Protocol,” a spokesperson for the European Commission said.

All of this follows an even longer period of political unrest in Northern Ireland where the self-governing executive has collapsed and ‘unionist’ support for the ‘Belfast Agreement’ has been diminishing due to the questions posed by the protocol about the province’s place within the United Kingdom.

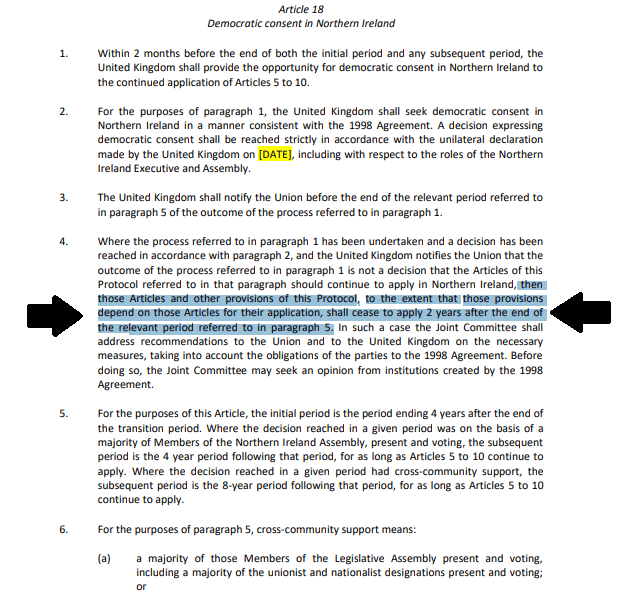

Above: Article 18, Northern Ireland protocol. Click image for closer inspection.

Above: Article 18, Northern Ireland protocol. Click image for closer inspection.

Cross-community participation is required by the Belfast Agreement for there to be any devolved government in the province - it's government from Westminster otherwise - and this participation is being withheld because there never has been and still is no 'unionist' consent for much of the protocol.

This democratic consent is a fundamental requirement of the protocol itself under Article 18, which provides a legal pathway through which much of the protocol can be repealed and replaced in 2024 and at frequent intervals thereafter if consent is not obtained from the Northern Irish Assembly.

“Article 18 of the Protocol contains what is known as ‘the democratic consent mechanism. This is a vote by the Northern Ireland Assembly on Articles 5 to 10 of the Protocol – these are the parts of the Protocol under which Northern Ireland applies regulations relating to the EU single market,” the Northern Ireland Assembly says in an explainer.

“If the Assembly votes against the motion, Articles 5 to 10 shall stop applying after two years. Exactly what would happen in this case is uncertain...If the motion is passed by a majority of MLAs, the next vote will be held 4 years later. If the motion is passed by a majority of MLAs and has cross-community support, the next vote will be held 8 years later,” the assembly also says.

Consent could never be obtained if the Northern Irish Assembly is closed and the province is being governed from London.

All of this often goes unacknowledged in other media and among financial market commentators, which calls into question either integrity or competence.