Pound Sterling Recovers Alongside 'Oversold' Stock Markets

- Written by: Gary Howes

- Stocks enter oversold territory

- A rebound could support GBP/EUR & GBP/USD

- 2022 promises to be a year of volatility

- Morgan Stanley say buy UK stocks

Image © Adobe Images

The British Pound is recovering recent losses and could push higher in the short-term should a global stock market rout come to an end.

Markets have stabilised after the wild swings seen at the start of the week and analysts are of the view that 2022 will be a volatile year for investors, posing difficulties in predicting how the UK currency might behave.

Pound Sterling dramatically reversed some of its 2022 gains against the Euro and Dollar after investors sold stocks and associated 'risk' assets in anticipation of higher U.S. interest rates and the ratcheting up of tensions on the Ukraine border.

"It has been a brutal start to the week for stocks," says Chris Beauchamp, chief market analyst at IG.

The Pound to Euro exchange rate fell as low as 1.1870 at one point on Monday before recovering back above 1.19 into Tuesday, the Pound to Dollar exchange rate went as low as 1.3440 before recovering to 1.479 on Tuesday.

The near-term outlook remains volatile as the Pound has a higher 'beta' to equities when compared to the Euro and Dollar, meaning it tends to decline against these two currencies when investors dump stocks.

"The catalogue of earnings this week, along with a key Fed meeting, have combined to keep investors firmly in risk-off move. In addition, investors will have spent the weekend reading of troop build-ups around Ukraine and the growing tensions between Russia and the West," says Beauchamp.

Above: Analyst George Saravelos at Deutsche Bank issued the above chart, blaming Federal Reserve policy for equity declines. Image courtesy of @johnauthers, Bloomberg.

- Reference rates at publication:

GBP to EUR: 1.1923 \ GBP to USD: 1.3482 - High street bank rates (indicative): 1.1689 \ 1.3205

- Payment specialist rates (indicative): 1.1863 \ 1.3415

- Get a market-beating rate quote, here

- Set up an exchange rate alert, here

But, the sell-off could now be entering extended territory, presenting the prospect of a rebound in sentiment that could aid the likes of the Pound and associated currencies that outperform in 'risk on' conditions.

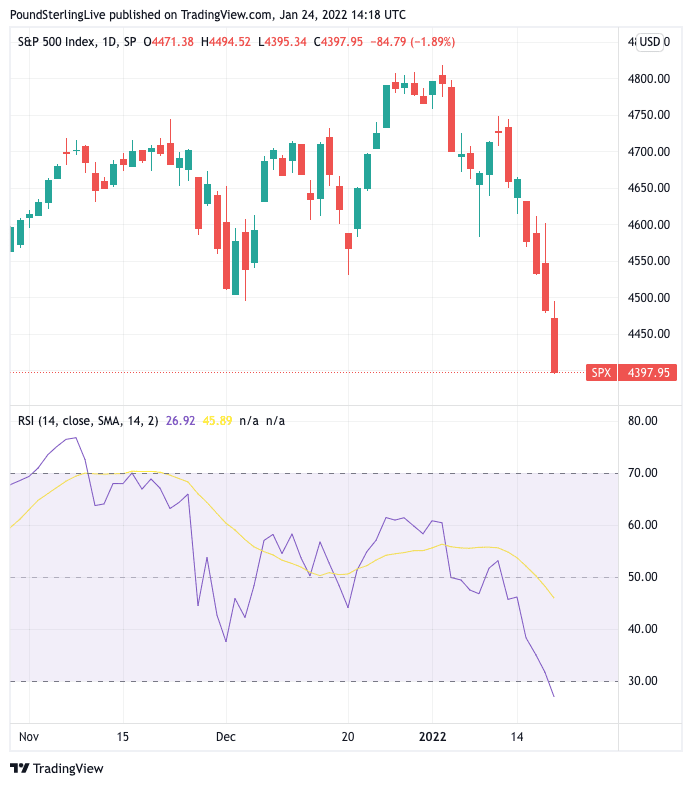

A favoured proxy for investor sentiment is the U.S. S&P 500 index which has fallen by 7.75% already in January. The decline takes the Relative Strength Index into oversold territory as it has slipped below 30.

The last time this happened was in 2020 when markets slumped amidst the spread of the Coronavirus.

For the RSI to stabilise downward pressure on stocks would likely ease.

"With the Relative Strength Index at oversold levels of sub 30, I wouldn’t be surprised to see some “bargain hunting,” possibly as early as today or this week," says Fawad Razaqzada, Market Analyst at Markets.com.

Above: The Relative Strength Index for the S&P 500 daily chart is now flashing oversold (lower pane).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"The decline of 7.7% in the S&P this month, and to below the 200dma on Friday, is the worst since March 2020 but of course the index doubled from the pandemic lows thanks to Fed liquidity driven buying splurge," says Kenneth Broux, a strategist a Société Générale.

Global foreign exchange markets have reverted to trading a binary risk-on / risk-off reaction to global risk sentiment, which has resulted in predictable outcomes.

The safe-haven currencies of Japan, the U.S. and Switzerland are benefiting while the biggest losers have been the commodity dollars of New Zealand and Australia as well as Norway's Krone and Emerging Market names.

In between the two groupings is the Pound and Euro, although the Pound to Euro exchange rate does itself tend to decline in times of risk-off market conditions.

Fortunes would flip on any relief style rally.

"The sell-off in risk has been relentless, but the bulls could emerge from the ashes soon. A correction for the US technology sector and cryptocurrencies was always on the cards given the size of the rally from the initial slump in early 2020 and the fact that yields have been on the rise for months," says Renee Friedman, Senior Economist at EXANTE.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Friedman says there’s light at the end of the tunnel as the Omicron variant is in retreat, and the UK has this week announced that there will no longer be a requirement to take covid tests for fully vaccinated individuals arriving in England.

"Other European countries are likely to follow the UK’s lead, we reckon," says Friedman.

But financial analysts warn of a volatile year ahead as traders readjust to a new regime of rising inflation and interest rates, volatility that would likely impact movement in foreign exchange markets.

"Adjusting portfolios and preparing for the volatility that typically accompanies the run-up to a tightening cycle in the US was never going to be a walk in the park," says Broux.

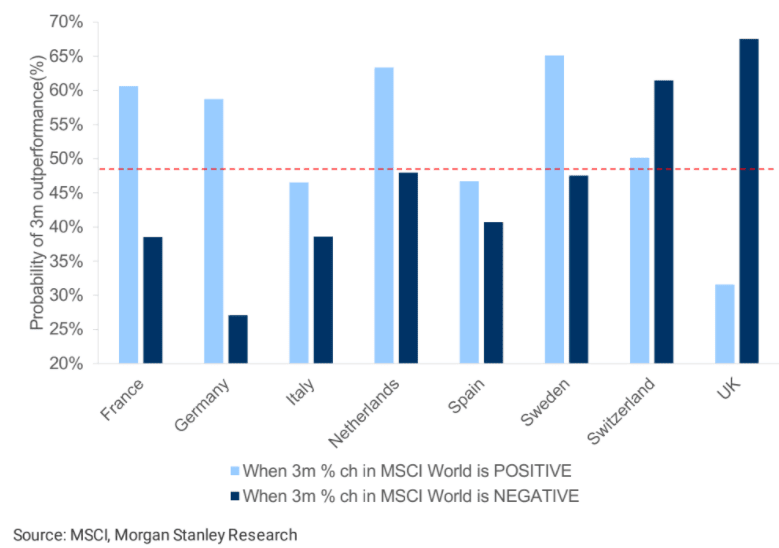

But analysts at Wall Street-based investment bank Morgan Stanely have this week told clients they now see a "compelling case" for UK assets and say they are buyers of the FTSE.

"Rising real yields benefit FTSE100, which is one of cheapest global indices by some distance. UK equities are also more defensive than peers, offer twice the dividend yield of global stocks and are a big beneficiary of Energy strength," says Graham Secker, Equity Strategist at Morgan Stanley in London.

International demand for UK assets would prove a boon for the Pound which appreciates when foreign investor inflows increase owing to the country's persistent Balance of Payments deficit that must be funded by capital flows.

As long as global investors are buying the UK, the Pound can benefit.

Morgan Stanley notes six reasons why UK markets should outperform the broader European market over the next few months:

1) UK tends to outperform in risk-off periods - "over the last 20 years, MSCI UK has outperformed MSCI Europe 68% of the time during periods when global equities are falling," says Secker.

Defensive sectors account for 37% of UK market cap according to Morgan Stanley.

Above: "Over the last 20Y, the UK has had the highest probability of outperforming when global stocks where falling" - Morgan Stanley.

2) UK is a relative beneficiary of higher real yields - "a move up in US real yields to our bond strategist's target of -10bps would point to c. 12% outperformance of MSCI UK versus Europe-ex-UK," says Secker.

3) UK is one of the cheapest major global stock markets - "At 12.6x, the FTSE100 is the cheapest major index versus its own 10-year history," says Secker.

4) UK to benefit from increased focus on dividends - "MSCI UK's dividend yield of 3.6% is currently twice as high as that on offer from MSCI World and nearly 150bps more than MSCI Europe-ex-UK."

5) EPS expectations are very low for the UK

6) UK is a key beneficiary of our positive view on oil - "A rising oil price is very positive for UK EPS, given that 25% of UK profits comes from Energy sector," says Secker.