Pound Sterling Drops vs. Euro, Dollar on Stock Market Sell-off

- Written by: Gary Howes

Image © Adobe Images

A stock market sell-off has finally caught up with 2022's high-flying British Pound which has shed close to half a percent against the Euro while also losing ground against other safe haven currencies ahead of the weekend.

It has been a poor start to the year for stock markets - particularly U.S. stock markets - so why would another fall in equities suddenly hit the Pound now?

The reason lies with the driver of these falls: investors have over recent weeks taken money off the table in anticipation of higher central bank interest rates.

But for the Pound, expectations for higher rates at the Bank of England are ultimately supportive as they imply higher returns for UK-monetary assets, in turn attracting international capital inflows.

The nexus of the market's worry is the Federal Reserve which could raise rates up to four times in 2022, but higher rates at the Fed also provide cover for the Bank of England to proceed with rate hikes.

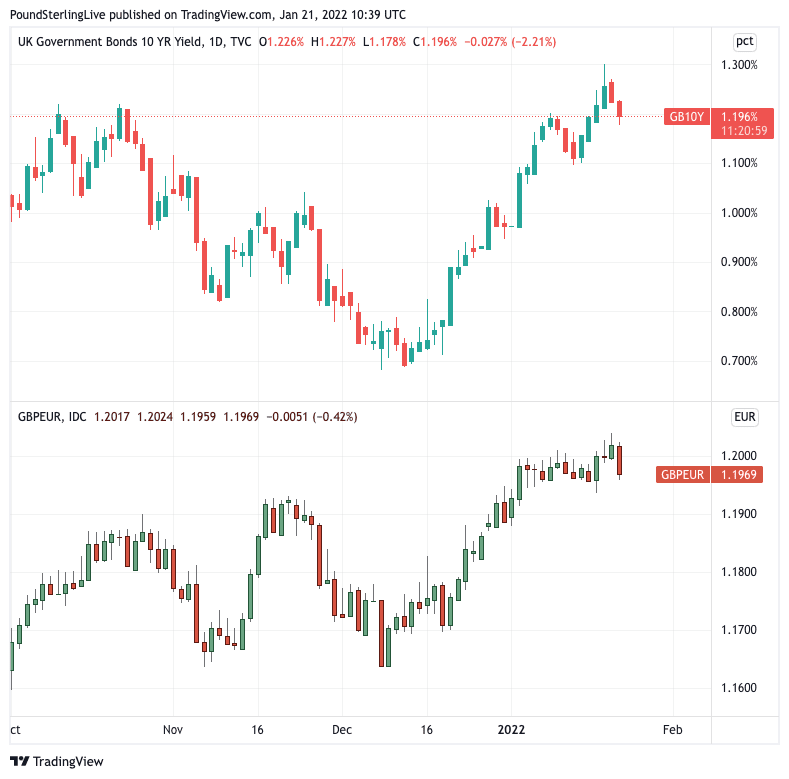

Above: UK ten year yields (top) have been rising of late as markets anticipate Bank of England rate hikes. The GBP/EUR exchange rate (bottom) is closely correlated, meaning any reversal in UK yields hurts GBP.

- Reference rates at publication:

GBP to EUR: 1.1970 \ GBP to USD: 1.3569 - High street bank rates (indicative): 1.1736 \ 1.3289

- Payment specialist rates (indicative): 1.1910 \ 1.3500

- Get a market-beating rate quote, here

- Set up an exchange rate alert, here

Therefore, a higher U.S. rates story is also proving a higher UK rates story.

This means any rate-related stock market sell-offs are relatively supportive of Sterling.

It is also worth pointing out that in this regime the FTSE 100 has in fact been outperforming, a marked contrast to the underperformance of the past two years - with global investors apparently keen to pick up on the UK's undervalued companies.

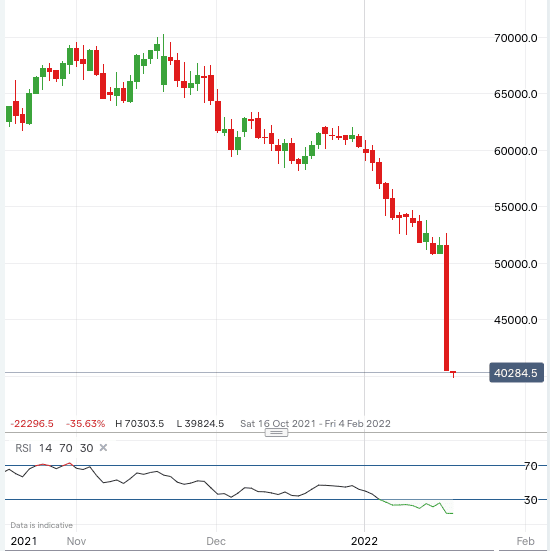

But, over recent hours markets have fallen as fears for future earnings in technology stocks start to hit home: a walloping 20% fall in Netflix following disappointing earnings seems to have spooked markets.

Above: Netflix's all session share price, image courtesy of IG.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Shaky quarterly earnings reports also helped to lower the market sentiment yesterday. Netflix, for example, fell by around 20% after the number of new subscribers was lower than expected. Increased tensions between the United States and Russia may also have contributed," says Lara Mohtadi, an analyst at SEB Bank.

So now equity markets are falling for reasons other than interest rate hike expectations, for Sterling therefore this is the 'wrong' kind of market selloff.

"Sterling unsurprisingly lost out, as it is a typical risk-on currency that does well when equity markets are rallying and suffers when they fall," says Thomas Flury, a strategist at UBS.

The Pound to Euro exchange rate is down 0.44% at 1.1963, the Pound to Dollar exchange rate is down 0.20% at 1.3572.

However, gains are being recorded against the 'high beta' commodity currencies such as the Australian and New Zealand Dollars, see here.

Expect these dynamics to extend until investors rebuild confidence and start buying again.