Pound Sterling Pulled Lower by Market Sell-off, Euro and Dollar Rise

- Written by: Gary Howes

- GBP hit by deteriorating global sentiment

- Markets fall as Biden's Build Back Better bill fails

- Omicron surge prompts more global restrictions

Image © Adobe Images

The British Pound enters the new week on the back foot as 'risk off' sentiment grips global markets as investors pare exposure ahead of the Christmas period amidst fears over the spread of the Omicron variant and reduced central bank support.

Added to the mix was overnight news that President Joe Biden's Build Back Better package - seen as a major stimulus for the U.S. economy - would not pass the Senate.

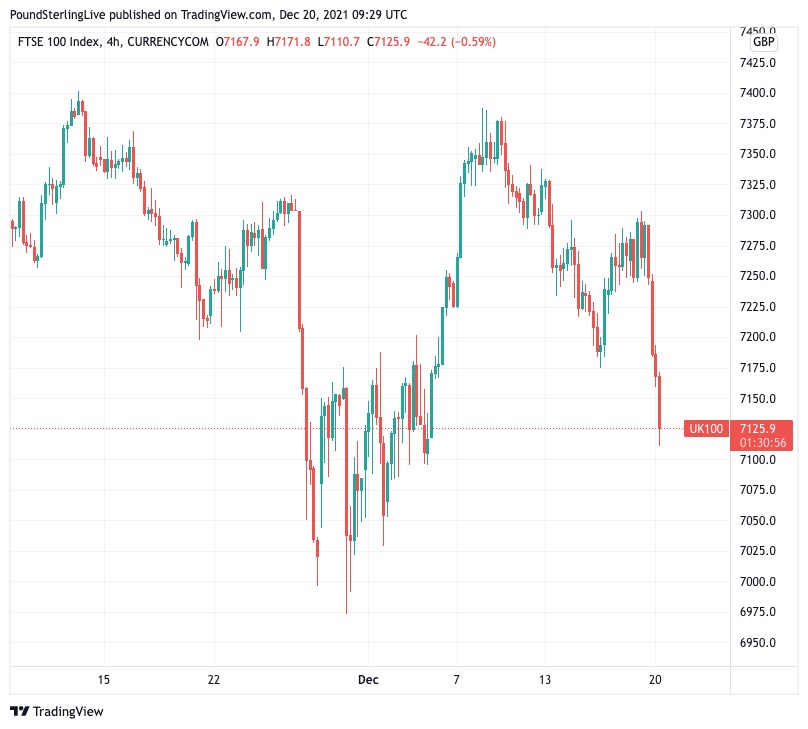

As a result the major stock markets traded in the red on Monday while the 'safe haven' currencies of the Yen, Franc and U.S. Dollar were in demand.

The Pound was gaining against 'high beta' and commodity currencies such as the Australian Dollar, New Zealand Dollar and South African Rand.

Losses were also registered against the Euro which tends to benefit relative to Sterling during times of market stress.

"The GBP is among the currencies that are particularly sensitive to spikes in risk aversion," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

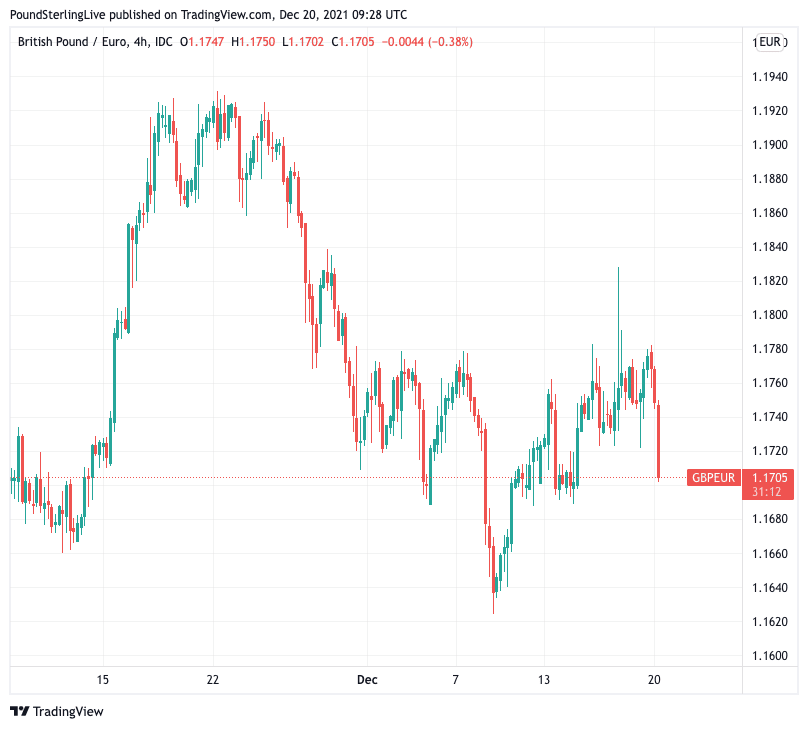

Above: GBP/EUR four-hour chart.

- Reference rates at publication:

GBP to EUR: 1.1705 \ GBP to USD: 1.3178 - High street bank rates (indicative): 1.1477 \ 1.2909

- Payment specialist rates (indicative: 1.1646 \ 1.3112

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

The Pound to Euro exchange rate was over a third of a percent lower at 1.1715, the Pound to Dollar exchange rate was down 0.20% at 1.32.

"The recent decline of the GBP was also driven by a wave of risk aversion that swept across global markets in the wake of reports on the new COVID-19 variant, omicron. Sterling unsurprisingly lost out, as it is a typical risk-on currency that does well when equity markets are rallying and suffers when they fall," says Thomas Flury, Strategist at UBS.

2021 looks set to end on a dour note for investors fretting over the impact of the Omicron wave, all the while knowing the U.S. Federal Reserve will steadily withdraw stimulus over coming months.

"The rampant nature of Omicron and its potential impact in sharply slowing global growth is continuing to unnerve investors," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. "Uncertainty about the year ahead is rippling through the markets."

The Netherlands has put in place a lockdown to try and curb the spread of Omicron, while reports suggest tighter restrictions are due to be imposed in Germany.

In the UK there is speculation that further restrictions are also due.

Above: FTSE 100 four-hour chart.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

New restrictions come amidst a surge in inflationary levels as the global economy pays the price for the restrictions put in place during 2020 which combined with unprecedented central bank monetary stimulus.

High inflation means central banks would be loath to loosen conditions again, which in turn means financing special government programmes to mitigate against controls becomes more costly.

"The rapid spread of Omicron is making headlines across the globe and sucking the life out of risk appetite," says Jane Foley, Head of FX Strategy at Rabobank.

President Joe Biden's Build Back Better stimulus package looks unlikely to pass in 2022 after Senator Joe Manchin said he will not vote for the bill, depriving the Democrats the crucial single vote they required to get it passed.

"The risks to world growth have been underpinned by the body-blow that was dealt to President’s Biden signature fiscal package," says Foley.

Manchin said he cannot vote for the $1.75TRN package as it risks pushing the country's debt to $29TRN and stimulating already hot inflation levels further.

"Inflation taxes that are real and harmful to every hard working American at the gasoline pumps, grocery stores and utility bills, with no end in sight," he said.

For the Pound to find its feet ahead of the new year risk sentiment would be required to take a turn for the better, but given the layers of worry at hand it is hard to see any meaningful shift occurring soon.

Above: GBP/USD four-hour chart.