Pound Sterling: PMI Data Greenlights December Rate Hike at the Bank of England

- Written by: Gary Howes

- PMIs show strong economic activity in Nov.

- Amidst strong demand at UK businesses

- Prices pressures remain acute

- Bank of England to raise rates: IHS Markit's Williamson

- GBP to remain supported

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

Despite surging price pressures UK business continue to see robust demand from clients, suggesting the economic recovery will remain intact into year-end and the Bank of England will hike interest rates.

A monthly survey of UK business conditions from IHS Markit encouraged expectations for a rate hike at the Bank of England in December, which should in turn keep the Pound relatively well supported against its peers over coming weeks.

"The UK PMIs strengthens the case for a BoE December rate hike and offers GBP support," says strategist Elias Haddad with Commonwealth Bank of Australia.

Businesses reported customer demand rose sharply in November, despite the pass through of higher costs to clients, with the overall rate of new order growth accelerating to a five-month high.

But the data also showed the increase in average cost burdens owing to surging global inflation was the fastest since this index began in January 1998.

The manufacturing PMI read at 58.2 in November, which is ahead of the 57.3 forecast by economists and stronger than October's reading of 57.8.

The services PMI read at 58.6 in November, which is ahead of what the market was expecting (58.5), but down on the hot 59.1 reported in October.

The composite PMI for November - which balances the PMIs to account for their share of the overall economy - read at 57.7, which is ahead of the 57.5 forecast by economists and ahead of a touch off the October reading of 57.8.

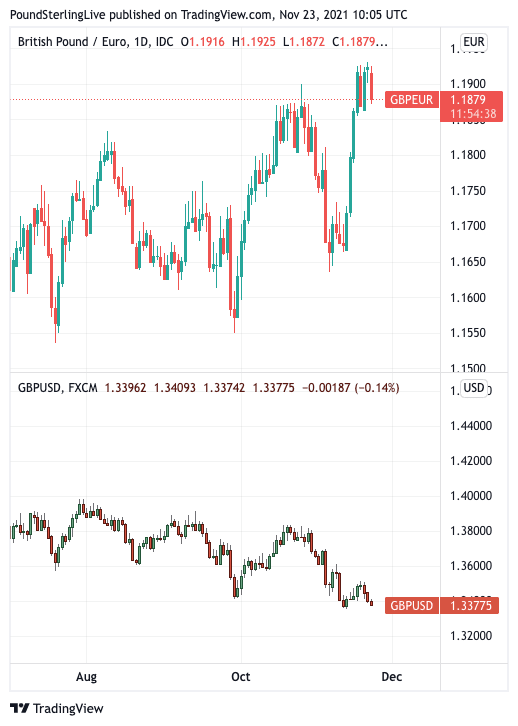

- Reference rates at publication:

Pound to Euro: 1.1875 \ Pound to Dollar: 1.3376 - High street bank rates (indicative): 1.1643 \ 1.3100

- Payment specialist rates (indicative: 1.1816 \ 1.3310

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The data is supportive of the Pound in the broader context, although price action on November 23 sees the UK currency come under pressure in sympathy with dour investor sentiment on global markets suggesting near-term the FX market is focussed on broader issues.

Survey respondents noted rising client demand due to improving economic conditions and a continued boost from the roll back of pandemic restrictions.

The report paints a picture of an economy that continues to recover at a fast clip as new order intakes increased at the strongest pace since June, fuelled by robust rises in business and consumer spending.

"November’s flash PMIs indicate that the economy is proving fairly resilient even as they brought further signs that the rise in price pressures has continued," says Bethany Beckett, UK Economist, at Capital Economics.

"That suggests to us that the balance of probabilities at the Bank of England’s Monetary Policy Committee meeting in December remains skewed in favour of an interest rate hike, most probably from 0.10% to 0.25%," she adds.

IHS Markit says strong customer demand and increased backlogs of work contributed to another marked rise in private sector employment during November.

The UK is currently seeing record levels of vacancies, raising expectations for ongoing wage increases.

Above: Daily charts for GBP/EUR (top) and GBP/USD (bottom).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Bank of England is concerned that these pressures will push up inflation over coming months, raising expectations for rate hike in either December or February.

These expectations will be cemented by the PMI report finding staffing numbers have now picked up in each of the past nine months.

"A combination of sustained buoyant business growth, further job market gains and record inflationary pressures gives a green light for interest rates to rise in December," says Chris Williamson, Chief Business Economist at IHS Markit.

Survey respondents reported recruitment difficulties amidst unexpected staff departures for higher wages or lifestyle changes had constrained employment growth.

That employees are moving to seek out higher wages will be of particular interest to the Bank of England as it points to durable wage increase dynamics.

Bank of England Monetary Policy Committee Member Jonathan Haskel said in a speech on Tuesday his vote at upcoming meetings will depend on the underlying drivers of UK wage dynamics.

"We’re trying to be very vigilant about trying to understand whether the labor market is persistently tight or not," he said. "If the labor market stays tight, bank rate will have to rise".

"For policymakers concerned about the health of the labour market after the end of the furlough scheme, the buoyant jobs growth signalled should bring some reassuring comfort," says Williamson.

Inflationary pressures remain elevated with 63% of UK private sector companies reporting an increase in their average cost burdens during November, while only 1% signalled a decline.

The report's cost index pointed to the steepest rate of input price inflation since the series began in January 1998.

Record rises in operating expenses were seen in both the manufacturing and service sector during November.

Exceptionally strong cost pressures meant that prices charged by manufacturers increased at the steepest rate since the index began 20 years ago.

However, service providers indicated a slight slowdown in output charge inflation to its lowest for three months, with some citing greater resistance to higher selling prices among clients.