Outperformer Pound Sterling Looks to Shore up Gains against Euro and Dollar This Week

- Written by: Gary Howes

Image © Adobe Images

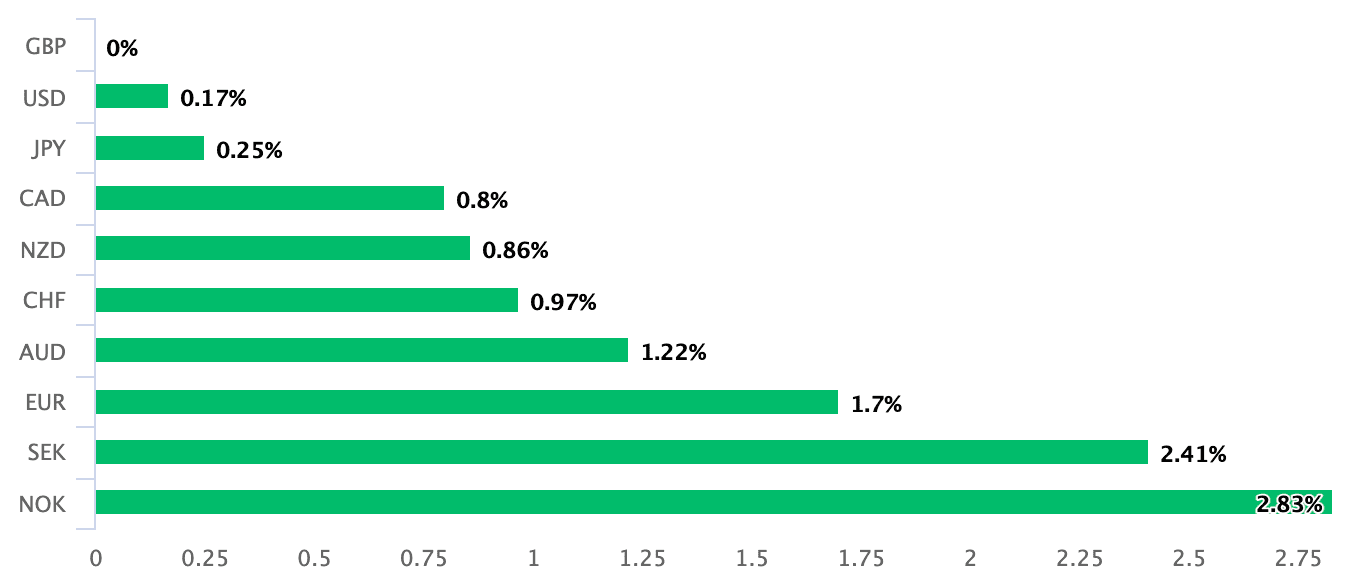

The British Pound enters the new week with a supportive wind behind it having earned the distinction of last week's best performing major currency.

Outperformance came despite a clear 'risk off' market reaction to news of Covid restrictions being rolled out across many Eurozone countries, a backdrop that typically tends to hamstring the 'higher beta' UK currency.

The news that Austria would enter a nationwide lockdown starting Monday, combined with signs Germany was looking to tighten regulations, sent the Dollar, Yen and Franc higher in a classic 'risk off' move.

The Pound lost ground to these currencies but held an advance against the Euro, understandably given the focus on the deterioration in the Eurozone.

For the Pound to Euro exchange rate, closing above 1.19 is another bullish development and poses potential for further gains over coming days and weeks.

"Evidence that the COVID-19 pandemic is spreading again, primarily across the eurozone, may not help the euro," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

"Any pullback attempts still risk being turned into a new selling-into-rally opportunity," he adds.

Above: The Pound recorded a gain against all its major peers in the week ending November 21.

- Reference rates at publication:

Pound to Euro: 1.1918 \ Pound to Dollar: 1.3450 - High street bank rates (indicative): 1.1684 \ 1.3170

- Payment specialist rates (indicative: 1.1858 \ 1.3380

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Austria became the first country in western Europe to reimpose a full Covid-19 lockdown, it was announced on Friday.

Neighbouring Germany warned it may follow suit, and the trajectory in cases over coming days will be crucial in determining a final call.

Indeed, expect financial markets to take a close interest in the case charts for France, Spain and Italy this week as these countries are also seeing cases spike.

The rise in cases could prompt markets to push back expectations for a European Central Bank rate hike, a rates market move that would be felt by the currency.

The market had been bringing forward rate hike expectations having observed the spike in Eurozone inflation rates, with money markets showing a 2022 move by the central bank was on the cards.

"Our FX forecasts have shown EUR as the laggard over the forecast horizon given the scope for the ECB to remain well behind most other G10 central banks in hiking rates," says Derek Halpenny, Head of Research at MUFG.

"The shifting economic risk profile could quickly change what markets expect from the ECB at its December policy meeting. Suddenly, the ECB may have strong justification for maintaining a more dovish stance through a larger or longer APP program," he adds.

Covid cases in the UK are meanwhile maintaining a broadly sideways trajectory and there are signs the country will not follow Europe.

Given the favourable Covid situation in the UK relative to the EU, combined with a flush of strong economic data out last week, the odds of a December rate hike at the Bank of England are above 50%.

The odds of a February move are meanwhile set above 100%.

Expectations for a Bank of England rate hike are proving supportive of the Pound and this could provide some sustenance to the bulls into the mid-December policy meeting when a decision will be delivered.

The Dollar meanwhile looks firm, supported by expectations the Federal Reserve will raise rates in 2022 owing to sharp increases in inflation in the world's largest economy.

For now the Dollar bull trend remains intact and this could mean the Pound to Dollar exchange rate struggles to make headway in sympathy with outperformance by Sterling more generally.

"The USD should continue to strengthen gradually," says Paul Mackel, Head of Currency Research at HSBC. "In 2022, we still have trust in the USD, expecting it to be resilient versus most major currencies."

With regards to the Pound HSBC are bearish, forecasting downside in the UK currency against the Dollar and Euro in 2022.