Delta Blues: Pound Sterling Sinks to New Multi-week Lows vs. Euro and Dollar as the Global Pandemic Hits its Next Phase

- Written by: Gary Howes

- Global pandemic jitters hit markets

- GBP sinks on deteriorating sentiment

- Prone to losses vs. EUR and USD

- Haskel sinks rate hike expectations

Above: Prime Minister Boris Johnson delivers a Covid-19 press conference. Still courtesy of 10 Downing Street.

- Market rates at publication: GBP/EUR: 1.1593 | GBP/USD: 1.3660

- Bank transfer rates: 1.1368 | 1.3480

- Specialist transfer rates: 1.1510 | 1.3664

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound has been routed by the Dollar, Euro and other so-called safe haven currencies amidst a significant sell-off on global stock and commodity markets.

Declines came amidst a realisation amongst investors that the pandemic is shifting into a new phase that will inevitably see another wave of infections sweep the globe, driven by the Covid-19 Delta variant.

Declines in Sterling came on the same day the country saw all restrictions eased, although a spike in Covid-19 cases in the country meant that hundreds of thousands workers were being forced to self-isolate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The UK seems to be well ahead of major developed peers in this next wave of the pandemic and what is concerning to investors is that even a heavily inoculated country such as the UK can succumb to a wave of the virus.

"Concerns are now around global growth coming off the peak amid the persistence of supply constraints and the spread of the highly transmissible Delta variant of SARS-CoV-2 in countries/regions with low vaccination rates. The USD and alternative safe havens have remained supported," says Erick Martinez, an analyst with Barclays.

The Delta variant's transmissibility advantage over other versions of the virus means that vaccinations alone won't result in a final herd immunity reckoning for the pandemic.

This is because most societies have vaccine refuseniks in the adult population, which when combined with children means no population is likely to achieve a required threshold to beat the virus without natural infections.

"Markets seem to be grappling with the fear that the virus isn’t going away despite widespread vaccinations in the major economies. New and more resilient mutations might be a perpetual phenomenon that wreaks havoc, especially in developing countries, ultimately keeping a lid on the recovery," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

Above: GBP/EUR (blue) and the FTSE 100 (orange).

"Sterling is also under heavy pressure thanks to its high correlation with stock markets," adds Hadjikyriacos.

The Pound-to-Euro exchange rate fell to its lowest level since early June when it reached 1.1572.

The Pound-to-Dollar exchange rate fell to its lowest level since February when it reached 1.3662.

But while the Pound succumbed to the Euro, Dollar, Yen and Franc it found itself better supported to other 'high beta' currencies such as the Australian, New Zealand and Canadian Dollars as well as Emerging Market currencies.

This is because these so-called commodity currencies and high-yielding currencies tend to display a greater sensitivity to the sentiment of investors.

When markets sell off they tend to lose more ground than does the Pound.

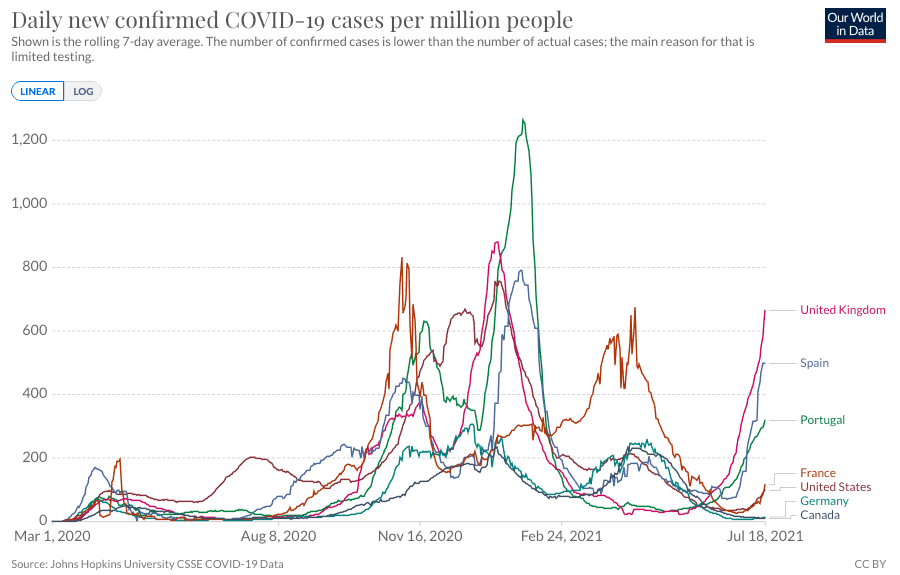

Above: The delta variant is pushing up cases in other major economies.

The outlook for global foreign currencies therefore resides with how long this current bout of fear extends, at least until Delta variant concerns ease.

If the market enters a more pronounced downtrend then the Pound could be in line to lose further ground against the Euro and Dollar but make gains against those above-mentioned high yielders and commodity currencies.

But there are also UK-specific concerns potentially weighing on the Pound.

Increasing numbers of the UK workforce are being forced into self isolation by the NHS Covid-19 application, which alerts users to having been in close contact with someone carrying the virus.

"This 'pingdemic' has left boards, and businesses including CBI and Marks & Spencers calling for the Government to amend policies surrounding requirements upon being pinged in order to avoid mass shortages in staff, and the huge economic impact this onslaught of pings has already triggered," says Chris Biggs, Partner at Theta Global Advisors.

Some estimates suggest that over a million people have been told to self-isolate as a result of this contact.

The knock-on effect has seen businesses and public services come under strain owing to staff shortages due to the self-isolation rules.

The developments point to a largely unexpected hit to the economy which will come just as the UK was expected to reach exit velocity from pandemic-era restrictions.

"While restrictions have been eased the fact that Covid is so rife within the country does breed the kind of caution that could inhibit the exact economic activity encouraged by the government," says Joshua Mahony, a market analyst with IG.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound has advanced on other currencies through 2021 as the UK's economy started to recover and data beat expectations.

Should incoming data over these next few weeks disappoint then the Pound could be subject to further weakness.

Risks to the outlook have meanwhile lead a member of the Bank of England's policy setting committee to say it was too soon to consider raising interest rates and ending quantitative easing, even though the economy appears to be recovering rapidly.

Jonathan Haskel, External Member of the Bank's Monetary Policy Committee (MPC) said the rise of the Delta variant of Covid-19 combined with the ending of government support schemes over coming weeks means the Bank must remain risk averse and keep its generous settings in place.

"The risk of a pre-emptive monetary tightening curtailing the recovery continues to outweigh the risk of a temporary period of above-target inflation. For the foreseeable future, in my view, tight policy isn’t the right policy," said Haskell.

In an online webinar to the University of Liverpool Management School Haskel was however optimistic the economy would not suffer lasting damage due to Covid-19 restrictions and the labour market outlook has improved considerably in 2021.

But his risk-averse stance to ending monetary support will disappoint those hoping for a stronger Pound.

Last week the Pound rallied after two of Haskel's colleagues, Michael Saunders and Dave Ramsden, said the prospect of inflation remaining above the 2.0% target for a protracted period meant the time to reduce monetary support was approaching.

Their calls were met by a stronger Pound.

But Haskel's intervention serves as a reminder that the Bank could remain a headwind for the currency for some time yet and the market is yet to fully get on board with the view the Bank of England will be one of the early movers on interest rates.