Delta-Inspired Market Rout Sinks the Pound

- Written by: Gary Howes

Image © Adobe Stock

- Market rates at publication: GBP/EUR: 1.1611 | GBP/USD: 1.3725

- Bank transfer rates: 1.1386 | 1.3440

- Specialist transfer rates: 1.1530 | 1.3630

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

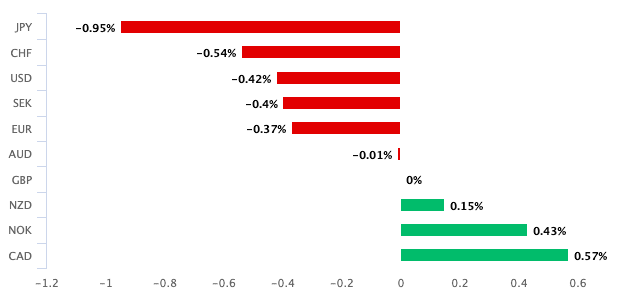

A sell-off in global markets meant the Pound fell against the Euro, Dollar and other safe-haven currencies, but gained against 'high beta' names such as the Canadian Dollar, Krone, New Zealand Dollar and Australian Dollar.

Foreign exchange markets are now in a decisive risk-on / risk-off mode, meaning that currencies are reacting to broader investment sentiment.

A sell-off in global stocks and commodities means the Dollar, Yen and Franc are the most preferred, with analysts saying investors are turning fearful of rising Covid-19 cases across the globe.

"As global markets cratered, the dollar soared to February highs versus the Canadian dollar, and strengthened to April peaks against the euro and sterling," says Joe Manimbo, Senior Market Analyst at Western Union.

"Markets are on edge over the fast spreading delta strain of Covid-19 which threatens to slow the pace of the global recovery," he adds.

Investors sold Sterling despite the UK dropping most of its Covid-19 related restrictions on Monday, a development that came even as cases in the UK were seen to be rising rapidly.

"Net GBP long positions dropped back sharply. A sharp increase in the number of UK Covid cases could be undermining the growth outlook," says Jane Foley, Senior FX Strategist at Rabobank.

Above: The Pound underperformed safe-havens.

The Pound-to-Euro exchange rate (GBP/EUR) fell back a third of a percent to test 1.1610 while the Pound-to-Dollar exchange rate (GBP/USD) fell back half a percent to test 1.3699.

The Pound-to-Canadian Dollar exchange rate was meanwhile two-thirds of a percent higher at 1.7468.

"The mood is far from celebratory as the spread of the Delta variant continues to accelerate, weighing on the economic growth outlook and dragging the pound to multi-month lows against safe haven currencies," says George Vessey at Western Union Business Solutions.

The UK reported 48161 new cases of Covid-19 on Sunday, although the country's rapidly rising rates have been with us for some time now and hardly a surprise to the Pound or markets in general.

The government feels emboldened to lift restrictions noting that vaccines have meant the Covid-19 death rate continues to plummet:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Instead it appears that investors are waking up to the realisation that the rest of the world is likely to see a similar spike in cases, a development that is of serious concern given the UK is one of the most vaccinated countries in the world.

"Risk appetite has taken a beating in overnight trading as markets continue to fret about the delta variant and its impact on the recoveries of various economies," says Stephen Gallo, European Head of FX Strategy at BMO Capital Markets.

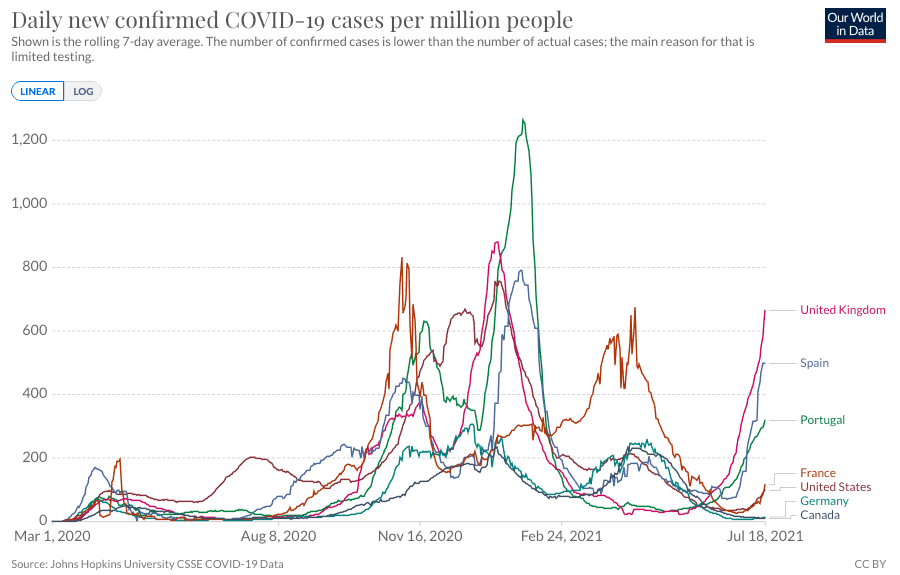

In Germany, a steady increase in new infections has been reported since 8 July while France, Spain and Portugal are all starting to record exponential growth.

The U.S. is also seeing cases start to rise.

Cases are ticking higher not just in the UK. Image courtesy of Our World in Data

The common denominator in all these countries is the Delta variant, which is now dominant.

"The final removal of Covid restrictions doing more to raise fears of a more pronounced outbreak that raise hopes around an economic boost. Just as the FTSE heads lower, we are also seeing the pound underperform as it loses ground against the euro, yen, and dollar," says Joshua Mahony, Senior Market Analyst at IG.

Above: Delta has quickly come to dominate the landscape. Image courtesy of Our World in Data.

The Pound will likely remain tethered to broader risk sentiment for as long as the Delta variant story is of concern.

Unfortunately for those wanting a higher rate of exchange, this is a story that might only just be getting started.

Elsewhere, the Pound was undermined further after a member of the Bank of England's Monetary Policy Committee (MPC) poured cold water over rising expectations that higher interest rates were needed to cool inflationary pressures in the UK.

Jonathan Haskel, External Member of the MPC, said the rise of the Delta variant of Covid-19 combined with the ending of government support schemes means the Bank must remain risk averse and keep its generous settings in place.

"The risk of a pre-emptive monetary tightening curtailing the recovery continues to outweigh the risk of a temporary period of above-target inflation. For the foreseeable future, in my view, tight policy isn’t the right policy," said Haskell.

The Pound benefited last week when two members of the MPC said ending quantitative easing and raising interest rates might soon be needed owing to fears inflation might prove more stubborn than previously expected.

Haskel's comments therefore push back against any source of support emanating from the Bank of England.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}