Pound Sterling Registers Sizeable Gains against Euro and Dollar

Image © Adobe Images

- Market rates at publication:

GBP/EUR: 1.1594 | GBP/USD: 1.3945 - Bank transfer rates: 1.1369 | 1.3655

- Specialist transfer rates: 1.1513 | 1.3847

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound advanced by over half a percent against the Euro and went higher by a percent against the Dollar at the start of the new week.

Gains in Sterling were widespread and cut across the various currency classes suggesting some genuine outperformance by the UK unit, which has been one of the better performers of 2021.

"GBP/USD up just shy of 1.0% today, on track for its best day since 12 Jan, and a sixth straight gain, which would be the best winning run since July last year," says Michael Brown, Senior Market Analyst at CaxtonFX.

The Pound-to-Dollar exchange rate (GBP/USD) was higher by a percent at 1.3959 at the time of writing, the Pound-to-Euro exchange rate was higher by half a percent at 1.1595.

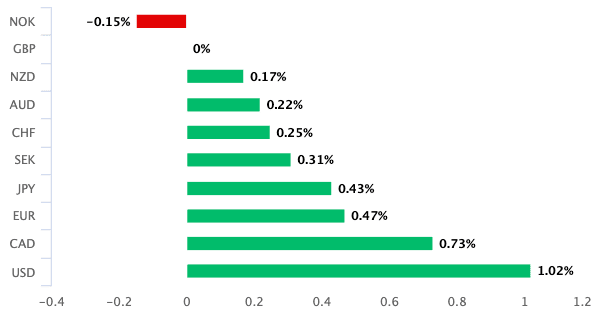

Only the Norwegian Krone was seen to be outperforming Sterling:

Above: Daily changes in the Pound.

"Sterling jumped to one-month highs against a vulnerable U.S. dollar. Pound bulls, meanwhile, were looking ahead to U.K. numbers this week that could offer signs of the economy turning the corner after its worst year in centuries," says Joe Manimbo, Senior Market Analyst at Western Union.

Data of interest due out this week include inflation on Wednesday; but it is perhaps the PMI survey for April out on Friday that offers a better guide for markets given they will be more timely.

The PMI's are the most timely set of data available for markets and investors will be looking for signs that the unwinding of covid-19 restrictions this month are feeding to a pickup in economic activity.

The Pound has been bought over recent months as investors bet the UK economy would bounce back in strong fashion in 2021 as it recovered from the covid-19 pandemic.

Key to that rebound was the UK's rapid vaccine rollout programme which now leaves more than 60% of the adult population vaccinated and bestows a greater confidence on investors that the reopening will be a permanent one.

"The UK economic outlook has improved markedly during the past months due to successful vaccination programmes. This has resulted in a rapidly stronger GBP," says a research briefing note from SEB.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound's 2021 rally was however interrupted in the first half of April as an ebullient and over-positioned investor community left the currency looking vulnerable to a reversal.

How the Pound moves through the remainder of the month could well depend on whether that positioning clean out has fully run its course.

Seasonality could prove to be a critical factor for the Pound over coming days as it tends to appreciate in April.

Historical data shows the latter part of the month as being particularly bullish for the UK currency.

"In broad terms, a pro-cyclical, risk-on environment should be GBP supportive as it will for other high beta currencies. What will see GBP standout is whether the UK can continue to attract investment inflows, which have been a hallmark of the recent appreciation," says Kamal Sharma, G10 FX Strategist at Bank of America.