British Pound in Recovery Mode against Euro and Dollar, Upside seen Capped as Trade Negotiation Developments Expected

- GBP looks to recover lost ground on Tuesday

- Upside capped by trade talk anxieties

- Coronavirus fears to benefit USD

- EUR lacking safe-haven qualities say JP Morgan

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

Pound Sterling went back onto the front foot on Tuesday and recovered some of the losses suffered against the Euro and Dollar over previous hours, but with the spotlight increasingly turning to the EU-UK trade negotiations upside will likely be limited in nature.

The Pound-to-Dollar exchange rate was seen trading half a percent higher at 1.2987 while the Pound-to-Euro exchange rate is higher by 0.45% at 1.1965.

The gains for Sterling come amidst ongoing market fears concerning the impact of the coronavirus on the global economy and suggests the UK currency remains largely immune to sentiment over the outbreak.

"GBP continues to perform idiosyncratically rather than as a traditional reserve currency," says Paul Meggyesi, Head of FX Research at JP Morgan, referencing the Pound's apparently detached performance relative to coronavirus concerns.

The Pound's apparent independence from global investment trends is perhaps largely down to the overarching impact EU-UK trade negotiations are expected to have on the currency over the course of 2020: should the two sides agree a comprehensive free trade deal by year-end then Sterling's upside potential could be released. However, fractious negotiations and the ultimate failure of trade negotiations could unleash some significant downside, similar to that seen in 2019 when markets fretted over the prospect of a no deal Brexit.

"The UK Pound's recent performance can be considered somewhat confusing. The currency has been torn for weeks between emerging optimism resulting from the recent economic data, and the potentially challenging EU-UK trade negotiations," says Marc-André Fongern, Head of Research at Fongern FX.

Trade headlines will be on tap over coming hours and days as EU ministers meet on Tuesday to agree a mandate for the negotiations, which are scheduled to commence on March 02.

The BBC reports the document will say that a trade deal should be based on EU rules in some areas as "a reference point". The key sticking point between the EU and UK will be how many of the EU's rules does the UK conform to in order secure a free-trade deal, the EU wants the UK to sign up to EU rules governing the environment, state aid and various other issues. Unhindered fishing rights and the jurisdiction of the European Court of Justice in settling trade disputes are also seen as central to the mandate.

UK ministers will also meet today to discuss the UK's opening stance for negotiations and it is expected they will maintain a desire to secure a deal similar to that already given by the EU to Canada which is ultimately free of the kind of restrictions the EU are looking to impose on the UK.

The foundations for disagreement are certainly being laid.

Foreign exchange analysts at Wall Street bank JP Morgan say they see "considerable downside" potential in the British Pound in the event of the UK and EU failing to strike a trade agreement at the end of 2020.

The issue of trade talks has been a background consideration for the Pound for some weeks now, but Brexit is likely to return to the limelight now that the two sides are preparing to lock horns.

"The risk of no-deal come December, which we continue to believe the market underappreciates and thus underprices, leaves a low ceiling for the currency, but considerable downside," says Meggyesi.

The British Pound has lost ground against the Euro and Dollar over recent days and on current trends is set to end February on a soft footing, with financial market analysts laying the blame for the softer performance over growing anxieties over trade negotiations.

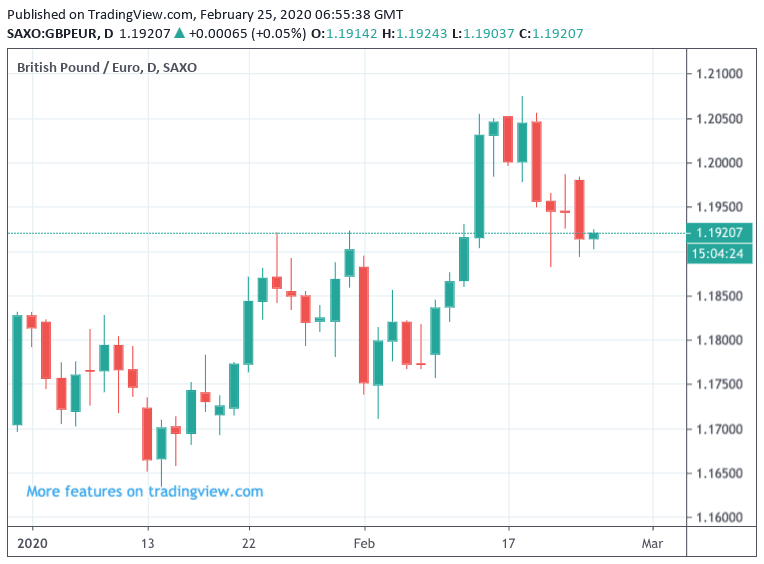

Above: Has the Pound peaked against the Euro?

The trend lower could remain intact considering the Pound's apparent unwillingness to react to positive factors, particularly to signs of an economic pickup and the potential for a the announcement of sizeable spending pledges in next month's budget.

"The relatively underwhelming price action is notable following what were some solid data prints coming out of the UK - beats in CPI, retail sales and the PMIs stand out. That GBP couldn't catch a material bid from those positive cyclical indicators highlight the degree to which GBP price action will ultimately a function lesser of domestic factors and more of the state of UK-EU free trade negotiations," says Meggyesi.

Despite Tuesday's rally, the British Pound retains a soft bias against the Euro and U.S. Dollar and with little on the UK calendar it is hard to see what could snap the Pound's current run of lacklustre performances.

The focus for global markets meanwhile remains firmly locked on the coronavirus outbreak which saw a sharp selloff in global stocks on Monday and spurred demand for the Dollar and Swiss Franc, which are the two undoubted safe-haven currencies at this point in time.

The Euro and Pound meanwhile appear at sea in the current environment, showing no decisive positive or negative reaction to swings in market sentiment driven by coronavirus fears.

"In the past few weeks we have argued how the Eurozone’s fragile growth outlook and capital flow structure has made it an inferior funding safe haven currency," says Meggyesi. Meanwhile, "GBP continues to perform idiosyncratically rather than as a traditional reserve currency."

JP Morgan observe "a dwindling roster of defensive currencies in which to hedge or otherwise express defensive views, namely the Swiss Franc and the U.S. Dollar."

The Euro More at Risk of Coronavirus

Foreign exchange analysts at one of northern Europe's largest lenders, Nordea Markets, have however adjusted higher their forecasts for the British Pound against the Euro, citing the impact of the Coronavirus outbreak for the decision.

"We adjust GBP in a slightly stronger direction as the political instability around the Brexit 2.0 negotiation is not a market theme short-term. Wuhan/China is more important negative news for EUR than GBP," says Jan von Gerich, Chief Analyst at Nordea Markets.

The call comes as global stock markets trade in the red on Monday, February 24 amidst signs that the coronavirus outbreak is spreading beyond China with a rise in cases and deaths in South Korea, Italy, Iran and other countries suggesting this is now a global pandemic. Indeed, Professor Devi Sridhar, director of Edinburgh University’s global health governance programme, said "the window of opportunity to contain the outbreak is closing very quickly.”

The Pound-to-Euro exchange rate is trading at 1.1950 at the start of the new week, having fallen below the psychologically significant 1.20 level on February 19, however the UK currency remains relatively well supported against its European counterpart and is still over a percent higher for 2020.

One of the reasons for the Pound's advance is the relative outperformance of the UK economy over that of the Eurozone: the UK is seeing a post-election bounce in confidence while the Eurozone economy remains stuck in a low gear in part due to the effects of fears of the coronavirus.

An unprecedented shutdown in China - aimed at stemming the spread of the disease - has inevitably meant that global trade will slow sharply in the first half of 2020, which is bad news for economies such as Germany which are dependent on both demand for final goods from China, and the provision of intermediate goods for German industrial output.

"The Corona virus more of an issue for the EUR ... given that the EUR is closer linked to world trade," says von Gerich.

The call by Nordea Markets comes as Italian officials cut short the Venice Carnival as they try to control what is now the worst outbreak of the coronavirus in Europe.

Authorities in the Veneto region said the event would end later on Sunday, two days earlier than scheduled.

Italy has by far the highest number of coronavirus cases in Europe, with 152 cases and three reported deaths.

Two regions close to Milan and Venice have meanwhile imposed strict quarantine restrictions, a move if repeated that could have a real direct impact on Eurozone economic activity.

According to the BBC, about 50,000 people cannot enter or leave several towns in Veneto and Lombardy for the next two weeks without special permission. Even outside the zone, many businesses and schools have suspended activities, and sporting events have been cancelled including several top-flight football matches.