British Pound: Money Supply Data Disappoints, GBP Sterling Recovers Through Course of the Day

Note all quotes are reflective of the inter-bank market. Your bank or payment institution is free to levy a rate at their discretion. However, FCA-registered independent providers guarantee to undercut your bank's offer, thus delivering up to 5% more FX.Please learn more here.

16:22: £ rally is on

A strong performance being put in towards the London equity close; improvements seen right across the exchange rate complex.

16:10: GBP-CAD consolidation continues, no reversal yet say TD

Shaun Osborne says he does not see a full-blown reversal lower in GBP-CAD:

"There is an interesting configuration on the daily GBPCAD chart; the Feb-Mar range between 1.8645/1.8285 implies scope for a drop back to just under 1.80—effectively the early February low. While the GBP has slipped below trend channel support at 1.8470, the market is only reluctantly trading

lower at this point and we think that rather than signaling a major top or reversal in the broader bull trend, recent patterns suggest that GBPCAD is consolidating.

"Downside potential is limited and measurable and the broader trend higher remains firmly entrenched still on the longer-term charts. Weakness back to 1.80 or so—if it comes to that– is likely to be well supported. We still think a push higher to 1.92 is on the cards over the balance of the year."

15:36: GBP/USD crawls higher, Chicago PMI disappoints

GBP has held steady against the USD after the release of disappointing US manufacturing activity data.

Data showed that the Chicago purchasing managers’ index fell to 55.9 this month from a reading of 59.8 in February. Analysts had expected the index to decline to 59.0 in March.

14:23: Beware a surprise from the ECB

More on our GBP-EUR focus - the pair where we see much of this week's risk lying - this comment from Andy Scott at HiFX:

More on our GBP-EUR focus - the pair where we see much of this week's risk lying - this comment from Andy Scott at HiFX:

"There really can be no option but for the ECB to follow their talk with policy action this Thursday as they are arguably already well behind the curve. The downwards inflation trend looks like it could continue further too as China’s vast thirst for commodity slows, putting downwards pressure on prices for energy and other resources whilst the euro is up over 7% from this time last year against the dollar, towards its highest in over two years.

"Whilst it is not the ECB’s policy to directly target the euro’s value, they don’t look to be left with any choice but to try and weaken it to at least stem the tide of disinflation which has set in even in Germany where inflation is now just 1%. With the economies of the Eurozone still only managing meagre growth, there’s little likelihood of significant price rises, particularly when input and producer prices are all falling so the currency seems the most effective option."

14:13: Why is the euro performing well in the face of deflation?

The EUR is where much interest is to be found today. With inflation coming in lower why is the shared currency not being punished?

Boris Schlossberg suggests:

"Mr. Weidemann's reluctance to admit deflation suggests that the ECB may not make any additional accommodative moves at the upcoming monthly meeting this Thursday. The EUR/USD which dropped initially to a low of 1.3720 on the news quickly recovered and found itself in a vicious short covering squeeze as traders continued to bet that the ECB will remain stationary for the time being."

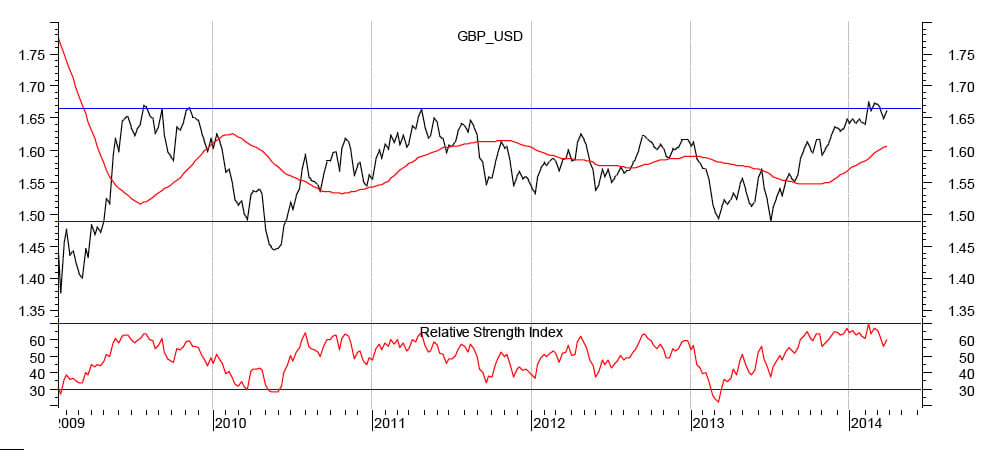

11:54: Pound dollar exchange rate outlook

More from Bill McNamara at Charles Stanley, this time his prediction for the GBP-USD:

"After failing at 1.675 or so (which it tested on three occasions) the UK currency subsequently dropped back to 1.6488, and the fact that it then bounced from that level strongly suggests that a new range has been established up near the recent highs. In fact, the broader technical picture is indicating that we should expect to see another challenge to the top before too long."

11:40: 1.223 achievable on GBP-EUR

Bill McNamara at Charles Stanley comments on the GBP-EUR:

"The small double-bottom that formed a around 1.19 has acted as a floor for sterling and this has lately provided it with the impetus to start tracking higher again. Last week’s 1.2% gain marked a clear reversal off the lows and it is going to be interesting to see whether the previous uptrend now starts to represent resistance. The January peak, at 1.223, is still the resistance point to watch and it is entirely possible that we could see that tested in the near term."

11:15: English, Welsh, Northern Irish should have a vote on sharing the pound

A note on the issue of the sharing of the pound with an independent Scotland.

A note on the issue of the sharing of the pound with an independent Scotland.

Alistair Darling said people outside Scotland “need to have a say” on whether they share the currency with an independent state.

He told the BBC Radio 4 Today programme that Nicola Sturgeon, the SNP Deputy Leader, “patently doesn’t understand what a currency union is”.

It means the rest of the UK must have a say on any currency-sharing deal, he said, in the form of a referendum in England, Wales and Northern Ireland.

10:57: GBP-EUR under pressure, Nowotny comments boost EUR

A sharp reversal in fortunes for GBP-EUR with the pair now 0.3% in the red.

The inflation figures out this morning proved negative for the EUR, however we have since heard ECB Governing Council member Ewald Nowotny say that Eurozone recession had come to an end and that the economic situation in the area had improved significantly although problems remained to be solved.

10:06: GBP-EUR rallies post-Eurozone inflation

The scene is set for further stimulus at the European Central Bank following signs the Eurozone is experiencing deflationary pressure.

The scene is set for further stimulus at the European Central Bank following signs the Eurozone is experiencing deflationary pressure.

The big event for the EUR today is the release of Eurozone inflation data.

Consumer Price Index (YoY) (Mar) came in at 0.5 pct, below an expected 0.6%. Analysts reckon the data will likely force the Bank to stimulate the economy further, a negative for the shared currency

09:50: GBP-AUD at risk of deep slide

Looking at the Aus Dollar, the team at TD Securities note:

Looking at the Aus Dollar, the team at TD Securities note:

"GBPAUD remains at risk of a deep slide. Losses have slowed through the end of the week but trend momentum is bearishly aligned across the longer-term studies and monthly price action (bearish key month reversal is all but certain) suggests a major turning point in this cross. We look for limited gains (1.81/1.83 at most) from here and, with the GBP sliding below the neckline of the bearish H&S reversal that formed up through the early part of this year, a drop to 1.7150 (measured move target) beckons."

09:35: GBP softer after money supply data

The UK unit has eased off somewhat following the release of this morning's money supply numbers.

Consumer Credit (Feb): £0.552B, below forecasts for £0.70B.

Mortgage Approvals (Feb): 70.309K, below expectations for 75.250K.

08:56: Cable might have a hard time to develop significant upward potential

This week’s action in sterling is likely to be again determined by the three pivotal PMI figures for Britain.

UniCredit tell us what they are looking for:

"While we expect both the manufacturing and the service PMI to slightly ease from elevated levels seen last month, the construction PMI will most probably be boosted by benign weather conditions in March. Cable might have a hard time to develop significant upward potential due to even stronger US data, but should be able to broadly defend current levels. As for EUR-GBP, we expect levels of just below 0.83."

08:36: Pound euro strength to be short-lived?

We keep an eye on the euro. March has seen a slump and then sharp recovery in the GBP-EUR, UniCredit say they predict strength to resume shortly:

We keep an eye on the euro. March has seen a slump and then sharp recovery in the GBP-EUR, UniCredit say they predict strength to resume shortly:

"In the very short-term, EUR-USD may be exposed to some downside bias as markets await the ECB press conference on Thursday; however, we remain convinced that any potential verbal intervention will not have a lasting effect on the EUR, which should resume its upward trend in the medium term as a result of the improvement in the euro area growth outlook."

08:34: The main drivers this week

"On both sides of the Atlantic, the main drivers for next week will undoubtedly be the US employment report, the ISM index as well as the ECB meeting and preliminary CPI figures from the eurozone. Markets will also scrutinise the three important PMI data for Britain and PMIs in several other countries as well as the rate decision in Australia and the Canadian Ivey index." - UniCredit Bank.

08:27: Money supply data ahead, GBP-USD resistance ahead

At 09:30 we get data concerning the supply of money to the economy. Higher numbers will suggest more activity and is thus positive for the British pound (GBP).

Lloyds comment:

"The money and credit data today may well provide a further indication of acceleration in the economy, and consequently prove supportive. EUR/GBP and GBP/CHF continue to look the best vehicles for GBP bulls in this environment, but EUR/GBP may find support at 0.8240 initially. 1.6660 looks like the first important resistance for GBP/USD."

Morning view: GBP to remain supported for now

Lloyds Bank Research tell us:

"While UK current account data on Friday were disappointing, for the moment, there is still more focus on the performance of the economy and yield spreads, and these still suggest that GBP will be well supported for now."