1st Election Debate Doesn't Shift the Dial on Sterling, Losses Tipped to Remain Shallow

- Written by: Gary Howes

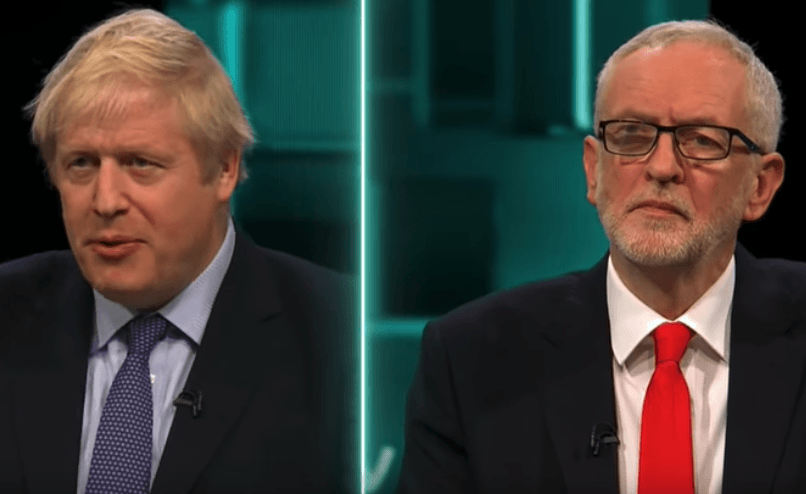

Above: Johnson and Corbyn at the ITV General Election debate of November 19. Image courtesy of ITV News.

- Pound-to-Dollar exchange rate: 1.2903

- Pound-to-Euro exchange rate: 1.1667

- Sterling softer in wake of ITV election debate

- Odds of Conservative majority remain elevated, should keep Sterling elevated

The British Pound traded with a softer tone in mid-week trade but remains towards the top end of its recent ranges against the Euro, Dollar and other major currencies, with market focus remaining fixated on the December 12 General Election which is currently expected to deliver a Conservative Party majority.

With the Conservatives holding an advantage in the polls over the opposition Labour Party, all eyes were on the ITV head-to-head debate between party leaders Boris Johnson and Jeremy Corbyn for any stand-out performances that might shift the electorate's opinion.

Sterling is currently tracking the odds of a Conservative majority, showing a positive correlation with increased prospects of such an outcome, therefore a poor performance by Prime Minister Boris Johnson could well have triggered declines in the currency.

However, the debate went well for both leaders, an outcome encapsulated by a snap YouGov poll following the debate that showed the two leaders virtually split on perceived performance, with 51% of polled viewers judging Johnson to have won the debate, against 49% for Corbyn.

"Investors digested the first televised debate yesterday between Tory leader Johnson and Labour’s Corbyn. The debate was almost a tie, a poll showed, but offered little news to the public. Lack of data or other high profile (political) headlines resulted in technical, sideways range trading. If anything, Sterling marginally lost ground vs. the Euro," says Mathias Van der Jeugt, an analyst with KBC Markets in Brussels.

"We grabbed our popcorn yesterday to watch Boris Johnson and Jeremy Corbyn go at it in the first televised debate of the 2019 UK election campaign, and while we felt the PM performed much better than the Labour leader, a YouGov poll released right afterwards said otherwise, showing it was a draw," says Erik Bregar, a Director and Head of FX Strategy at the Exchange Bank of Canada.

"If we combine this slight disappointment with some other polls showing the Tories now just 12pts ahead of the Labour Party (vs 14pts earlier this week), it’s not surprising to see GBP/USD a little weaker again today," adds Bregar.

Following the debate the implied odds of a Conservative majority sit at 65.8% according to the Betfair Exchange, this is unchanged on the implied odds seen ahead of the debate and explains why currency markets have not moved in significant fashion over the past 24 hours.

The odds translate into a FX market expectation for a Conservative majority, and this should ultimately keep Sterling supported over coming days we believe.

"The debate has basically reflected the trend of recent weeks, i.e. a comparatively clear election victory for the Conservative Party seems absolutely achievable. In any case, the latest polls don't indicate a head-to-head race, while the Tories are comfortably in the lead. The Pound Sterling, however, is not particularly impressed by the respective election campaigns and continues to tread water," says Marc-André Fongern, G10 FX Analyst with MAF Global Forex.

Above: Sterling has pared gains against the Euro over recent days but remains well supported over a multi-week timeframe

"Overall, GBP will remain supported as long as the Conservative Party maintains its strong lead in the polls," says Elias Haddad, a FX strategist with CBA in response to the leaders' debate.

The Pound has rallied of late in response to growing odds of a Conservative majority outcome on December 12, markets are of the belief this will allow for a swift ratification of the EU-UK Brexit deal, which will immediately quash significant uncertainty hanging over the UK economy.

However, with odds of the outcome sitting at around 65%, we wonder just how much of this outcome is already 'in the price', i.e. has the Pound already risen enough to fully reflect a Conservative majority?

With this election proving particularly difficult to call, we would suggest that further gains are possible. However, markets will almost certainly wait for the result itself before pushing Sterling higher.

This leaves the balance of risks for Sterling pointed lower over the coming three weeks, simply because any closing of the gap between Labour and the Conservatives in the polls will likely trigger a downside correction.

Markets see a Labour majority as a remote outcome, but an indecisive result poses months of further uncertainty for the UK economy, and therefore the Pound would likely track lower if odds of a hung parliament were to grow.

"It looks very unlikely that Labour would be able to win a majority in the election. However, the situation was similar in the 2017 general election when Labour did tremendously well in the televised debates and was able to almost close an even larger gap to only around 2 points in the popular vote at the election day," says Richard Falkenhäll, Sr Currency Strategist at SEB.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement