Pound Sterling at Risk of a Deeper Correction Lower

- Last Updated: 04 April 2014

Updated: The GBP is an underperformer on the first Friday of April. With US Non-Farm Payrolls coming out in support of the commodity dollar complex we are seeing the UK currency suffer against the likes of the AUD, CAD and NZD. The unit is stable against the USD and EUR.

Payrolls coming out in support of the commodity dollar complex we are seeing the UK currency suffer against the likes of the AUD, CAD and NZD. The unit is stable against the USD and EUR.

Those hoping for the pound sterling uptrend to re-establish itself will be disappointed. The deterioration in the GBP-CAD uptrend (image at righ) is representative of the malaise being seen by many of the CAD crosses.

Keep in touch with our Live Coverage Here. For the archived material for the day in question please scroll through please scroll down.

Live Rates:

- GBP to EUR:1.1519

- GBP to USD:1.3612

- GBP to AUD:1.9405

- GBP to CAD:1.8616

- GBP to NZD:2.2624

- GBP to ZAR:21.8354

16:19: "A rock and a hard place"

Dr. Vasileios Gkionakis at UniCredit tells us next week will likely be a tough one for the GBP:

"Sterling bulls will most likely feel like they are caught between a rock and a hard place. On the one hand they are set to take advantage of better growth prospects, but on the other, they may fear that strong sterling appreciation bears the risk of a delay in the first rate hike.

"Hence, our best guess for cable is the same as last week, i.e. it will remain strong but not much stronger. As for EUR-GBP we see some leeway to the downside."

16:08: A big week ahead for Sterling

Next week there are three important UK events on the agenda for the local currency.

UniCredit Bank give their thoughts:

UniCredit Bank give their thoughts:

"First, the unemployment report, which is expected to be sound.

"Second, Chancellor Osborne will deliver his preelection budget. We expect the chancellor to announce another round of spending cuts, although these will not likely take effect until after the 2015 election. Offsetting this, Osborne will be able to bask in the good news that the OBR will have to raise its estimate for 2013 growth, possibly for 2014 too.

"Third, we expect the BoE minutes to have a dovish tone with a pivotal discussion about the amount of slack in the economy and there is also a good chance that the minutes will consider further sterling appreciation unhelpful, as already outlined by several MPC members in recent speeches."

15:14: Expecting further tight trading today

"The pound traded in a tight range overnight, and expectations are for this to continue, as no market-moving economic data will be coming out of the US. Look for 1.6630 to act as a firm resistance level on the topside, with 1.6580 acting as support." - Jonathan Terela at Western Union.

15:09: Is this a pause in the slump tow 1.64?

FX Market Alerts see the potential for trouble in the outlook for the UK unit:

"A modest decline traded into this pm. but no material change here- GBP's responded back to the Thurs pm & overnight pivot 1.6620, with some scope to develop a rally in response to 1.6650 (approx the same distance higher that we saw lower this am.)Upside open to 1.6685 otherwise. A range day is potentially only a pause in continuing decline toward 1.64 (next week.)"

13:55: European markets decline, £ subdued

Amidst the risk-off sentiment on global markets the UK's currency struggles to find joy.

Lee Mumford at Spreadex reflects on the lie of the land:

"European markets continued to decline, with the FTSE 100 heading for its worst week of losses since June. Markets remained tentative ahead of a referendum in Crimea on whether to leave Ukraine to join Russia. Wall Street futures are indicating a 40 point lower open as investors refuge from risk on concern the situation in Ukraine is escalating. Clashes in eastern Ukraine late yesterday saw the death of one person whilst US Secretary of State John Kerry and Russian Foreign minister Sergei Lavroc met in London today."

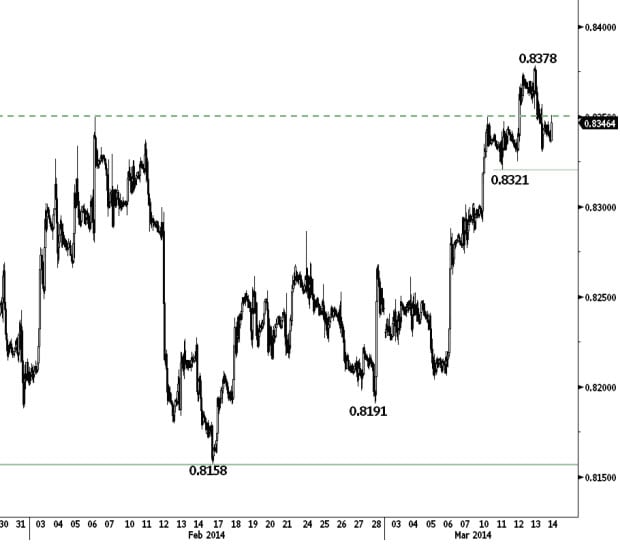

13:28: Beware, EUR-GBP has broken resistance

More forecasts from Swissquote, this time on the EUR-GBP:

"EUR/GBP has broken the key resistance at 0.8350, but has thus far failed to hold above it. The short-term technical structure remains positive as long as the support at 0.8321 (11/03/2014 low) holds. Resistances can now be found at 0.8378 and 0.8405 (25/12/2013 high).

"In the longer term, the breakout of the resistance at 0.8350 (13/01/2014 high) validates a base formation with an implied upside potential at 0.8532. Key resistances stand at 0.8464 (13/11/2013 high) and 0.8585 (29/10/2014 high)."

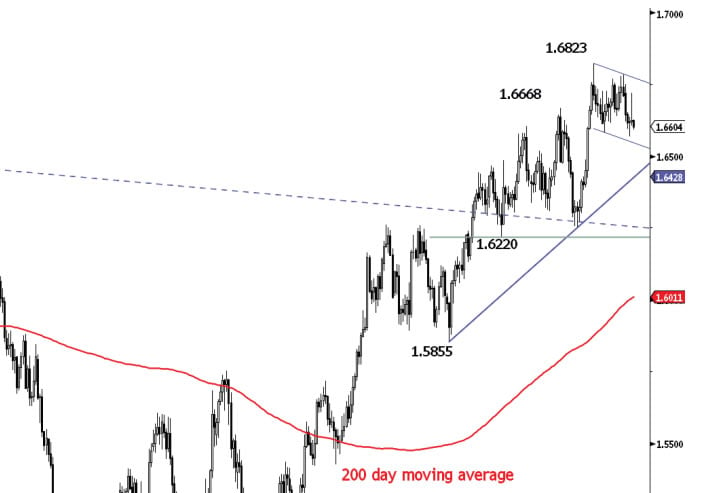

12:14: A correction in an underlying uptrend

Luc Luyet at MIG Bank on the longer-term prospects of the GBP-USD:

"GBP/USD completely erased yesterday's gains, creating a bearish intraday reversal. Monitor the hourly support at 1.6569 (12/03/2014 low). Another support is given by the rising trendline (around 1.6428). Resistances now stand at 1.6718 (13/03/2014 high) and 1.6786 (07/03/2014 high).

"In the longer term, the technical structure favours a bullish bias as long as the support at 1.6220 (17/12/2013 low) holds. The decisive break of the resistance at 1.6668 opens the way for a move towards the major resistance at 1.7043 (05/08/2009 high). The recent weakness still looks like a correction within an underlying uptrend.

11:03: Commerzbank still negative on EUR-GBP

According to an outlook note from Commerzbank analyst Axel Rudolph, these could be good levels to position for further advances in GBP vs the EUR:

"On Wednesday EUR/GBP broke through the .8348/50 January/February and previous March highs and reached the .8378 level before coming off again and now trading back below the .8348/50 area. Medium term we still look for a re-test of the 55 day moving average at .8271 and the .8253 December low. Below these lies the .8231 January 9 low. Strong support comes in between the .8205 March 5 low and the .8159 February low. Once this has given way, the long term Fibonacci support (the 61.8% retracement of the move in 2012-2013) at .8160 will be in focus.

"We remain longer term still negative and failure at .8160 will target .8000/.7963. It is the 78.6% retracement of the move up from 2012. Only a rise above the current March high at .8378 will put the .8391 late December high back on the map. Should this level be exceeded, the 200 day moving average at .8426 will be targeted (not favoured)."

10:23: A tense weekend ahead

As mentioned earlier the UK currency does not enjoy the current negative market conditions. And with a tense weekend ahead, we doubt there will be any pick-up in sentiment.

As mentioned earlier the UK currency does not enjoy the current negative market conditions. And with a tense weekend ahead, we doubt there will be any pick-up in sentiment.

"There is no sign that recent discussions of the UN or in London today are convincing Russia to back off Crimea. This Sunday's referendum in Crimea on joining Russia should keep risk appetite low for the remainder of the day. In addition we suspect heavy safe haven positioning (Gold & CHF) heading into the weekend." - Ipek Ozkardeskaya at Swissquote Bank.

10:00: A poor morning for the UK pound

Today's poor trade figures have not helped sterling. However, it is the broader negative market sentiment that we would suggest is the main culprit. Amidst the selling seen on equity markets this week the GBP has found no favour. Will things only improve for the currency once the equity markets pick up?

09:30: Trade balance data disappoints

Not good news on the data front.

Goods Trade Balance (Jan) came in at £-9.793B, analysts had expected £-8.700B.

Total Trade Balance (Jan) read at £-2.565B.

08:54: Poor trade data will do £ $ no favours

"The UK trade balance data will be published. A substantial rise in the deficit is expected. In theory, this is a negative for sterling. However, we have the impression that the focus of markets and of sterling traders will be on global factors. Even so, a poor figure can be a factor to push cable for a test of the 1.6584/69 range bottom." - Piet Lammens at KBC Markets.

08:32: Trade data ahead

The British pound (GBP) has some data due this morning.

UK trade numbers are out, delayed from Wednesday reportedly because of “quality issues”.

"While we wouldn’t read too much into this, it perhaps does increase the risk that the data is away from expectations, so there is some greater prospect of GBP volatility in response. GBP/USD has found good support below 1.66, and EUR/GBP resistance above 0.8375, so it may now be that any excess positioning in GBP has been unwound. Nevertheless, ahead of the vote in the Crimea, it will probably require significantly positive UK news to trigger any more substantial near term GBP advance," say Lloyds Bank Research.

08:10: New bearish indicator on Cable suggests further downside

The GBP-USD exchange rate is tipped for further declines after the formation of a bearish "Triple Moving Average Crossover" at last night's close of 1.6625.

According to an alert issued by Recognia, the price is thus considered to be in an established downward trend for the time horizon represented by the moving average periods.

08:26: Recent setback doesn't alter bull case on GBP

"The recent setback doesn’t change the bullish picture as long as support

holds at 1.6537. Resistance is at 1.6718 ahead of 1.6878." - UBS.

08:05: Remarkable swings in Cable and EUR-GBP

There was again no important news from the UK yesterday, though this didn’t prevent any remarkable swings in the major pound sterling exchange rate pairings.

"Initially, the euro stayed well bid, pushing EUR/GBP further north in the 0.83 big figure. Later in the session, a cable short squeeze pushed the pair higher in the 1.6584/1.6823 trading range. This rebound in sterling and comments from ECB’s Draghi that the valuation of the euro is becoming increasingly relevant in the ECB assessment of price stability finally pushed EUR/GBP back below the 0.8350 previous range top," notes Piet Lammens at KBC Markets.