The British Pound Draws a Bid after Business Investment and Stockpiling Lift Economy

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

The Pound caught a fresh bid from the market on Friday when official data showed the economy gaining momentum in the first-quarter for the first time in five years, with business investment and pre-Brexit preparations among manufacturers proving a key source of activity.

The UK economy grew by 0.5% during the first quarter, up from 0.2% in the final three months of 2018, which marks the first time in five years the economy has gained momentum heading into a New Year rather than losing it.

This means the economy grew by 1.8% during the 12-months to the end of March 2019, up from 1.4% during the previous period, although many in the market still expect it to expand by only 1.4%-1.5% for the 2019 year overall.

"Stockbuilding activity did not provide a significant boost to GDP growth in Q1 either. Admittedly, it added 0.7ppts (excluding the alignment adjustment). But a large proportion of stocks were imported. As such, net trade subtracted 0.6ppts from Q1 GDP (excluding the volatile non-monetary gold component). The “net” boost from stockbuilding was pretty minimal (+0.1ppts)," says Ruth Gregory, an economist at Capital Economics.

Consumer spending did much of the heavy lifting, with private consumption up notably for the quarter, but the biggest news item was growth in business investment that brought an end to a full year of contraction.

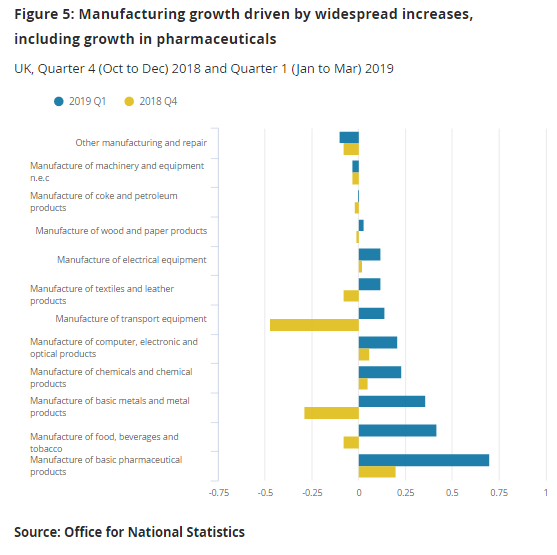

Manufacturing production growth also picked up sharply, in part due to firms stockpiling products ahead of the March 29 Brexit date in case of disruption at ports, although its contribution to GDP was quite small.

'Net trade' was a subtraction in the calculation of GDP as the trade deficit actually widened during the quarter. Meanwhile, Britain's mighty services sector, which is the largest component of the economy, saw its contribution to growth slow.

"Given the Brexit paralysis, there is a real risk that business investment declines further over the coming quarters. After Q1’s 0.5% q/q expansion, then, we still think that growth may moderate in Q2 and remain pretty sluggish for the rest of the year," Gregory warns.

Currency markets care about the GDP data because economic growth has a direct bearing on inflation and it is changes in consumer price pressures that central banks are attempting to manipulate when they tinker with interest rates, which are themselves the raison d'être for most swings in exchange rates.

Changes in interest rates, or hints of them being in the cards, are only normally made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

Economic output rose by a total of 0.7% in the first two months of the year, which is even faster than the 0.6% pace of growth seen through the whole of the third quarter of 2018, but GDP fell by -0.1% during March. After the numbers are rounded, that leaves GDP growth at 0.5%.

"With real income growth currently supported by above-inflation wage increases and a big increase in the income tax personal allowance, growth in consumers' spending should remain solid, keeping GDP on a steady rising path," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "We expect quarter-on-quarter GDP growth to slow to 0.2% in Q2, as the manufacturing boost turns into a drag. Nonetheless, with growth across the first two quarters of 2019 likely to be close to trend, the MPC will act quickly to raise Bank Rate again if Brexit uncertainty lifts."

Above: Increases in manufacturing production by industry.

It's still early days for the economy but a further pickup during the months ahead could be enough for markets to begin taking the Bank of England (BoE) a bit more seriously when it says that it wants to raise Bank Rate in order to safeguard the inflation target against a challenge from the consumer price index.

However, and given that growth was so strong in the first quarter relative recent history, it will be a tall order for the economy to grow at all in the second quarter. This could mean the next set of GDP numbers leave the market disappointed.

The Bank of England suggested in April that it could raise interest rates two times before the end of 2020 and projected that even with those rate hikes in the bag, inflation would still challenge the 2% target next year and in 2021.

This pledge was delivered at a time when the Federal Reserve is close to ending its interest rate hiking cycle and as central banks elsewhere in the world contemplate fresh monetary assistance for their economies. If the BoE was to hike rates in such an environment, it could prove a boon for Pound Sterling.

The Pound-to-Dollar rate was unchanged for the session at 1.3008 following Friday's announcement, although it had been lower earlier on, while the Pound-to-Euro rate was -0.15% lower at 1.1579 due to a resurgent single currency.

"We no longer expect the increase in August but now judge it most likely that Bank rate will be raised 25bp to 1.00% in November," says Phillip Shaw, an economist at Investec, following the BoE's latest update. "As investors latch on to the prospect of policy tightening, we expect this to provide a degree of support for the Pound."

AA

Pound Sterling Hugs Familiar Ranges amid Brexit Inertia

Pound Sterling has effectively traded in a straight line lower against the Euro over recent days, with the Pound-to-Euro exchange rate moving from the 1.17s firmly back into the 1.15s.

The Pound has also suffered weakness against the U.S. Dollar, dropping from the week's high at 1.3150 to trade at 1.30 on Friday morning.

Brexit has been the overarching concern for Sterling, with signs that the Labour and Conservative parties are unlikely to settle on a deal that would allow for a cross-party ratification of a Brexit deal.

This makes for a cocktail of political uncertainty that the country will have to work through over coming days and weeks, creating an uninspiring environment for Sterling bulls.

Above: Sterling is the week's worst-performing major currency.

“The cliff-edge has been pushed down the line for now but rather than provide some respite, the Pound has limped along for the start of May, drifting lower against most of the majors. The lack of progress in talks between May and Corbyn only highlights the political instability the UK is currently facing, and means that the 6 month delay is only protracting the uncertainties rather than providing some short-term reprieve for the economy," says John Goldie a dealer with brokers Argentex.

The Euro, meanwhile, has shot higher against the Pound and the Dollar in response to a sharp escalation in global trade tensions after the U.S. went ahead and imposed tariffs on a huge tranche of Chinese goods.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement