Pound Sterling's Outlook Tilted Lower Alongside the Conservative's Plunge in the Polls

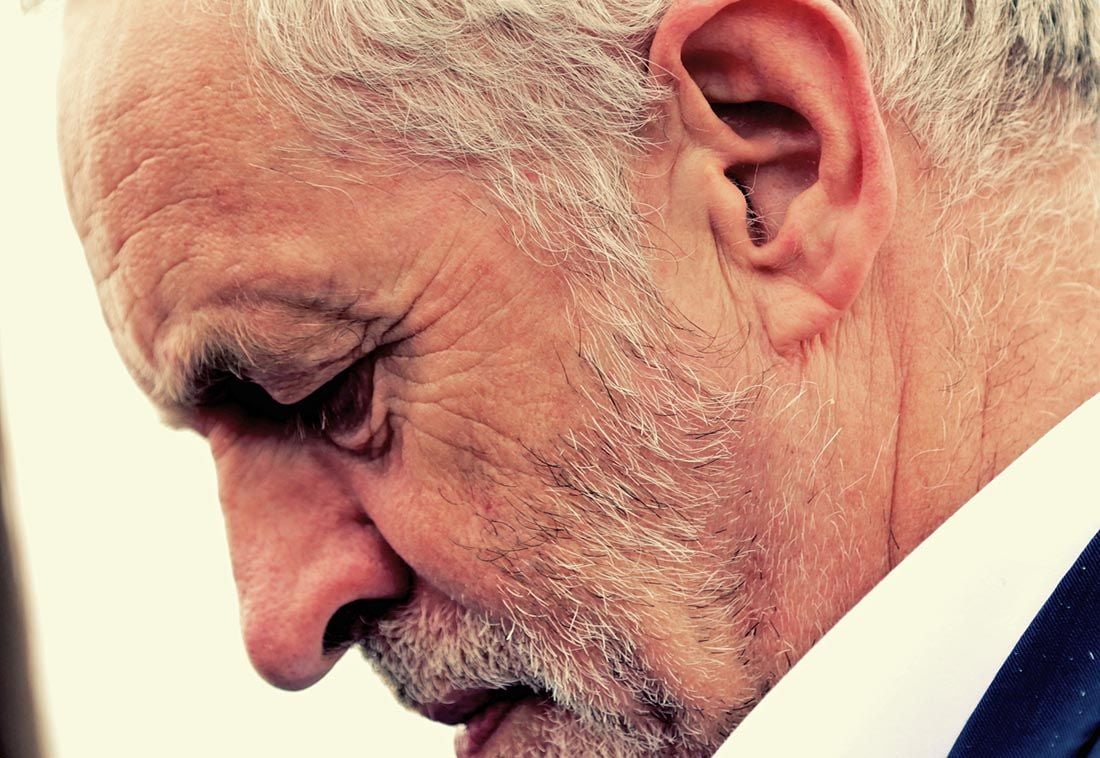

Labour leader Jeremy Corbyn's Labour is now ahead in the polls, but he is seen as 'market unfriendly' by FX analysts © Andy Miah, Flickr, reproduced under CC licensing.

Foreign exchange markets could once again start taking instruction from UK voting intention polls, amidst an increasingly popular view the country is heading for a general election.

With pressure on Prime Minister Theresa May growing in light of the latest delay to Brexit, which has caused much consternation amongst grass-root party members - there is a growing sense that a new prime minister might be installed by autumn has grown.

Our suspicion is that a the new Conservative leader might well find they inherit a party that no longer controls a parliamentary majority. This expectation is based on the view the new leader will likely be a 'hard Brexiteer' eager to reposition the party as one that will deliver a 'pure' Brexit, even if it means leaving without a deal in place on October 31.

While this might placate advocates of Brexit, it would almost certainly alienate the 'remainer' wing of the parliamentary party and potentially trigger more parliamentary resignations, in much the same manner as that of Nick Boles in mid-March.

General elections matter for Sterling which tends to fall in times of political uncertainty, particularly now that the main opposition Labour Party appears intent on pursuing an anti-business agenda should they take power.

"A UK election leading to Corbyn as PM is a negative tail risk for Pound Sterling that some think is underpriced, or not at all priced," says Brent Donnelly, a trader with HSBC's currency trading desk in New York.

The below graph shows the decline of the Pound-to-Euro exchange rate into the May 2015 general election, and the recovery on news of the Conservative's victory.

From a currency perspective, a change in government represents a change in the settings that guide the economy, and the market's understanding of a potential Labour government under leader Jeremy Corbyn is that the change in settings would not favour business.

The declines ahead of the 2015 vote could be minor when compared to a 2019 election simply because the stakes are so much higher this time around: Corbyn represents a radical departure from the economic approach embodied by 2015 candidate Ed Miliband.

"This could spark a move towards the re-nationalisation of certain UK companies, investors could take fright. For the Pound, the coming months are still fraught with danger," says Jane Foley, a foreign exchange strategist with Rabobank in London.

Polling data has in the run-up to previous elections triggered moves in Sterling. A notable example is the market's response to a YouGov poll that came out in the run-up to the 2017 election that indicated a sudden and dramatic slump in support for May's Conservatives to the benefit of Corbyn's Labour.

Looking at the current polls, the prospect of a Labour government has risen sharply since it became clear the government would rather opt for a lengthy Brexit delay rather than make a clean break from the EU.

According to a Kantar poll out on Thursday, April 11, support for the Conservatives dipped 9% to 31%, putting them second behind Labour who saw a 4% increase to 35%.

A Survation poll also out on Thursday shows a drop in support for the Conservatives by 8%, down to 37% against Labour's 41%.

"Investors are well aware that the next 6 months could provide various twists and turns both for the Brexit process and for UK politics. It is not out of the question that a general election will take place this year and that this could yield a hung parliament which could provide an opportunity for Labour’s Corbyn to form a coalition government," says Foley.

BMG Research also published their latest poll on Thursday, April 12 and show a whopping 10% decline in support for the Conservatives to 29%, against Labour's 31%.

A look at the above 'poll of polls' data - which collates the findings of all the polls - shows a clear shift away from the Conservatives and towards Labour from about February, so this is something of a trend.

Therefore, while we see a sharp fall in support for the Conservatives of late, it must be emphasised that the trend had already been against them for some weeks now, and the decline could well continue.

"There will be huge political fallout from a further Brexit delay. The tight ranges in EUR/USD and GBP/USD and the further compression in volatility (which is probably not over yet) partly reflect the fact that FX investors do not know how to quantify these political risks, nor are they able to estimate the economic effects," says Stephen Gallo, a foreign exchange strategist with BMO Capital Markets.

Looking ahead, parliament embark on their Easter break over coming days, and we expect behind-the-scenes plotting against the Prime Minister to intensify.

We also expect the 'runners and riders' for the top job to emerge over coming weeks.

Of course, a strong leader might offer the Conservatives a bounce in the polls, but purely from a currency market perspective the uncertainty is thick, and we would not expect the Pound to excel in these conditions.

The risks are, if anything, tilted to the downside.

Martin Enlund, a strategist with Nordea Markets, says Prime Minister Theresa May "is doomed" and it is very hard for him to see any progress being made on Brexit without a shakeup of the current parliamentary mandates.

"New elections are eventually unavoidable,” says Enlund.

We view the UK council elections due on May 02 as a key moment for UK politics as the Conservative Party could be facing a wipeout, if chatter amongst political pundits is anything to go by.

Such an outcome would only hasten the demise of Prime Minister May who would likely face significant opposition from her parliamentary party.

"We continue to see substantial upside for GBP on a 'soft' Brexit resolution, but investors may be reluctant to engage while uncertainty remains high and with the threat of general elections looming," says Zach Pandl, a foreign exchange strategist with Goldman Sachs in New York.

Roberto Mialich, a FX Strategist with UniCredit Bank in Milan says the new delay to Brexit opens up the possibility of a new general election in the UK.

The strategist says a vote would however unlikely offer a solution of the current impasse on Brexit.

If anything, "an election could add confusion to the UK political climate, the prospect of which might weigh on the GBP in the meantime," says Mialich.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement