The Pound Slides against Euro and Dollar after Third EU Withdrawal Agreement Defeat Opens New Chapter in Brexit Saga

- Written by: James Skinner

Image © Number 10 Downing Street

- GBP slides after MPs reject PM May's withdrawal agreement a third time.

- European Commission chief appear to incite push to revoke for Art 50.

- European Council summit called for April 10, says EU's Donald Tusk.

- Odds of long Brexit delay improving, but so are the odds of an election.

- Election risks seeing a Brexit Prime Minister in Downing St says MUFG.

- ONS says UK GDP rose by 0.2% in Q4 2018, and by 1.4% for 2018 year.

The Pound fell sharply in volatile trading Friday after the House of Commons rejected Prime Minister Theresa May's EU Withdrawal Agreement for a third and potentially final time, opening a new chapter in the Brexit saga but heaping further uncertainty onto the economy and markets in the process.

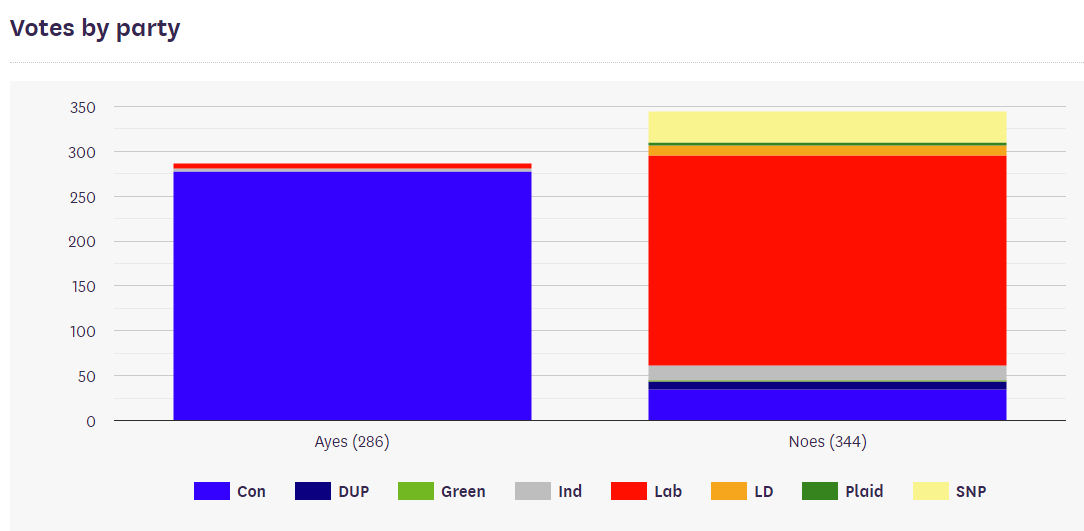

344 MPs voted against the withdrawal agreement on the third asking this Friday while 286 supported it, meaning it was defeated by a majority of 58. The latest rejection means further consequences for the Brexit process.

Friday's result is a significant improvement on the 149-majority loss suffered by the government on March 12 but it was not enough to get the proposal, which will be an international treaty once it is ratified, over the line.

277 Conservative Party MPs voted in favour of the agreement, up from 235 previously. Five opposition Labour Party MPs also voted with the government on Friday for the first time, although no MPs from any other parties backed the government.

Just 34 Conservative MPs voted against the Prime Minister on Friday, down from 75 previously, and all 10 of the Democratic Unionist Party MPs voted against it too. 234 Labour MPs also came out against the government.

Above: EU Withdrawal Agreement voting result, House of Commons. March 29, 2019.

Now the UK will receive from the EU an Article 50 extension that runs only until April 12, at which point the PM will choose between requesting a much longer extension that would require participation in the EU parliament elections, or a so-called no deal Brexit.

European Commission Secretary General Martin Selmayr appeared to incite, on social media Friday, a rumoured push by anti-Brexit activists to have the Article 50 notification of the UK's pending exit from the EU revoked.

MPs rejected a motion to revoke Aritcle 50 already this week, although there will be more "indicative votes" held on Monday, which means the opposition and rebels within the government's own party could reconsider it. There has been speculation that another vote on a "permanent customs union" will be held.

On 12 April, right before midnight #lastchance

— Martin Selmayr (@MartinSelmayr) March 29, 2019

Donald Tusk, who heads the European Council, said following Friday's result that he has called a meeting of national leaders from across the European Union for April 10. That's two days before an April 12 deadline for the UK to determine its next step.

1. Just seen Cabinet minister pointing finger in face of arch-brexiteer, in Commons corridor - 'you're not going to get no deal on the 12th, back it today or this place going to stop it - THAT'S YOUR CHOICE' he shouts - they both walk off shaking their heads

— Laura Kuenssberg (@bbclaurak) March 29, 2019

"Whilst it’s tempting to focus on the potential positives of: a) a permanent customs union or b) a second vote, PM May’s impending departure and the risk of a more pro-Brexit PM arriving will curb investors’ enthusiasm for GBP. 1.2950/3000 could limit [GBP/USD] weakness," says Chris Turner, head of FX strategy at ING Group.

Prime Minister Theresa May said this week she will resign once the withdrawal agreement is approved by MPs, in an effort to win support for it among MPs. The third failure means calls for her resignation could now grow louder over the coming days.

The withdrawal treaty risks tying the hands of the next PM or whoever happens to lead the next stage of negotiations because of the so-called Northern Irish backstop inside it. That weakens, if not sabotages, the negotiating position of whoever handles the next stage of the negotiations.

"Back in December 2017 we warned about the dangers of the backstop.

— DUP (@duponline) March 28, 2019

We cannot sign up to something that would damange the Union"

https://t.co/EWPco9NuFP pic.twitter.com/x1dTw25r3o

Above: Pound-to-Euro rate shown at hourly intervals.

The Pound-to-Euro rate was -0.38% lower at 1.1573 following the result but is up more than 4% for 2019. Meanwhile, the Pound was -0.43% lower at 1.2995 against a stronger Dollar, and is up 2% this year.

"GBP/USD has eroded the 3 month uptrend at 1.3065 but continues to hold the 200 day ma at 1.2980 and for now we are unable rule out the idea of recovery. However it should be noted that downside risks are growing and intraday rallies are likely to struggle 1.3165/75," says Karen Jones, head of technical analysis at Commerzbank. "Below the 200 day ma lies the double Fibo retracement at 1.2900/1.2895. This guards the recent low at 1.2772."

Above: Pound-to-Dollar rate shown at hourly intervals.

May's exit plan was rejected by the House of Commons for a second time on March 12, by a majority of 149. PM May has since said it won't be put before the house again unless the government can be confident it will pass. It's far from clear whether she will able to get the numbers.

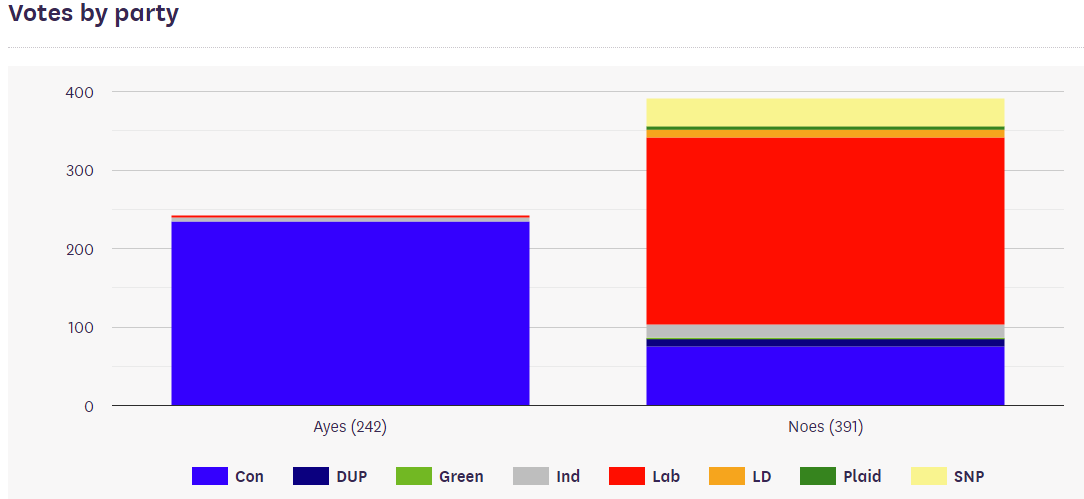

The previous Withdrawal Agreement vote resulted in a record-breaking landslide of opposition to what is the government's signature piece of work. 432 MPs voted against the bill on January 15, with only 202 in favour of it, making for a rejection by a majority of 230 votes.

Many of the withdrawal agreement's opponents object to it because of party-political reasons, but the DUP and other unionists have concerns about the treaty because of the so-called Northern Irish backstop inside of it.

Above: House of Commons result for EU Withdrawal Agreement vote on March 12, 2019.

The backstop enshrines in an international Treaty a commitment that will see the government forced to impose on the UK many existing and yet-to-be-made EU laws on a potentially-indefinite basis and without any ability to influence those laws or EU institutions. The UK will also form part of the EU's customs territory.

That's unless, of course, the UK is willing to allow Northern Ireland to be effectively annexed by the EU in the event the backstop is activated, in which case only Northern Ireland will be subjected to that treatment.

Once May's agreement is in force, the backstop could only be circumvented through the Prime Minister of the day satisfying the EU's demands as they relate to the "integrity of the single market" and adherence to the Belfast Agreement in the next stage of the negotiations.

Such a structure could be said to create an incentive for the EU to remain perpetually unsatisfied with UK proposals for the future relationship. This is why many MPs have expressed deep-seated opposition to the EU Withdrawal Agreement and some have even gone so far as to describe it as a trap.

Even if the withdrawal agreement had been approved on Friday there would still need to be another fractious parliamentary process next week, where opposition MPs would have another opportunity to express their views on the orphaned future relationship declaration.

Both must be approved in the House of Commons for the withdrawal agreement to be ratified, which would then enable the UK to leave the EU and immediately enter a so-called "implmentation period", but only the withdrawl agreement itself needed approval Friday to meet conditions set out by the European Council on March 22.

Meeting those conditions is necessary for the Article 50 negotiating window to be further extended until May 22, with the latter extension said to be aimed at facilitating the ratification process.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement