Pound Sterling Higher after Austria say Three-month Brexit Extension Possible, Pound Touches Fresh 2-Month Highs

Image © Number 10 Downing Street

- May said to acknowledge Brexit delay likely

- Austrian Chancellor Kurz says delay to Brexit can only last three months

- ECB meeting could shake the GBP/EUR

- "GBP remains a buy on dips" - Morgan Stanley

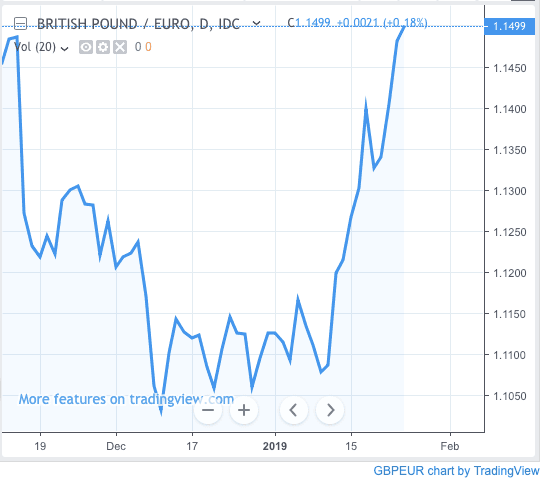

The British Pound has pushed to new 2019 highs on Thursday, November 24 as markets continue to price in the expectation that Brexit will be delayed beyond March 29 with Austraian Chancellor Sebastian Kurz saying a three month extension might be considered by the EU.

This makes for a relatively short timeframe within which to finally iron out a solution to the Brexit impasse, but Kurz notes the EU will find their hands tied on the matter owing to European parliamentary elections falling in the middle of the year. Speaking in Davos Kurz says he believes Britain knows the EU will grant an extension if requested.

The extension will likely be requested on the basis that the UK parliament has established a mechanism by which they can instruct the government to go to the EU to request a delay.

While any delay only serves to extend the Brexit-induced uncertainty hanging over the UK economy, it does signal to markets that the worst-case scenario for Sterling - a 'no deal' Brexit - becomes increasingly unlikely.

A report in the Times says Prime Minister Theresa May "privately accepts that she is powerless to prevent legislation removing the immediate threat of a no-deal exit proposed by Yvette Cooper of Labour."

Cooper and other MPs opposed to a 'no deal' Brexit have this week tabled a number of amendments in parliament that aim to force the government into steering the UK away from a 'no deal' Brexit. Cooper's amendment is widely held to be the most important in this regard as it 1) appears to command broad-based support and 2) is deemed to be the most enforceable.

There are questions as to whether the government has to abide by a number of other amendments, but the Copper amendment is said to be different.

"There is a difference in kind from the other amendments and Cooper’s,” an ally of Prime Minister May told the Times. "The first are expressions of parliamentary will which, in theory, she could ignore. But Cooper is proposing legislation. If that passes there is nothing we can do. It’s massively unhelpful."

In short, markets are confident there is some insurance in place that will ensure 'no deal' Brexit will be avoided on March 29, and Sterling has benefited as a result.

The Pound-to-Euro exchange rate is now quoted at 1.1483, but today's high is set at 1.1498, which is the best rate of exchange for those buying euros since November 14.

The Pound-to-Dollar exchange rate at 1.3066 but today's high is at 1.3094 which is the best rate of exchange for those looking to buy Dollars since November 97.

"GBP has taken some comfort from news that a Brexit delay bill would likely be approved by lawmakers. This has been proposed by a cross party group of MPs and would extend Article 50 if a deal was not in place by the end of February. While this would remove the prospect of a hard Brexit, plenty of political uncertainty remains in the UK and this suggests that the coming week or so could be another rocky ride for market sentiment," says Jane Foley, Senior FX Strategist with Rabobank.

Of course, the best possible outcome for the British Pound would be May's Brexit deal being voted through as this 1) avoids a 'no deal' Brexit and 2) delivers much-needed certainty to the UK public and businesses 3) will allow the Bank of England to raise interest rates in 2019.

We sense there has been seen some movement towards backing May's deal by Brexiteers of late as Brexit itself has been imperilled by the latest developments in parliament. A delay to Brexit could only encourage further parliamentary moves to backing a Norway-style customs union or a second EU referendum. However, Brexiteers will need some concessions to be allowed to make the shift towards backing the deal after having been so vociferously opposed for so long.

The single most important concession that will bring movement by Brexiteers is a time limit being placed on the Irish backstop. We know Ireland has been under pressure on the matter this week with an EU official confirming a hard border in Ireland would be likely if no deal is agreed, an assessment that is said to have taken Irish officials by surprise and places domestic pressure on Ireland's Taoiseach Leo Varadkar to work towards a compromise.

Meanwhile Poland broke rank with the EU consensus this week by suggesting a 5 year limit should be applied.

"The focus is on the Irish backstop, with Poland now diverting from the official line that the backstop is not for renewed negotiation. Any sign of more EMU flexibility concerning the backstop could push GBP significantly higher," says strategist Hans Redeker at Morgan Stanley. "GBP remains a buy on dips, as chances of a no-deal hard Brexit have fallen."

This week we have heard a number of EU officials say they remain committed to the Irish backstop and that this is non-negotiable. But we believe the EU know what May needs, and the time for a famous last-ditch EU concession is fast approaching.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

ECB in Focus Today for GBP/EUR

Those watching the Pound-to-Euro exchange rate should be aware that today the European Central Bank (ECB) deliver their January policy meeting in which they are to give guidance on monetary policy for the coming year.

With the Eurozone suffering a slowdown in the second-half of 2018, all eyes are on ECB President Mario Draghi and his team to see whether they have become more cautious.

The lacklustre performance of the Euro over recent weeks would suggest that this is an expectation that is widely shared by the FX market.

Therefore, the risk is that the ECB come across as being more sanguine about the risks, and a more upbeat-than-expected assessment could cause a rapid short-term recovery in the Euro.

The ECB event starts at 12:45 GMT.