Intesa Sanpaolo: X-Rate Forecast Update

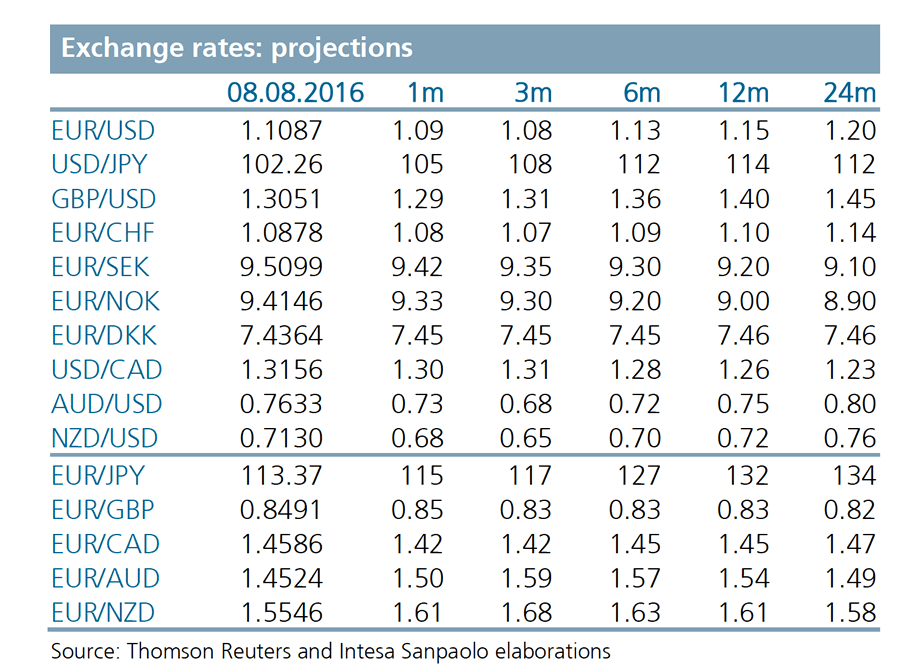

Analysts at Italy’s Intesa Sanpaolo have updated clients on where they forecast the foreign exchange markets to go in a three, six and twelve month timeframe.

The standout changes are on the GBP’s outlook.

Of note is that while Sterling projections have been downgraded, if analysts are right, then the UK currency could well be near its nadir.

Consider that Intesa Sanpaolo’s new projections are GBP/USD 1.29-1.31-1.36 on a 1m-3m-6m horizon, from GBP/USD 1.30-1.33-1.38 previously, which against the euro translates into EUR/GBP 0.85-0.83-0.83 from EUR/GBP 0.84-0.82-0.82 previously.

In Pound to Euro exchange rate (GBP/EUR) terms, this translates into 1.1765-1.2049-1.2049 and 1.1905-1.2195-1.2195.

However, don’t expect a notable bounce-back anytime soon.

“This depreciation should prove persistent, in the sense that the exchange rate will stay at new levels below its pre-referendum quotations for a rather long time,” says Chief Economist Luca Mezzomo.

For a full account of Intesa’s forecasts, please see the table below: