Credit Suisse post-Referendum FX Forecasts Released

- Written by: Gary Howes

Credit Suisse Fixed Income Research analysts have announced ‘material’ revisions to their FX forecasts following the vote by the UK to Leave the European Union.

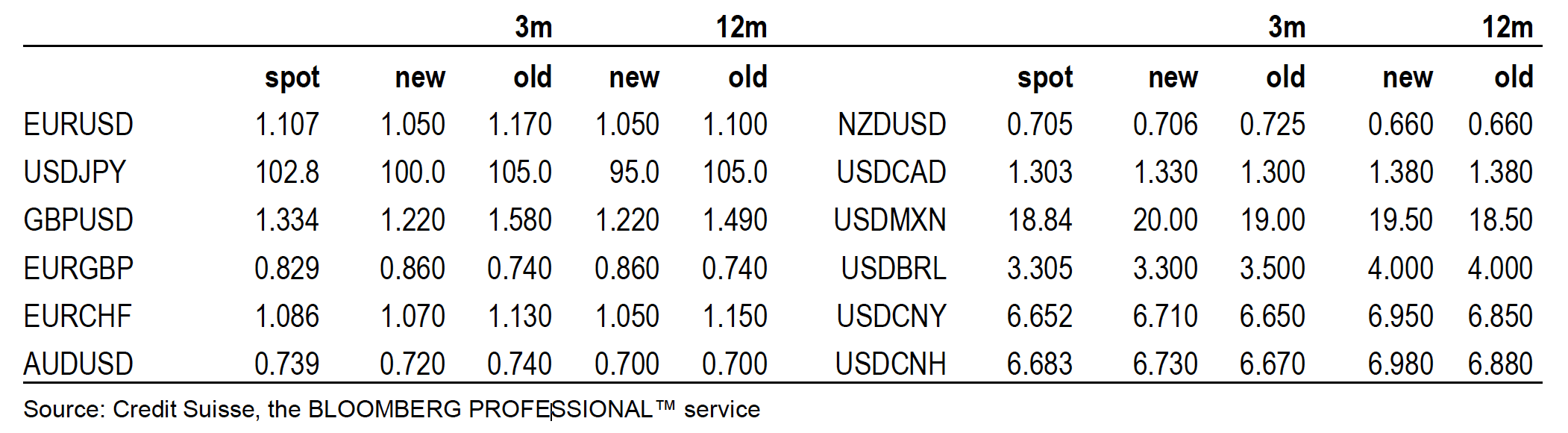

The standout revision is that to the GBP/USD forecast, lowered from 1.58 to 1.22.

This is below the 1.30 we have seen preferred by a number of other big-name analysts.

Credit Suisse are seen lowering their three-month-ahead EURUSD forecast to 1.05 from 1.17 previously.

The former forecast had anticipated a general jump in European currencies which were all pricing in some degree of Brexit contagion risk premium.

“Now the bad outcome is realised, we suspect the market will be consistently looking to sell EURUSD rallies,” says Shahab Jalinoos at Credit Suisse.

Credit Suisse are lowering their 3m EURUSD forecast to 1.05 from 1.17 previously, reflecting the likely growth spillover into the wider European region from the UK's woes.

Now that Brexit has been realised Credit Suisse suspect the market will be consistently looking to sell EURUSD rallies.

Issues such as the Italian constitutional referendum in October also present risk events that need to be priced.

Elsewhere, analysts lower their 3m and 12m USDJPY forecasts, the latter below 100 towards 95.

Credit Suisse believe the BOJ's hands remain tied by the inability of fresh easing measures to find genuine traction in terms of moving the currency while global bond yields remain in a downward trajectory.