Soc Gen Exchange Rate Forecasts for Euro, Pound and US Dollar Revised After Turbulent start to 2016

- Written by: Gary Howes

Societe Generale have updated their foreign exchange forecasts in the wake of what has been a volatile start to 2016 for currency markets.

The dynamics driving foreign exchange markets in 2016 are very different to those that drove markets in 2015.

Where 2015 was almost exclusively about central bank policy 2016 has become defined by headline risks - China, oil and the UK's place in the European Union

2015 was also about dollar strength while 2016 has seen the US dollar become, "a mid-table player in a league where the biggest winner by far is the Japanese yen and the big losers are the Mexican peso, the pound and the Korean won," notes Societe Generale's Kit Juckes in a foreign exchange forecast update to clients.

Demand for dollars has softened despite US data remaining firm confirming worries over the news headlines are driving demand for safe-haven assets such as the yen to a greater extent than many forecasters had expected.

Societe Generale had previously said they were looking for the EUR to USD conversion to hit a 1:1 exchange rate in 2016 but now the French bank say they do not see such weakness in the euro.

Another development that has caught forecasters off guard is the violent sell-off in sterling; the uncertainty posed by the UK’s EU referendum has proven many analysts to have been overly optimistic on sterling.

Latest Exchange Rates for Reference

The pound to euro exchange rate is at 1.2817 on the inter-bank market, bank transfers are in the 1.2460 area while independent providers are quoting higher at 1.2660.

The pound to dollar exchange rate is at 1.3934 on the inter-bank markets while banks are offering international payments in the region of 1.3550-60 while money payment specialists are seen quoting towards 1.3750.

Increased Odds of Pound Hitting 1.36 Against US Dollar

With the pound hitting the lowest levels seen against the euro since 2014 and the pound / dollar falling to lows not seen since 2009 it is no wonder institutions such as Soc Gen are updating their GBP forecasts. (We have seen some pretty notable forecast changes come through from HSBC and UBS of late).

Societe Generale note both GDP and employment growth in the UK have peaked and expect Brexit uncertainties to hit confidence and accelerate and deepen the slowdown.

Soc Gen assign a 45% chance of a Brexit happening, which is pretty high when compared to probabilities assigned by other institutional researchers. HSBC see a 33% chance while UBS see a 40% chance.

“Substantial inter-week realised volatility suggests that the option market vastly underestimates the odds of reaching 1.36 GBP/USD over a quarter,” notes Juckes.

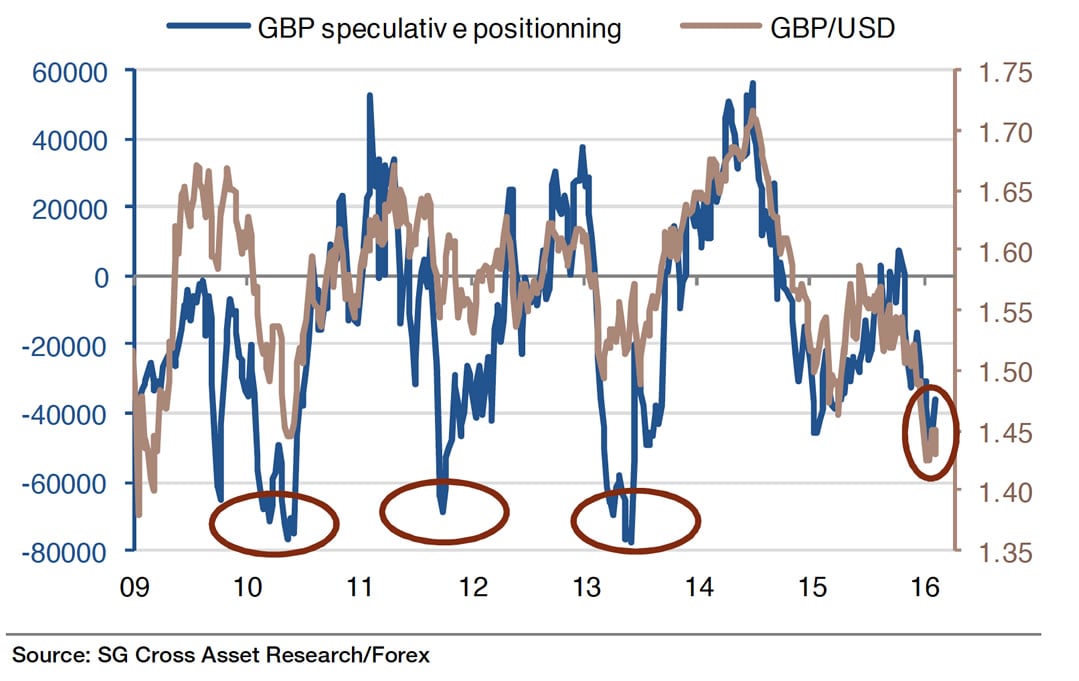

Indeed, positioning data suggests there is plenty of scope for the pound to fall further:

Soc Gen warn that further GBP declines are likely as the In camp have a great deal to gain by egging on the worst-case-scenario speculation concerning the economy.

"Theres too much uncertainty for bargain-hunters to buy the pound, and since one of the key planks of the Britain Stronger in Europe campaign will be to stress the downside of leaving. Inevitably, that highlights downside risks to the economy which will be reflected in FX valuations," says Juckes.

Juckes says the Brexit debate poses serious questions concerning the euro’s outlook too.

While the economic implications of a British exit are worrying for the euro, “the political risks, however, are much more worrying and would be at the centre of markets minds if Spain were to have a general election three days after the UK vote,” says Juckes.

This uncertainty undermines the euros safe-haven credentials. “As Bund yields head towards zero, the euro is unlikely to rally even if markets remain volatile,” says Juckes.

The euro has benefited to a degree as stock markets slump - the euro is not so much a safe-haven rather it has benefited from the return of capital borrowed at record low interest rates used to fund these initial stock market investments.

Exchange Rate Forecasts

It is noted that since February 2015 a simple 10-year bond yield differential has been the best guide to EUR/USD direction.

Soc Gen’s US bond yield forecasts have been lowered and this significantly reduces the scope for US yields to rise relative to Bunds, in turn suggesting that a move below EUR/USD parity is unlikely this year, but a retest of last years lows around 1.04 is still on the cards.

However, the forecast for June is 1.08 ahead of a move lower to 1.07 by September and 1.05 by early 2017.

The euro to pound sterling exchange rate is forecast to reach 0.81 by June 2016 ahead of a British pound recovery which will take EUR/GBP lower to 0.78 by September and 0.75 by the turn of 2017.

The pound to dollar exchange rate is forecast to fall to 1.37 by June, recover to 1.37 by September and 1.40 by the end of the year.

British Pound: The Week Ahead

GBP depreciated significantly last week as perceived risks of an EU exit increased.

"We maintain our view that the agreement was a positive development, EU exit risk has negative implications for the EUR, and EURGBP should correct lower," say Barclays in a note released ahead of the new trading week.

Barclays add that some reversal in recent GBP weakness against the USD is also possible this week given their above-consensus forecasts for February PMIs, including manufacturing (Tuesday; Barclays: 53.0; consensus: 52.3), construction (Wednesday; consensus: 55.5) and services (Thursday; Barclays: 55.5; consensus: 55.0).

Manufacturing firms’ sentiment is likely to remain supported, in line with the February CBI Industrial Trends survey, in which volume expectations remained buoyant at just above 10pts.

Services firms’ sentiment is likely to edge lower, in line with the February CBI Distributive Trades survey, as well as our broader view of a gradual moderation in economic activity.