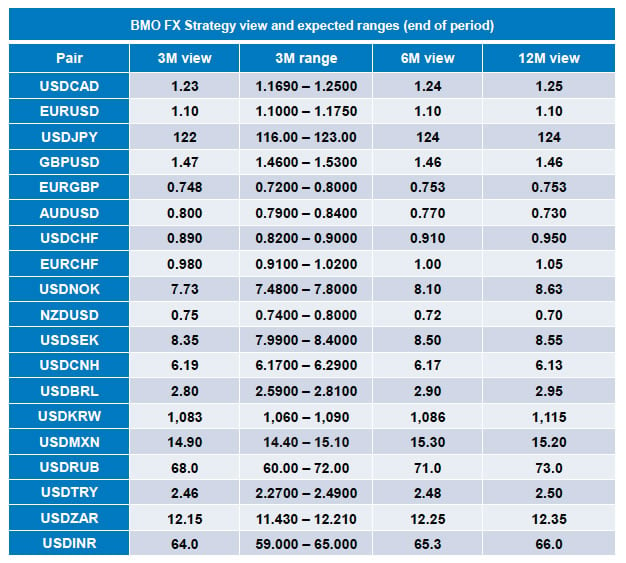

BMO Capital Update 12 Month Currency Forecasts: USD Still Undervalued

In the latest edition of their FX Quarterly, analysts Greg Anderson and Stephen Gallo at BMO Capital tell us that despite the impressive US dollar rally of 2014 the Greenback still has further to climb.

Indeed, the USD remains undervalued by historical standards which suggests there remains sizeable upside opportunities ahead.

Key Takeaways from the BMO currency forecast:

- Embarking on calendar 2015 with the key question: how much more can the USD gain before it runs out of steam?

- As FX strategists, our main focus is on the USD. We view its rally thus far as being a normal correction from extreme undervaluation.

- We see the USD as still weak relative to its historical inflation-adjusted average, so it is far too early to start talking about a USD overshoot.

- We fully expect the USD to rally another 5-15 percent in 2015.

- With the FX market now long-USD, the pace of USD appreciation should slow and the trend should become more jagged.

- We look for EUR to continue to decline as the ECB launches its QE program.

- We look for EURUSD to move to 1.10.

- A quick rebound in oil will help stabilise commodity currencies. A sustained trough, on the other hand, will bring further pressure by late Q1 and into Q2. We look for oil to dip further to $40/bbl in Q1 before bouncing.