Dollar Forecast to Rise 15 pct in 2015 Say BMO Capital

- Written by: Will Peters

The dollar is currently seen enjoying fresh highs against the British pound and the euro.

"We see the USD as still weak relative to its historical inflation-adjusted average, so it is far too early to start talking about a USD overshoot," says Stephen Gallo at BMO Capital, summing up the mantra that should guide currency markets for the next 12 months.

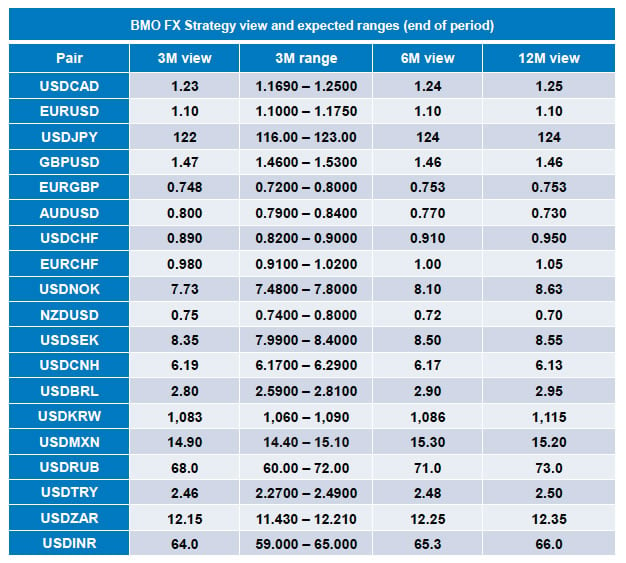

For reference the following levels are noted:

- The British pound to dollar exchange rate: 1 GBP converts into 1.5096 USD.

- The euro to dollar exchange rate: 1 EUR converts into 1.1446 USD.

- The Australian dollar to US dollar exchange rate (AUD/USD): 1 AUD converts into 0.8110 USD.

International Payments? Don't Get Burnt by the Markets or Your Bank - Ask your FX provider if they have the relevant stop loss order to protect against downside losses and a buy order to take advantage of your best-case rate when reached. In addition, using an independent provider instead of your bank can deliver up to 5% more FX.

BMO Capital: Reasons to Back the Dollar Rally Further

BMO Capital, in their latest FX Quarterly give the following reasons to back the buck in 2015:

- We see the USD as still weak relative to its historical inflation-adjusted average, so it is far too early to start talking about a USD overshoot.

- We fully expect the USD to rally another 5-15 percent in 2015. However, we don’t expect that move to be either smooth or equally distributed against other currencies.

- With the FX market now long-USD, the pace of USD appreciation should slow and the trend should become more jagged.

- In general, the timing of USD appreciation should be concentrated around the first Fed hike.

- But local fundamentals can focus USD appreciation in to different quarters for different currencies and cause some currencies to fall more or less than others.

- For Q1, the biggest story is likely to be the QE decision by the ECB. We look for EUR to continue to decline as the ECB launches its QE program.

- For the most part, other European currencies will move along with the EUR. We look for EURUSD to move to 1.10.

The 2014 Rally is Not Over

We enter Q1 of 2015 with a USD rally that appears to be gathering steam rather than tiring out.

The broad US dollar index rallied a little more than ten percent in the second half of 2014.

The Q3 move was the sharpest USD appreciation since the 2008 crisis.

The Q4 move was a little less abrupt against major currencies, but it broadened out to include cumulative moves in the vicinity of ten percent against many more currencies in both the developed market and emerging market realms.

Thus far in early 2015, the USD rally shows no signs of fading.

That leaves us embarking on calendar 2015 with the key question: how much more can the USD gain before it runs out of steam?