Pound Sterling Forecasts Against the EUR, CAD and USD: Will this Resistance EVER be Cleared?

- Written by: Gary Howes

The pound sterling (GBP) is predicted to retain a positive tone in global FX going forward with momentum continuing to advocate for further potential gains.

However we note significant resistance levels in many of the key crosses which are looking increasingly difficult to crack.

For instance, GBP-EUR remains anchored firmly between 1.21 and 1.22. A break above 1.22 seems remote at this stage.

The GBP-USD just can't clear 1.7, or even touch it, at this stage. 1.86 against the CAD just won't give - how many more failed attempts on this level are we going to see.

Today's FX market action confirms the consolidative tone remains:

- The pound euro exchange rate is trading 0.01 pct higher than seen at last night's close at 1.2136.

- The pound dollar exchange rate is trading 0.09 pct down at 1.6785.

- The pound Australian dollar rate is 0.11 pct lower at 1.8096.

If you are waiting for better rates it could be wise to lock-in the current levels with your currency broker; a forwards contract could offer you the best of both world's - better rates if the exchange rate rises and the peace of mind knowing that if these rates don't materialise you can still rely on the current locked-in levels. More details here.

Nevertheless, the longer-term momentum studies we present here suggest, if this deadlock is to be broken it will most likely be towards the upside.

Pound to Canadian Dollar forecast: Targeting a break of 1.86

Shaun Osborne at TD Securities reckons the GBP-CAD has more to offer, but a break of the long-term resistance level at 1.86 is needed:

"GBPUSD is attracting strong interest from momentum investors after the firm gains seen in the early part of the month and technically, we note strong trends are developing on many GBP fronts – versus the USD, CAD and JPY, for example.

"We have been long-term fans of GBPCAD and look for the recent rally in the GBP to extend through the mid 1.86 area in the next few days, driving the cross to new cycle highs. We think long positions are warranted above here and look for an extension to 1.92 to follow."

Pound Dollar exchange rate forecast

The following prediction on the Cable comes courtesy of MIG Bank:

GBP/USD has breached the fibo level at 1.6823. A solid break above would validated a short-term bullish trend reversal formation.

"The next resistance can be found at 1.7043 (11/11/2011). The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds.

"In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high)."

However, Craig Erlam at Alpari UK takes a more beairsh approach:

"Sterling is really struggling around 1.6820 right now having reached the 123.6 fib expansion level, which happened to coincide with a previous resistance level, dating back to 17 February. Numerous attempts to significantly break through this level have failed which suggests the bullish move may be running out of steam."

Euro pound exchange rate forecast

Analyst Piet Lammens at KBC Markets advocates selling the euro pound rate on upticks:

"We maintain our view that a sustainable break of the 1.6823/42 area won’t be easy (in GBP-USD).

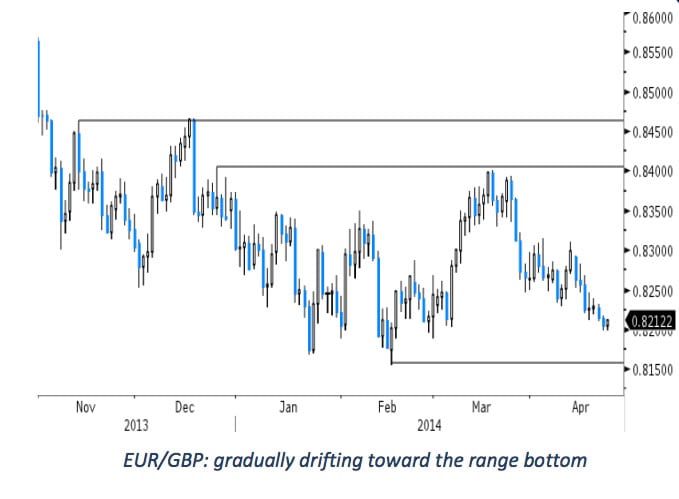

"EUR/GBP was under (moderate) pressure at the end of last week and drifted lower in the 0.82 big figure. The sterling

momentum is constructive, but a sustained break below the 0.8200/0.8157 support will be difficult without high profile news from the UK or Europe. We keep a sell-on-upticks bias for EUR/GBP."

Markets: Gold rises, WTI declines, euro up

Turning to the broader contenxt, we hear from Lee Mumford at Spreadex as to the state of today's market place:

"European and US markets continue to trade within a tight range as investors found few reasons to keep buying following six straight days of gains on the S&P.

"Gold advanced from a 10-week low after the escalating crisis in Ukraine increased investors’ appetite for safe haven assets.

"WTI crude declined, widening the distance between Brent to the most in five weeks on speculation oil stockpiles increased last week in the US.

"The euro strengthened against most of its major competitors after manufacturing and services expanded more than economists forecast. The news was seen as a positive sign for the currency as this could dampen bets the European Central Bank could ease monetary policy."