Euro Dollar Exchange Rate Forecast: Targets Upgraded at UniCredit

- Written by: Gary Howes

In a bullish forecast note on the euro dollar exchange rate UniCredit warn that not even the ECB will be able to dent the euro's robust performance in 2014.

The euro dollar exchange rate forecast for 2014 has been upgraded by the team a UniCredit Bank this March.

Consensus forecasts for a decline EUR-USD have time and again been proven to be wide off the mark; however UniCredit have stood out in that they have been notable bullish on the single currency.

Hence, we take suggestions that the EUR-USD will ascend further seriously.

Consensus is wrong, UniCredit is right!

At the beginning of 2013, consensus forecasted EUR-USD to end the year at 1.27; defying these expectations, the common currency finished the year at 1.3743.

In 2014 market expectations barely changed, forecasting EUR-USD to drop to 1.33 by the end of 1Q14 and to 1.28 by the end of 2014.

However, forecasters have been caught short as the EUR appears to be dismissing these expectations as wrong, trading now just short of the 1.40 level.

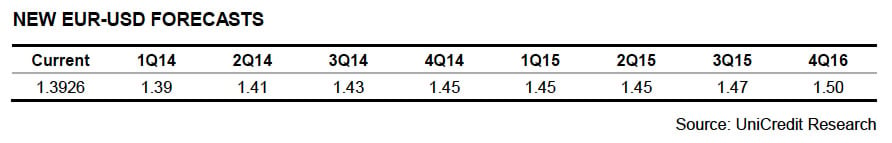

"We have long been arguing in favour of EUR strength, as part of our "normalisation theme" which we first introduced in late 2012. As reality has unfolded in line with our expectations and as EUR-USD is gaining momentum faster than we even thought, we raise our 2014-end forecast to 1.45 and our 2015-end forecast to 1.50," says UniCredit's Vasileios Gkionakis, Head of Global FX strategy.

NB: All FX quotes here are indicative of the wider wholesale market; rates are liable to a discretionary spread when being passed onto retail customers. However, an independent FX provider can pass on currency at a tighter spread, thus delivering more currency. Please learn more here.

The euro as a safe haven asset

In a FX Special note to clients the Italian bank say they have provided evidence of a significant shift in attitude towards EUR-USD.

"Namely we show that the currency pair traded as a risk asset during the period of the Euro zone crisis, but, interestingly, this has changed considerably since the summer of 2012. Latest evidence suggests that the EUR may be becoming a safe haven asset, which is likely to attract further inflows should emerging market portfolio outflows continue," says Gkionakis.

This reflects a massive increase in confidence toward European assets which, UniCredit say, started to take place alongside the compression of risk premia in the periphery of the Euro zone.

Will the ECB be able to keep the euro exchange rate complex down?

The short answer is no argues Gkionakis.

Because EUR appreciation happens to coincide with economic recovery and healthy inflationary growth the argument is that the ECB has no reason to interfere, particularly if the important economic indicators continue to move in the right direction.

The ability of the ECB to talk the euro down is also questioned, as noted by Gkionakis:

"If appreciation continues also due to momentum building and/or external factors (such as inflows from EM or geopolitical tensions) then the central bank is likely to step up rhetoric to try and talk the currency down; but verbal intervention is rarely successful when not backed by a high probability of physical intervention."

In short, to halt the appreciation, the ECB would have to engage in a balance sheet expansion, which however is unlikely as a reaction simply to currency strength.

Another LTRO conditional on bank lending is possible (in order to address the issue of fragmentation) and it might weaken the currency in the short term but would prove beneficial in the medium term as market participants would perceive such an action as improving the growth prospects in the Euro area.

"Only a full-scale QE could deliver a lasting blow to the currency but this is highly unlikely in our view, especially as a reaction to currency appreciation," says Hkionakis.

Revised 2014-2015 euro dollar exchange rate forecasts