Euro-to-Dollar Rate in the Week Ahead: Resumption Higher Expected After Support Reached

Image © European Central Bank

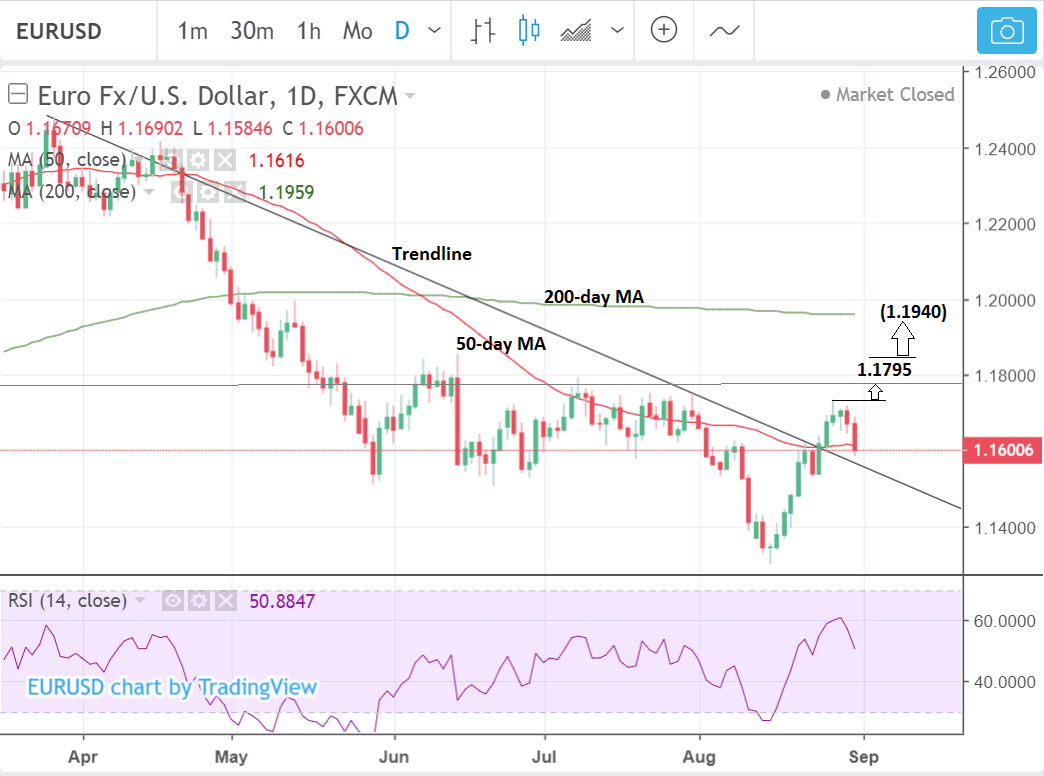

- EUR/USD has pulled-back into the 50-day MA

- The uptrend will probably resume from here

- The main release for the Euro is retail sales data and for the Dollar it is Non-Farm Payrolls

The EUR/USD rate has pulled back after escalating trade war fears weighed on most currencies except the Dollar, which rose instead, leading to a fall in the EUR/USD rate to the 1.1600 level.

Threats from Donald Trump that he would go ahead and raise tariffs on an extra $200bn of goods from China lent support to the greenback towards the end of the week.

The international trade outlook further worsened on news of a stand-off between the US and Canada in NAFTA talks and Trump's rejection of a free trade deal with the EU as not good enough because "... their consumer habits are to buy their cars, not to buy our cars," according to a report by Bloomberg, despite a zero-tariff deal being his original demand.

As we enter a new week of trading EUR/USD has pulled back sharply to a technical support level at the 50-day moving average (MA) where it currently resides, yet despite this pull-back it is still in an established short-term uptrend which is likely to extend higher.

The pull-back to the 50-day may mean the exchange rate is at the ideal point for a turn around and resumption higher, since it poses a formidable support level which the pair will have trouble breaking below.

The exchange rate has already broken above the 50-day MA and a major trendline drawn from the April highs which was an extremely bullish sign for the pair.

We expect the pair to recover and then continue higher given the dominant uptrend. A break above the 1.1734 highs would provide confirmation of more upside to an initial target at 1.1795 where the R1 monthly pivot is situated, a level where traders often anticipate pull-backs and reversals of the trend.

Alternatively, if EUR/USD manages to clear R1, confirmed by a move above 1.1845, it should then reach the next target at 1.1940, just below the 200-day MA, calculated by extrapolating the length of the move prior to the trendline (x) post-break (y), a common method used for forecasting the follow-through after trendline breaks.

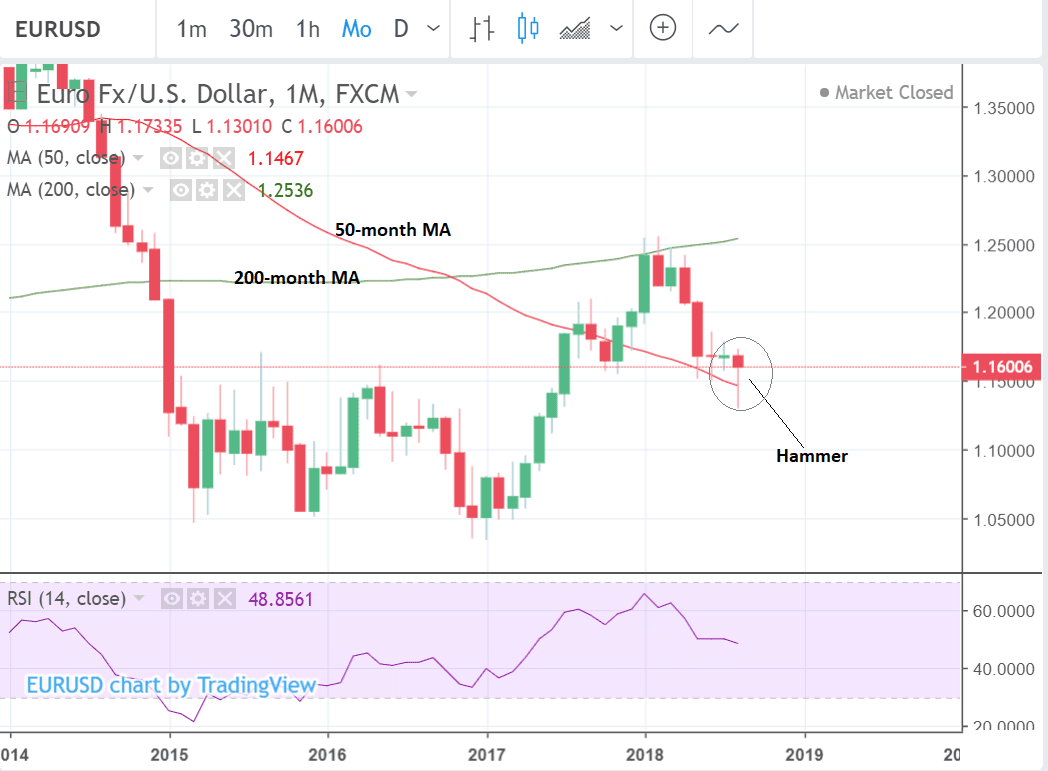

The bullish outlook is further supported by the monthly chart which is showing August has formed into a bullish hammer candlestick on the 50-month MA. Hammer's are strong reversal signals, especially when coupled with support from large MAs like the 50-month. if September is a bullish month, it will add confirmation and forecast more upside for the pair.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Euro: What to Watch

The Euro could be affected by the trade talks currently taking place between Eurozone and US negotiators in Washington.

Unfortunately the outlook for these talks is not particularly promising.

US President Trump originally asked for all tariffs to be dropped and the EU responded by offering him a free trade deal. Yet Trump has not accepted because, "... their consumer habits are to buy their cars, not to buy our cars," according to Bloomberg.

The US president said EU is 'as bad as China' in June when he imposed tariffs on iron ore, steel and aluminium. The EU retaliated with tariffs on iconic US brands like Harley Davidson and Bourbon.

On the 'hard data' front, the main release for the single currency is retail sales data for July, out at 10.00 B.S.T, on Wednesday, September 5.

It is expected to show a -0.2% result compared to the previous month of June, which is within the normal range. It is expected to rise 1.3% compared to July a year ago.

A larger-than-expected rise or fall would impact on the Euro because retail sales is a major component of growth since it is consumers who predominantly drive most non-export led economies.

Producer prices (PPI), also known as 'factory gate prices' are out at 10.00 on Tuesday September 4 and are forecast to show a 0.3% rise in July compared to June and a 3.9% annual rise.

PPI is often seen as heralding changes in broader inflation, which has been under pressure in the Eurozone recently. August inflation data showed a slide in both headline and core inflation of a basis point a piece, and this impacted negatively on the Euro, therefore, if PPI unexpectedly fluctuates it could have an impact, albeit marginal, on the single currency.

Eurozone Manufacturing and services PMIs are also out in the week ahead but these are final estimates so not expected to change much. The same goes for the second estimate of Q2 GDP.

Friday also sees a meeting of the Eurozone council of finance ministers, otherwise known as the 'Eurogroup'.

The Dollar: What to Watch

Non-Farm Payrolls (NFPs) is the main release for the US Dollar in the week ahead. It is forecast to show a 190k rise in jobs in the US in August against 157k recorded in July.

Average earnings will be released at the same time. Wages are as important to the Dollar as the headline payrolls' figure. A rise of 0.2% is forecast but a higher-than-expected result would be bullish for USD, and vice versa for lower. Higher wages mean higher consumption and growth usually, which is good news for the greenback.

The other key release for the Dollar is manufacturing and non-manufacturing sector data from the Institute of Supply Managers (ISM).

Manufacturing ISM is expected to come out at 57.6 in August, which is below the 58.1 result in the previous month of July, when it is released on Monday at 15.00 B.S.T.

Non-manufacturing ISM is expected to show a rise to 56.5 from 55.7 when it is released on Thursday at 15.00.

A result over 50 is indicative of expansion and below of contraction.

ISM surveys ask supply managers about their view of activity in their sector and collate the responses in a gauge. A higher-than-expected result would be positive for the Dollar and vice-versa for lower.

Other key data for the Dollar includes the trade balance on Wednesday as well as a lot of commentary from Federal Reserve officials all through the week.

ADP Employment Change which provides an alternative payrolls figure to NFPs is out on Thursday but it is not a reliable indicator of what NFPs will be.

Durable goods orders are also out on Thursday and oil data including an OPEC meeting kicking off on Monday also pepper the econ calendar in the week ahead.

The Dollar may also gain a boost if Trump goes through with slapping the extra 25% tariffs on $200bn more goods from China which looks increasingly to be the case.

Disappointing progress in NAFTA negotiations with Canada also means risk from that source. If geopolitical trade-risks continue to escalate it will benefit the USD which tends to rise from safety flows in these situations as well as lower supply due to expectations of less imports.

dvertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here