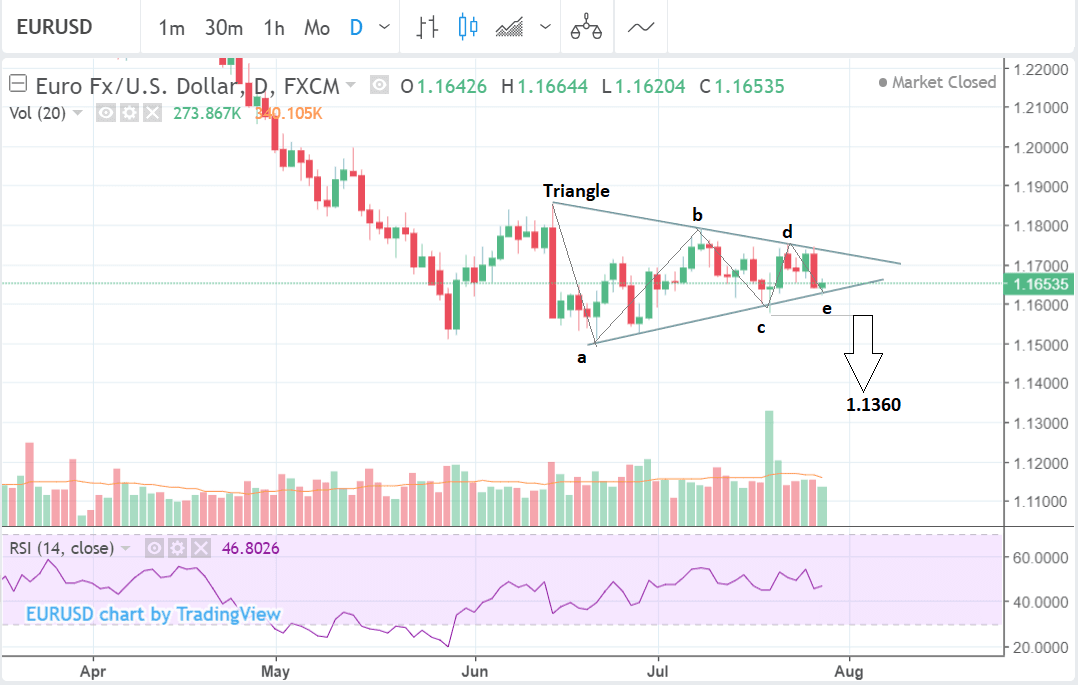

The Euro-US Dollar Forecast for the Week Ahead: Triangle Close to Breaking Out

- EUR/USD has formed a triangle pattern after going sideways for several weeks

- Downside break is probable, with a target in the 1.13s

- The main release for the Euro is inflation data; for the Dollar is is Jobs data and the FOMC

EUR/USD has been tapering in two converging lines since it based at 1.1510, and this tranche of activity is now looking very much like a triangle pattern; a development that forewarns of steep volatility on the horizon.

Triangles tend to lead to strong breakouts in either direction unless they are of the right-angled variety; but that is not the case with this particular specimen.

This triangle is probably close to breaking out as it is composed of 5-waves (labeled a-e) which is the minimum number.

The stronger downwards momentum in the three out of five component down waves (a,c,e) of the triangle suggests an greater probability of a breakout lower, rather than higher. Likewise, the fact the market was descending bfore the triangle formed is also bearish.

If the pattern breaks out lower it should reach a target in the 1.1360 based on the height of the triangle as a guide. A break below the 1.1575 C-wave lows would be required to confirm such a breakout lower.

An Elliot wave analysis of the pair also supports the probability of a break lower.

Such an analysis sees the pair consolidating in a wave (iv) triangle pattern, within a larger 5-wave structure down which began at the December 2017 highs.

The key line in the sand is the 1.1589 level, which if broken would signal the next wave of selling (wave (v)) with a downside target of between 1.1320 and 1.1439, says Alex Geuta for Elliot analyst at broker Liteforex.

Elliot waves are cycles of buying and selling, of rising and falling prices, which are composed of 5 smaller waves numbered 1-5, or labeled using Roman numerals, as in I, II, III, IV, and V.

Waves 1,3 and 5 move in the direction of the dominant trend whilst 2 and 4 represent corrections. Wave 3 is almost always the longest and the strongest wave.

After a 5-wave pattern has finished the market corrects back in a shallower counter-trend move labeled A,B, and C.

Elliot wave analysts try to establish the point at which the current market is in the greater wave pattern, which enables them to predict what will happen next.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to Watch for the Euro this Week

The main economic release for the Euro in the week ahead is inflation data out on Tuesday at 10.00 B.S.T.

Inflation data informs European Central Bank (ECB) policymaking, and if it rises the ECB is more likely to end its stimulus programme and start raising interest rates - a move which would be positive for the Euro.

Currently expectations for the first interest rate rise in years at the ECB is priced for the back end of 2019; bring that expectation forward and the Euro will find itself better bid.

Forecasters expect the inflation rate to remain at 2.0% in July and the Core rate to rise to 1.0% from 0.9% in June, on a year-on-year basis. A higher-than-expected rise in inflation, especially core would push the Euro higher.

Another key release for the Euro is Q1 GDP data, out at the same time as CPI, although it is a second estimate so is unlikely to surprise much either way.

Eurozone July PMIs are also scheduled for release during the week, but they too are second estimates so unlikely to move markets.

There are several German releases in the week ahead, including German retail sales in June and Unemployment in July - both out on Tuesday morning.

Events to Watch for the US Dollar this Week

Although the Federal Reserve meeting on Wednesday at 19.00 B.S.T. is a major event for the Dollar the actual reaction may be muted as there is not expected to be a change in policy at this particular meeting.

Nevertheless, analysts will be looking to the statement for signs of what is to come, with current expectations for a September meeting hike high.

"The central bank will release its post-meeting statement as investors look for any clues on whether it will follow through with rate hikes in September and again in December," says Investing.com.

"The Fed has forecast it will raise rates two more times in 2018, having already tightened policy twice this year," adds the site.

The current probability of a hike in September is 90% and 70% in December.

"On the central-bank front, the FOMC meeting on 1 August will be probably a non-event for the USD, although being the first since President Trump criticized the Fed’s tightening strategy. Rates are expected to remain unchanged this time with no major deviation in the statement from the bank’s recent rhetoric in favor of continued gradual tightening," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

The other big event of the week ahead is US labour market data out at 13.30 B.S.T. on Friday where markets will be watching for signs that the US economy's impressive performance will be maintained through the third quarter.

Despite record high employment in the US, Non-Farm payrolls still has the power to move markets although it is the average earnings component which is of most interest now.

A rise in average earnings would provide a sign of real growth in the US's consumer led economy and could keep interest rate expectations on the up, further boosting the Dollar.

Economists are forecasting wages to rise by 0.3% in July from 0.2% in June and to show an unchanged 2.7% rise compared to July last year.

Non-Farm Payrolls, meanwhile, is forecast to come out at 195k from 213k previously - anything around the 200k is very good considering the pool of labour is shrinking all the time.

The other highlight of the coming week for the Dollar is likely to be Personal Consumption Expenditure (PCE) on Tuesday at 12.30.

PCE is the favoured gauge of inflation for the Federal Reserve (Fed), the body tasked with setting interest rates in the US and since interest rates are a major driver of the Dollar, a higher inflation rate tends to drive up the currency.

Current market expectations are for a 0.1% rise in PCE in June compared to May and 2.0% for Core PCE, compared to June last year. Any rise above the expected might well send the Dollar higher.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here