Strategists Eye Euro-Dollar Rate in the Teens now that 1.20s are being Tested

- EUR/USD has weakened to lower 1.20s and threatens a deeper decline

- The consensus of technical views are bearish and expect a revisit to the 'teens'

- US Federal Reserve meeting on Wednesday is a major risk event on the horizon

© Andrey Popov, Adobe Stock

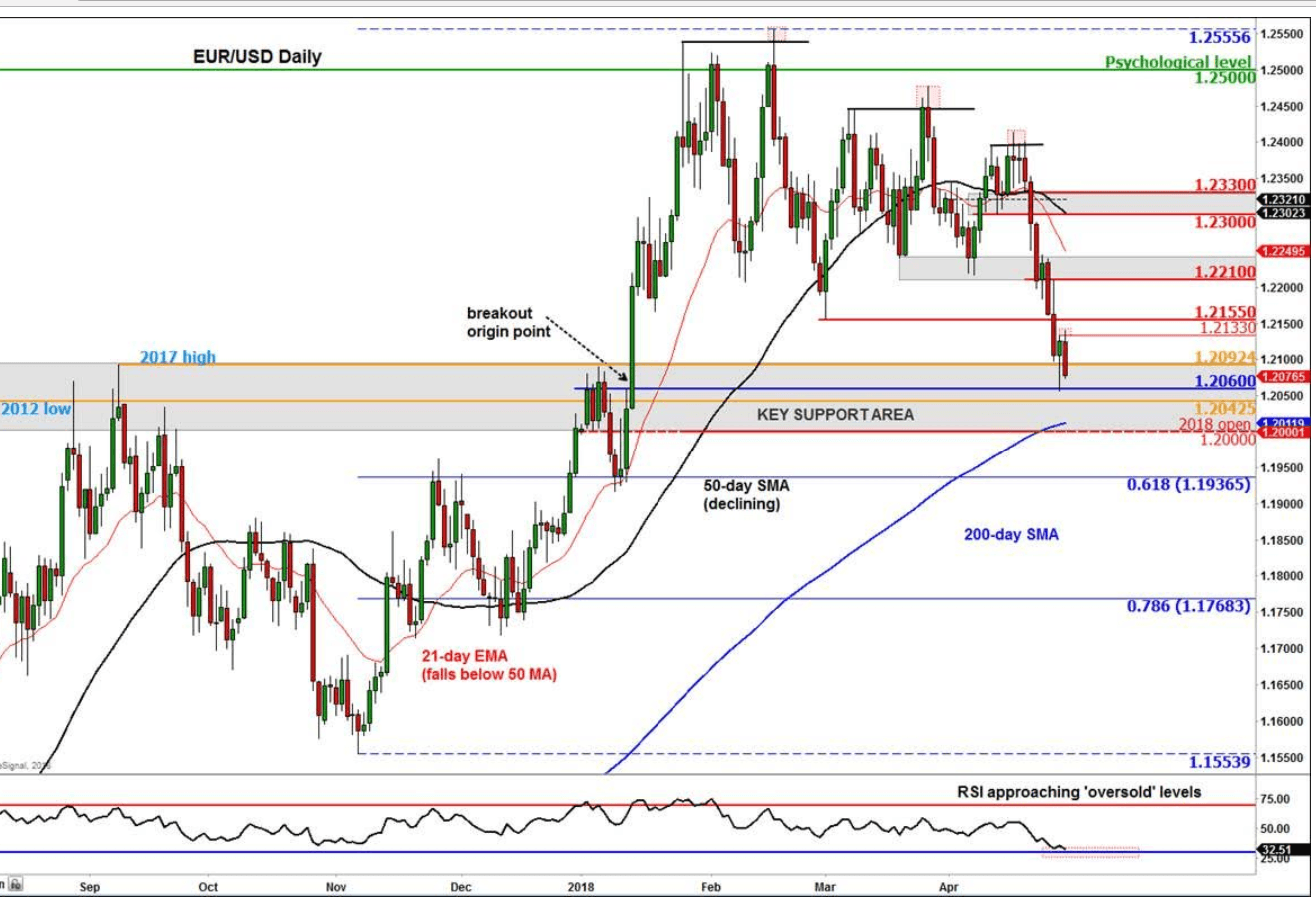

The Euro-to-Dollar exchange rate has sold off and entered a key technical make-or-break level between 1.20-21; it is currently trading at 1.2029.

The downtrend has intensified as the US Federal Reserve meets for its May policy meeting, the results of which will be made public midweek but market are expecting Fed officials to back calls for higher interest rates. There are of course therefore two-way risks for the Dollar depending on the outcome.

There are also two-way risks from a technical perspective, as this key support in the 1.20-1.21 area we are eyeing could well entice buyers back into the markey and stoke a recovery.

However, most analysts are warning the EUR/USD pair could break substantially lower should this support fail.

"Ahead of this week’s upcoming fundamental events, the EUR/USD has entered into a key technical area between the 1.20 and 1.21 handles," says Fawad Razaqzada, market analyst at Forex.com.

A move lower could open up more downside towards the mid-teens or the uptrend will resume and push higher towards a target at 1.23, according to Razaqzada.

"If the euro fails to stage a more significant bounce at this key support area in the coming days then this will increase the chances of a breakdown. However, given that the long-term trend for the EUR/USD has been bullish since the start of 2017, we are actually on the lookout for price to potentially form a base here and push higher again," continues the analyst.

Razaqzada targets resistance at 1.2300, "with intermediate hurdles seen at 1.2155 and 1.2210."

Alternatively if the "1.20 handle breaks" the pair could fall to the mid-to-high teens.

Other analysts are more bearish, such as Commerzbank's Karen Jones.

"EUR/USD remains under pressure and has now closed below 1.2092. We may see a small bounce from here but this is expected to remain tepid and we will maintain an immediate bearish bias below the 1.2155 February low," says Jones in a note to clients dated May 1.

Also now bearish is Quek Ser Leang, an analyst at Singapore-based Bank UOB.

"The odds for a shift to a bearish phase have increased considerably, " says Ser Leang, adding, "but we prefer to wait for a daily closing below 1.2090. A shift to a bearish phase would have an immediate target of 1.1960."

Storm clouds have been gathering above the Euro over recent weeks given the greenback is now receiving support from an increase in US bond yields, but until recently the lower bound of the exchange rate's four month range at the 1.2150 level has held firm.

Europe's single currency has spent 2018 bouncing between 1.2150 and 1.2550 after an earlier 12 month period where traders dumped the US Dollar and bought the Euro by the bucket load.

"We feel very comfortable with our forecast that EUR/USD will continue to correct downwards during the course of the year. The reason behind that is mainly a stronger dollar that is now beginning to benefit from higher US interest rates," says Thu Lan Nguyen, an analyst at Commerzbank. "The very hesitant ECB actions are certainly not likely to provide significant support for the Euro."

Also standing by what was once an out-of-consensus call for EUR/USD weakness are the strategy team with Bank of America Merrill Lynch, who had recommend selling EURUSD spot at 1.2378, with a target a 1.15.

"Data, rate differentials and our central bank calls are supportive. Market is short USD. We expect recent trade tensions to ease. We expect US profit repatriation. Quant and technicals supportive," says Athanasios Vamvakidis, an FX strategist at BofAML.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.