Euro-to-Dollar Rate Balancing on Major Trendline Support After Disappointing Eurozone Business Data

- EUR/USD down marginally after another slab of negative Eurozone data

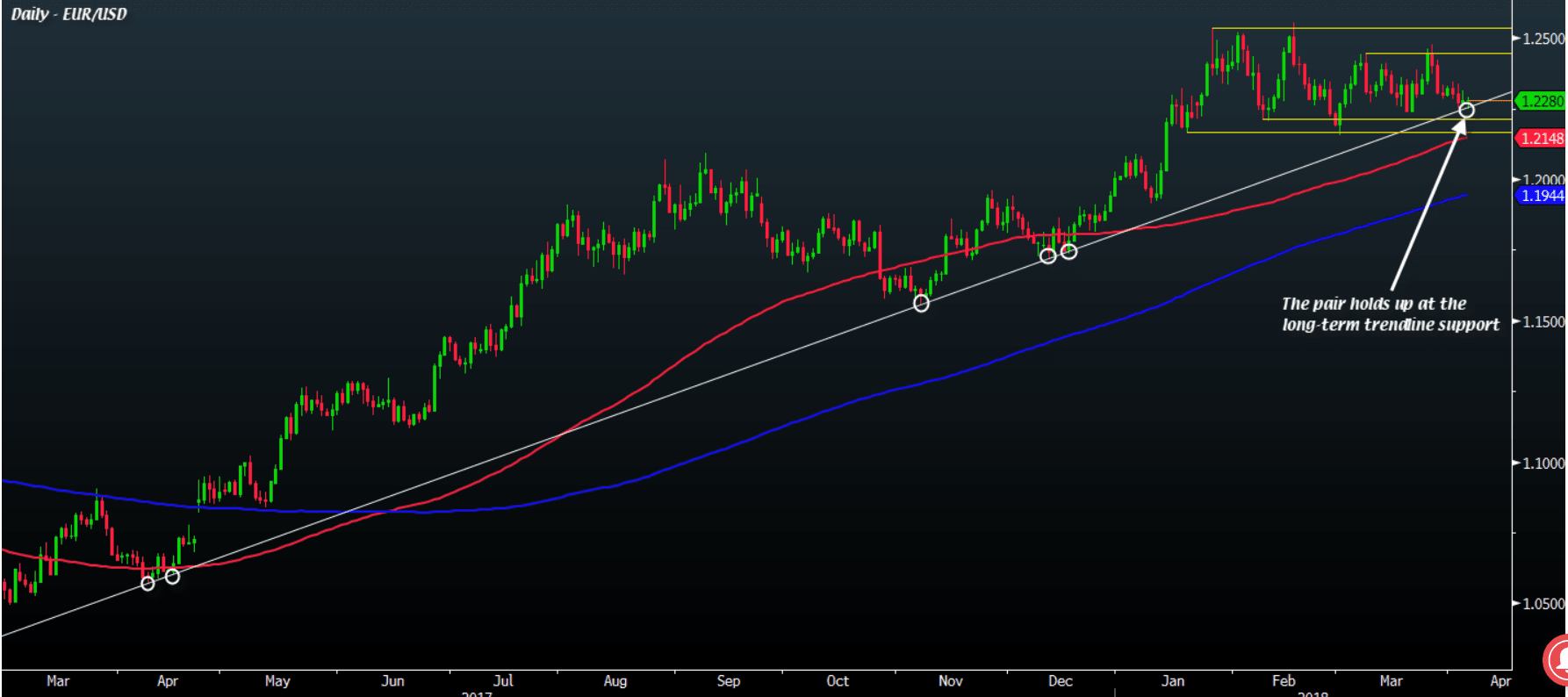

- Pair is now balanced on major trendline in make-or-break zone

- Liquidity rock-bottom ahead of US labour data tomorrow

© European Central Bank

The EUR/USD pair is under pressure today, sliding 0.3% to reach 1.2253 at the time of writing, its lowest level since March 21.

The slide comes on the same day a leading business survey reported the period of economic outperformance for the Eurozone had come to an end.

The IHS Markit Eurozone Services PMI, which is a timely gauge of economic activity, came out substantially lower on its final revision for March, falling to 54.9, from a previous estimate of 56.2.

The composite PMI, (Services and Manufacturing PMI combined) also came out substantially lower at 55.2 from 57.1 at the previous estimate.

For the PMI index to drop that steeply on a final estimate is rare, and although it remains above the 50 mark which differentiates expansion from contraction, markets will need to get used to more pedestrian rates of growth coming out of the area.

"The slowdown in these data looks grim, but we didn’t believe in the message of annualised GDP growth close to 4% when the PMIs were soaring in Q4 and January. Similarly, we don’t believe that the EZ economy is now suddenly slowing sharply," says Claus Vistesen, chief Eurozone economist at advisory service Pantheon Macroeconomics.

Also out this morning was Eurozone Retail Sales in February, which showed a large undershoot from forecasts, rising by a marginal 0.1% month-on-month when analysts had expected a 0.6% rise.

Even though this was an increase from the -0.3% previous result in January, it was not as high as expected and the yearly result also undershot expectations coming out at only 1.8% when forecasts were for 2.1%.

The one bright spot in Eurozone data was the Producer Prices, more commonly known as factory gate prices, which actually rose higher than analysts had expected and bode well for inflation as producer prices tend to pre-empt consumer price inflationary trends.

Yet all said and done the increase was only a marginal one basis point above expectations, with monthly increasing 0.1% in February and yearly 1.6%.

EUR/USD Testing Key Trendline

The Euro has weakened slightly and EUR/USD is now teetering on a major long-term trend-line, which could see buyers step into the market to buy Euros in anticipation of a recovery.

However, if the support breaks we might not find any buying interest anytime soon.

We think a deciding factor will be the US labour report out on Friday (tomorrow) at 13.30 GMT.

The flow of data since then has been especially negative rendering the deliberations of ECB officials largely redundant now, and probably over-optimistic looking.

"The pair is pretty much hugging the long-term trendline support stretching all the way back to April last year at this point. But traders are still displaying relative calm so far in the session," says Justin Low, an analyst at Forexlive.com.

"The trendline support sits around 1.2260 today, so watch out for that level if we get to it later in the day. There are large option expiries sitting between the 1.2200 to 1.2300 level, so barring any major surprises we are likely to see the pair trade between these two levels today," says Low.

"The Ddollar is also showing some form of steadiness so far, as it looks like the market is priming for tomorrow's jobs report for the next catalyst," adds Low.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.