The EUR/USD is Headed Towards Top of 2-Year Range

A new trade is on the cards with the strategy team at Societe Generale who are eyeing further advances in the Euro to Dollar exchange rate.

Strategists at the French bank have told clients they see the Euro heading towards the top of its two-year range against the Dollar.

On the surface this call could be seen as a ballsy one, coming at a time some strategists are looking to sell the Euro in light of its recent rally that leaves it looking potentially overbought.

At the time of writing EUR/USD is quoted at 1.2129 and is seen consolidationg following a strong upmove.

Of course timeframes in this debate are key and while some are looking for a short-term decline in EUR/USD it would appear that Societe Generale have a longer duration in mind.

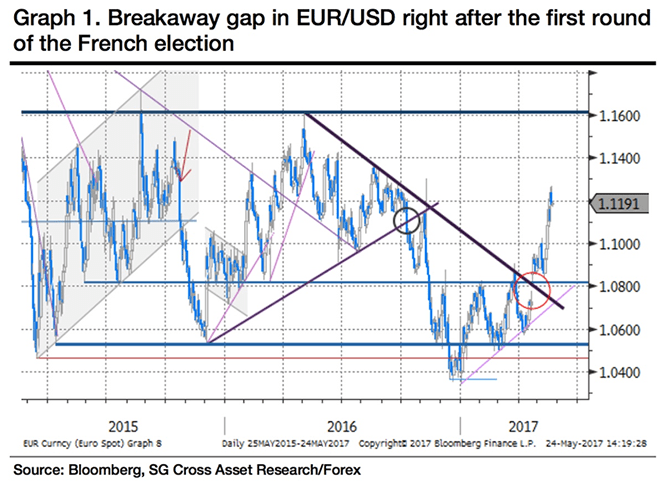

“Last month’s EUR/USD breakaway gap suggests that the price action validated politics. The combination of technical and political signals suggests that the bullish move is not exhausted yet,” says Oliver Korber who sits on the Forex £ Derivatives Strategy desk at Societe Generale.

Justifications for the call include the bullish signals on the EUR/USD charts being validated by the foreign exchange market’s reaction to the first round of the French election.

“Gaps are pretty infrequent in the 24/24 FX market, and more likely to open after a weekend, but they are nonetheless unimportant. Here, the combination of technical and political signals suggests that the bullish move is not exhausted yet,” says Korber.

Expected to drive the Euro higher over coming weeks is the French legislative election and the 8 June ECB meetings.

The events, “should prevent the pair from congestion around 1.12, and propel it towards the top of its two-year range,” says Korber.

But, this won’t be enough to decisively pierce the 1.15- 1.16 bound in the coming weeks and hence this is where the limited of the Euro’s efforts might lie.