EUR/USD Rate: The Rally Might be About to End Warn Blackwell Global

- Written by: Gary Howes

EUR/USD hit its highest level since November 2016 this week at 1.0990 and looks intent on testing and breaking 1.10.

The Euro has been spurred on by a commination of falling political risks in the Eurozone and a steadily improving economic data pulse.

Latest French election poll seems to show Macron widening the gap against LePen and this has been seen as a positive development.

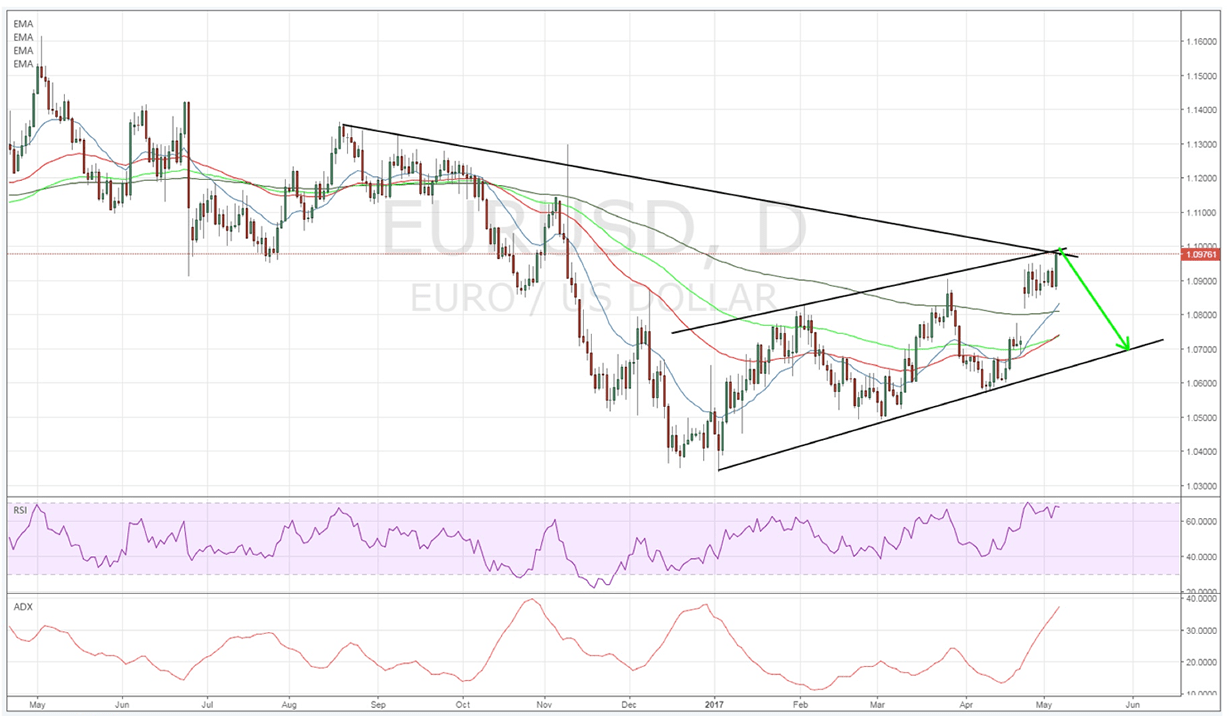

“Subsequently, the pair has rallied sharply to the top of the equidistant channel but some interesting technical analysis is suggesting that we might be on the way to a pull back,” says Steven Knight, Senior Market Strategist at Blackwell Global.

In particular, Knight notes EUR/USD’s recent rally has seen it establish itself at a key junction where the bearish and bullish trend lines intersect.

“Therefore, this is a relatively critical juncture and one that is likely to bring about some stalled upward momentum,” says the analyst.

“Additionally, the RSI Oscillator is largely telling the story with the indicator now edging into overbought territory suggesting that a pullback or period of moderation is ahead of us,” says Knight.

The ADX is also singing a similar song as the signal line has now reached a key reversal level and is also signalling a pullback ahead.

Subsequently, Blackwell believe there are plenty of reasons to suspect a technical correction in the coming session, not least of all the fact that price is now at an extreme and a mean reversion should be in play.

However, Knight cautions that there are also some fundamental risk events looming in the coming session which also lends further credence to the downside play.

In particular, the U.S. Non-Farm Payroll figures are due out late on Friday and are likely to bring with them plenty of volatility for the Euro.

Given the recent upbeat initial jobless claims result, the chance of a strong NFP number, above the 185k estimate, is relatively high.

Such a result would see the Euro depreciate against the greenback and send price action back towards the lower channel constraint.

“Ultimately, the pair’s rally is likely coming to an end with price action entering a key reversal zone and the RSI Oscillator indicating overbought levels,” says Knight.

Subsequently, the analyst believes the most likely scenario is where price action breaks down, towards the lower channel line at the 1.07 handle, following a failure to break through the 1.10 level.

“Keep a close watch on the pair as a decline through support at 1.0871 will likely signal the start of a new bearish leg,” says Knight.

The call by Blackwell echoes the view of another analyst we have recently covered.

Georgette Boele at ABN AMRO Bank NV has said she is expecting the Dollar to make a comeback in the near-term and this leaves the Euro looking exposed.

Her arguments can be found here.