A Magic Formula for Forecasting the Euro v Dollar on the French Election Outcome

If Marine Le Pen wins the French Presidential election it will cause a lot of uncertainty about the future of the European project and understandably the pricing of the Euro.

This could be a catastrophe for the EU given France’s position as the largest country in Europe and de facto joint chair of the club with Germany.

The Euro would be expected to rapidly lose ground if Le Pen wins, mirroring the Pounds fall following Brexit.

If Le Pen wins, how far will the pair fall; if she loses, how far will it rise?

To help answer this question HSBC’s FX strategist Daragh Maher has crunched the numbers and borrowed a method used to predict changes in Sterling before the UK’s EU referendum.

“In the run-up to the UK referendum on EU membership, the market was so fixated on the probability of Brexit that we were able to model the behaviour of GBP-USD as a simple weighted average of the binary referendum outcomes,” Says Maher.

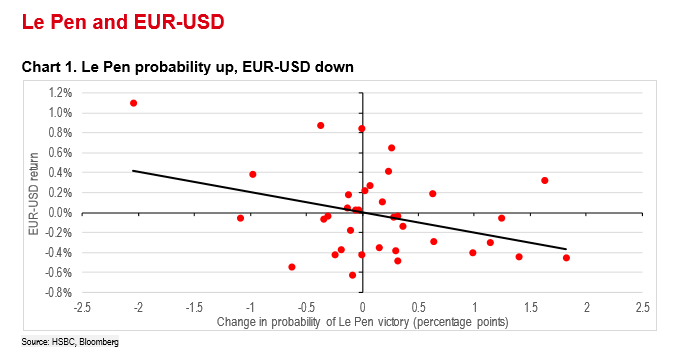

“Given how well that simple model worked for GBP-USD, people are naturally looking for an equivalent model to relate the price of EUR-USD to the probability of a Le Pen victory. We can use the relationship between changes in the probability of a Le Pen victory and returns in EUR-USD to deduce how sensitive the FX market is to Le Pen.”

Maher calls this ‘Le Formula Magique’ in a French version of “the Magic Formula” the team at HSBC developed for the Pound.

“We find that an increase in the probability of a Le Pen victory of 5 percentage points is associated with a fall in EUR-USD of 1%.

This relationship suggests EUR-USD at 1.13 if Le Pen loses, and 0.93 in the case of a Le Pen victory,” adds Maher.

But the formula works differently at different times – for example, the closer it is to election day the more reliable the relationship because the market becomes increasingly obsessed with that one factor which eclipses interest in all other FX drivers.

“Cable’s magic formula worked best in the last month before the referendum since, by that point in time, all other factors influencing the price of cable were far subordinated to the referendum outcome.”

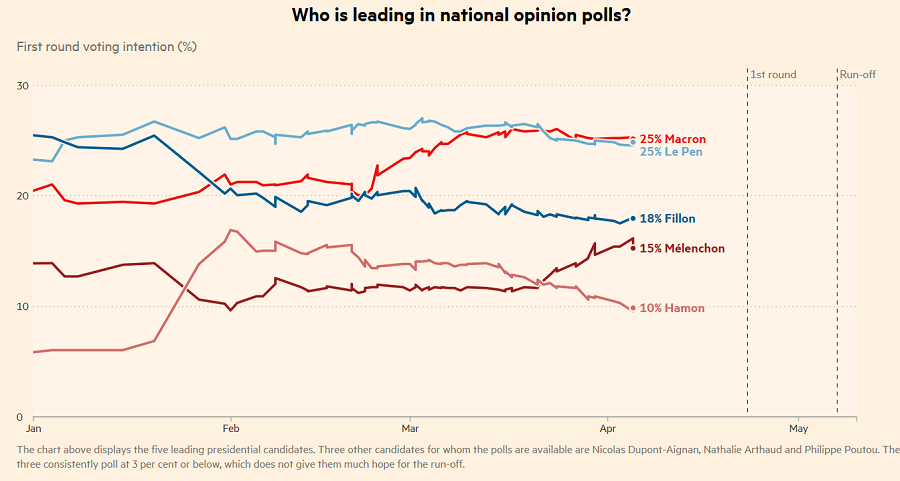

With the first round of the French elections on the 23rd of April, we are now already within that one month window, so the formula should be working fairly reliably.

Polls out on Thursday have also shown a resurgence in support for Le Pen from 45% to reach 47% - a new high.

Sure enough, EUR/USD has lost ground since the poll result, falling from an open of 1.0661 on Thursday to the current 1.0635 – a drop of 0.24%.

Is this in line with what the formula would predict?

A 2% increase in the Le Pen lead from 45% to 47% should result in a 0.40% fall in EUR/USD according to the formula, which is more than the actual 0.24% drop registered, suggesting the formula is overexaggerating the downside impact.

In March the HSBC formula also failed, as the EUR gained substantially despite Le Pen also gaining much ground in opinion polls, and whilst this was before the month preceding the election, it nevertheless shows how other drivers - in this case to do with the Dollar - can override purely Eurocentric political concerns.

It may also reflect a less hardline attitude from Le Pen on membership of the EU.

Scaling the Impact

HSBC's Mayer notes other variables which affect the relationship.

“It is likely that the relationship between these two variables is not as simple as a linear relationship between daily changes. To elaborate on the 5pp rule of thumb just described, it seems likely that an increase in the probability of Le Pen winning from 47% to 52% is likely to have a much more pronounced impact than an increase from 22% to 27%.,” he says.

Bottom Line, is that if the probability of a Le Pen victory suddenly jumped to 100% HSBC’s ‘formula magique’ would suggest a value for EUR-USD of around 0.93.

Meanwhile, a Le Pen victory would see EUR-USD below parity, and if the probability of a Le Pen victory went to a hypothetical 0% then this relationship would suggest EUR-USD moving to 1.13