EUR/USD Exchange Rate Recovers from Oversold Conditions, US Data Will be Key

The euro to dollar exchange rate has made a strong recovery from oversold conditions over the course of the past 24 hours and how the EURUSD ends the week will depende on the outcome of a key US data release.

The EUR to USD conversion is taking a breather at around 1.0950, after rising roughly 1% on Thursday.

The euro has been under pressure over recent weeks and the need to consolidate from recent falls was necessary. The trigger for the move was some less-than-stellar US data. However, we don't see anything untowards in recent numbers to suggest that the bounce in the euro was anything but technical.

The US labour market report for February is the dominant release today and will determine how the euro to dollar exchange rate ends the week.

Markets are looking for a reading of 190K, but watch average hourly earnings where a number of 0.2% is forecast.

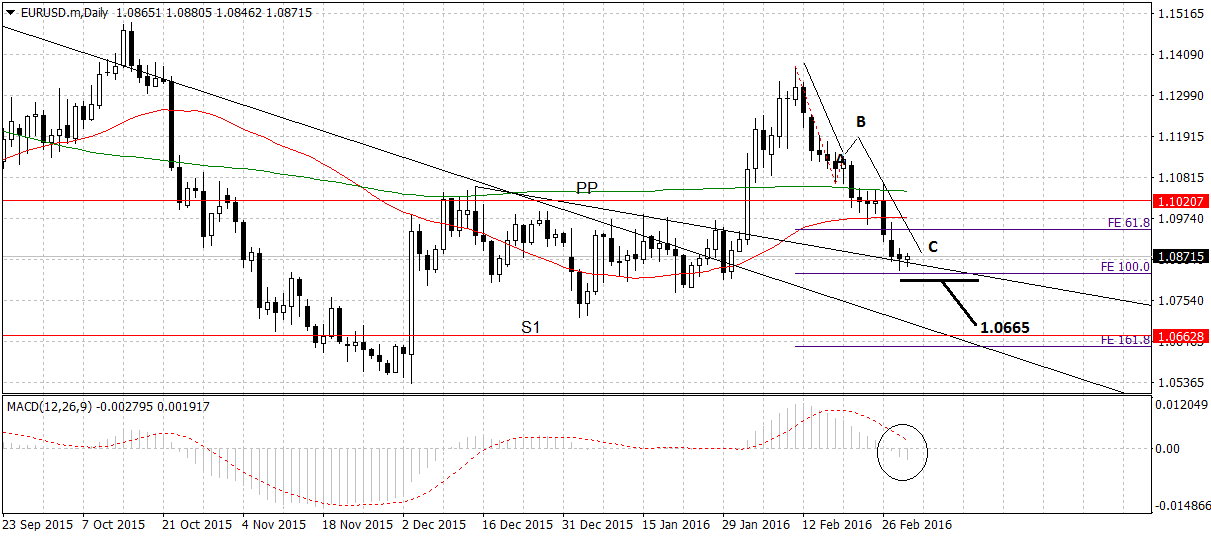

"Technically the rebound from 1.0825 is reaching important pivot resistance in the 1.0980-1.1060 region," says Robin Wilkins at Lloyds Bank, "a move up through here would suggest a stronger rebound towards 1.12- 1.1260, within the current range under 1.1375/1.1465."

Lloyds hold a bias for the immediate resistance area to hold and a move back down to the lower part of the range.

Key support lies in the 1.06-1.0460 region.

"Medium-term a breakdown below 1.06-1.0460, on stronger US data or easing from the ECB, would open up 1.03/1.0250, but for now our technical studies suggest the lows should hold, with current range boundaries likely to be maintained," say Lloyds.

Big Risks Ahead for the Euro

Over the medium term we expect the single currency to experience another round of downward pressure as the ECB’s easing bias, together with renewed talk of Greece’s debt situation take center stage in the coming months.

"ECB remarks mid-week on inflation and inflation expectations should serve as clear warning that more stimulus is coming at next week’s ECB policy meeting, a situation that will likely see the euro unable to sustain any strength over coming days, says Arnaud Masset, market analyst at Swissquote Bank.

We have had some notable hints at action come through over recent days.

Governor Francois Villeroy de Galhau’s focus on inflation expectations warrants attention as Eurozone inflation expectations (as measured by the 5Y 5Y breakeven rate) has recently reached a record low (1.4%) and is below the level prevailing when the ECB started its QE programme at the start of last year.

This tells us inflation will be the target at the ECB March 10 meeting which should bring with it measures that will likely keep the euro under pressure over coming weeks and months.

Longer-Term Declines Likely

“We continue to view EURUSD is overvalued relative to fundamental equilibrium which we estimate currently to be a little under 1.01, based on short-term rate spreads and relative equity returns. Look to sell,” says Shaun Osborne, analyst at Scotiabank.

Osborne concedes that the market has entered a sideways pattern of late but moves either side of resistance at 1.0880/00 and support at 1.0840 intraday will inject more impetus into the pair.

Lloyds' Wlkins, while also noting oversold conditions, does however concede that directional moves will likely be biased lower.

"Short term we continue to look for a decline back towards the 1.06-1.0450 range lows that have held since March 2015," says Wilkins.

The 2016 high in the euro to dollar exchange rate stands at 1.1376 which was achieved as markets became concerned that the US was potentially heading back into recession.

Ultimately the fears proved unfounded and the dollar recovery has been strong - the euro has fallen for 14 of the last 17 days confirming the establishment of a negative trend that dominates the technical outlook.

Indeed, we have just published a piece suggesting that the dollar could be about to fire up the engines and extend its stalled longer-term period of appreciation.

Societe Generale's Kit Juckes expects the advent of better risk appetite to pressure the euro further:

“A risk-on world with rising Treasury yields is not going to help the yen, and the contrast between the US and Eurozone data is going to keep up the pressure on the Euro, even if EUR/USD 1.08 remains a significant hurdle.”

The Pound Sterling Live view is that the down-trend remains intact but the current move lower is a little overextended and may pause to consolidate before resuming.

EUR/USD pair has found support at 1.0855 where an old trend-line is situated.

It has fallen from the 1.1376 highs in a three wave corrective A-B-C pattern, which has now completed.

A break below the trend-line and below the 1.0800 level would help confirm a resumption of the down-trend, to the next target at the S1 Monthly Pivot at 1.0665.