EUR/USD: Slight Upside Bias as Pair Nears 50-day MA

The EUR to USD conversion has pulled-back from its post ECB peak; upside potential persists despite the longer-term down-trend, but major resistance just above the current level stands in the way.

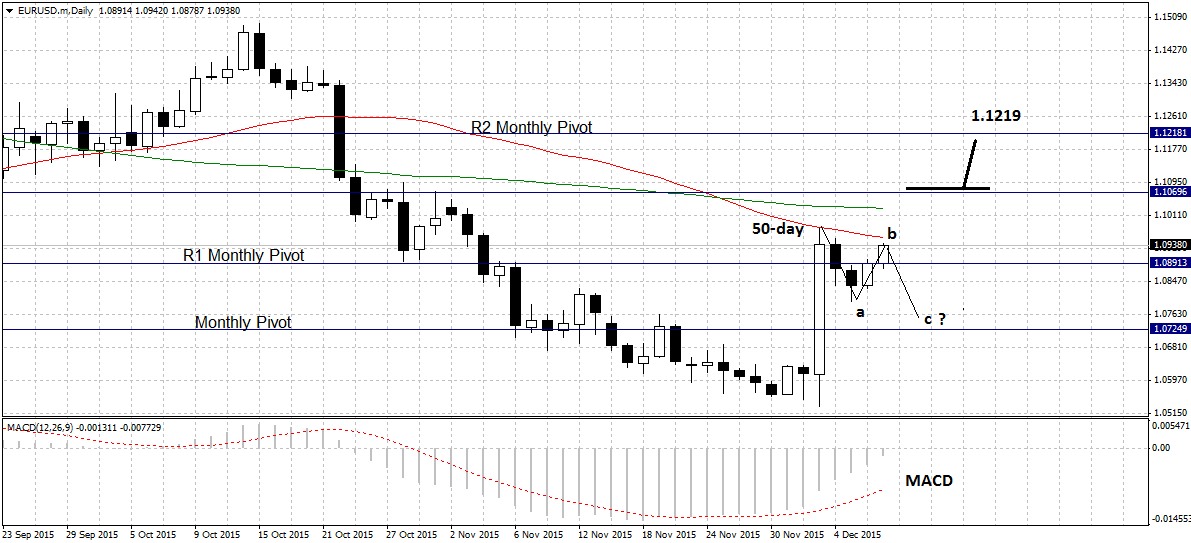

After spiking higher following the ECB rate meeting the EUR/USD pair has pulled-back, in what could be an unfinished three-wave A-B-C correction, which is currently still in its ‘B’ wave.

The latest wave has moved higher, reaching within a hair's breadth of the 50-day at 1.0957, where it is likely to encounter stiff selling pressure.

If the pattern is an A-B-C then it is likely to move lower eventually in a final wave C with a possibl end-point at the monthly pivot at 1.0725.

After the corrective pattern has completed the pair may start a fresh cycle higher, back into the moving-average bands again, and the R1 monthly at 1.0890.

Further upside is still not confirmed, however as, for one thing MACD - a useful trend-change confirmation tool - has still not moved in buy territory above the zero-line.

Ideally I would want to see a clear break above the 50 and 200 day MA's, as well as a signal from the MACD.

The green-light would probably come after a break above the 1.1070 highs, with a target located at the R2 Monthly Pivot at 1.1219.