EUR/USD Outlook Dictated by Descending Channel

- Written by: Gary Howes

Will the euro continue to fall against the dollar or will recent strength continue and invalidate the near-term negative scenario?

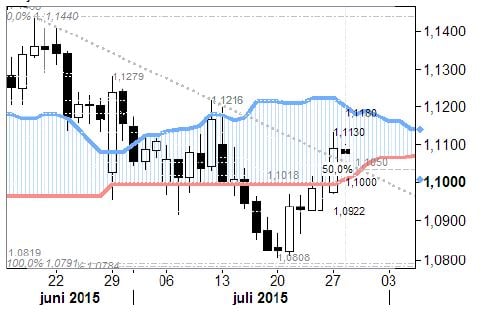

The euro dollar exchange rate has been trapped within a declining channel since June and for us this is the over-riding guiding light from a technical perspective.

However, as we look to close out July we note that the recent strength in the euro exchange rate complex has allowed the EURUSD to recover to an extent that the downward channel is threatened.

Will the euro break further higher towards 1.12 and thus invalidate the channel?

Or will the US Fed decision mid-week remind markets that parity is still the ultimate destination?

Analysts at SEB have taken a look at the euro / dollar and believe that 1.1180 is a possible target:

“The session close off the highs shows that it is two-way traffic going through but now there is a 1.1050 support building up and an extension higher to test the high end of the ‘Cloud’ (see image below), now at 1.1180 is a possibility.

“More important resistance comes with July 10th reaction high of 1.1216. Current intraday stretches are located at 1.0995 and 1.1160.”

At the time of writing the euro to dollar exchange rate is seen at 1.1060, “In the interim, EUR-USD may stall into the 55-day MA (1.1125) with key support not expected till the 1.1000 neighbourhood,” says Emmanuel Ng at OCBC Bank.

Meanwhile, we have reported that strategists at BNP Paribas are advocating for a sell on the euro / dollar on any bounces towards 1.11 targetting falls lower to 1.04 and even 1.02.

What Matters for the Euro Exchange Rate Family?

Technical discussions between Greece and the troika are scheduled to commence today with potential for headline risks while the pair also garnered marginal support from the better than expected German July IFO (108.0).

Beyond the near term, note that the IMF has also warned that the ECB’s QE may have to extend beyond September 2016.

The IMF said the ECB should “stand ready to extend the programme” if inflation remains below its target of below but close to 2 per cent.

Should we get any indication that the ECB intends to take this advice then we would certainly expect the euro exchange rate complex to take a notable step lower as the lion’s share of the present weakness is centred on the 60BN Euro injection being administered by the ECB.