Euro Hurt by PMIs

The euro exchange rate complex is under pressure following the release of disappointing PMI figures.

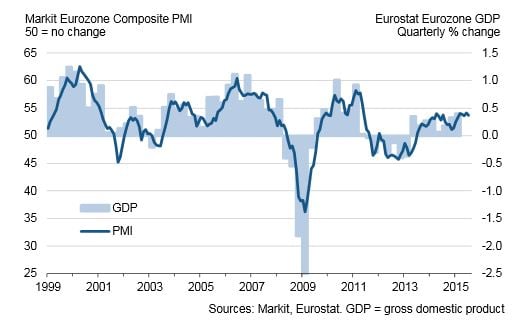

In July, eurozone PMIs lost some momentum: as a result of a combined drop in both the manufacturing and services activity, the composite PMI declined to 53.7 from 54.2.

“But the recovery looks resilient. At face value, today’s composite PMI remains fully consistent with 0.4-0.5% GDP growth in 3Q – in line with our forecast. It is difficult to understand whether the Greek crisis played a role. The data breakdown shows that the sluggishness in world trade continues to take its toll on the export performance of the eurozone, despite the tailwind from a weak EUR,” says Edoardo Campanella, Economist, at UniCredit in Milan.

In this context, the recent decline in oil prices comes as a welcome source of stimulus suggest Campanella.

The euro is lower across the board:

- EUR/GBP is down to 0.76 following a decent week which saw the shared currency reverse some of its recent losses.

- The EUR/USD is at 1.0941 after the pair successfully bounced off support at 1.08 – 1.10 is the next target in the advance.

In July, the manufacturing PMI dropped to 52.2 from 52.5.

The output index declined to 53.4 from 53.6, while new orders were down to 52.0 from 52.7, dragged down by a second consecutive decline in export orders to 51.8 from 52.7.

The new orders/stocks ratio stabilized at 1.08.

The hiring indicator rose to 51.8 from 51.7, which is consistent with ongoing moderate job creation. On the price side, the input price index declined to 54.8 from 55.7, while the output price index broadly stabilized at 50.9.

The services PMI was down to 53.8 from 54.4. The outstanding business index increased to 51.3 from 50.8 and the new business index was up to 53.7 from 53.5. The employment index declined to 51.7 from 52.2. The input prices index declined to 53.8 from 54.1, whereas the output price index was up to 49.6 to 48.9.

Country details so far available mirrored the patterns observed at the eurozone level.

In Germany, the manufacturing index dropped to 51.5 from 51.9 and the services counterpart declined to 53.7 from 54.0. Overall, the Composite PMI printed at 53.4 from 53.9.

In France, the manufacturing PMI decreased to 49.6 from 50.8 and the services index dropped 52.0 from 53.8. As a result, the Composite PMI was down to 51.5 from 53.3.

Long term we note that these data suggest the Eurozone continues its slow recovery - this should prove supportive to the euro in 2016.

Should the data continue in a similar fashion over the course of the next three / four months we could well start to see the beginnings of a bottom in the euro's trajectory lower.