Euro-Dollar at Inflection Point

- Written by: Gary Howes

Image © Adobe Images

EUR/USD could return to 1.08 before it falls to fresh lows below 1.0330.

This is according to a new analysis that comes on a day of Euro outperformance, despite news the French government is likely to fall on Wednesday.

France's parliament will debate a no-confidence motion in Prime Minister Michel Barnier's government, with a vote also due on the day.

With the numbers pitted against Barnier, France will likely have a caretaker government until July next year, when new elections can be held.

Yet, despite the news, the Euro to Dollar exchange rate (EUR/USD) is higher on the day and is certainly well above its November low at 1.0330.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The amount of negativity in the price for EUR is pretty extreme," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

"With French spreads blowing out, EU growth in question, German political tension, German data in the toilet, ECB rate cuts priced, elevated energy prices, Trump EU tariff risk, increasing Russia/Ukraine, tensions, etc. etc and yet the EUR/USD is still only 1.0500 handle, not 1.0000," he notes.

Bechtel thinks the Euro might be at peak pessimism, which opens the door to a recovery in the short term.

"It feels to me still that we are at an inflexion point, perhaps only a short-term one, but one that should manifest this month and result in a grind back to 1.0800 or so before we reset," he says.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Analyst Daragh Maher at HSBC says 1.05 is acting as an anchor of sorts for EUR/USD.

"After yesterday’s weakness in the EUR and French markets, there has been a bit of a recovery overnight. French equity markets are higher, the French 10Y yield spread over Germany has narrowed a bit, and the EUR has capitalised. The bounce seems at odds with the headlines," he notes.

France is set for an extended period of uncertainty, yet markets appear relatively sanguine. This could be because a new caretaker government will be enough to keep the wheels of the state turning, putting off until the second half of 2025 the tough decisions the country must take.

"Much is unclear about how this situation will play out, including how the EU Commission will assess France’s compliance with the Growth and Stability Pact. The EUR is vulnerable," says Maher.

Euro resilience in the face of the headlines opens the door to a bounce in Euro-Dollar on any disappointing U.S. data, the highlight being Friday's U.S. job report.

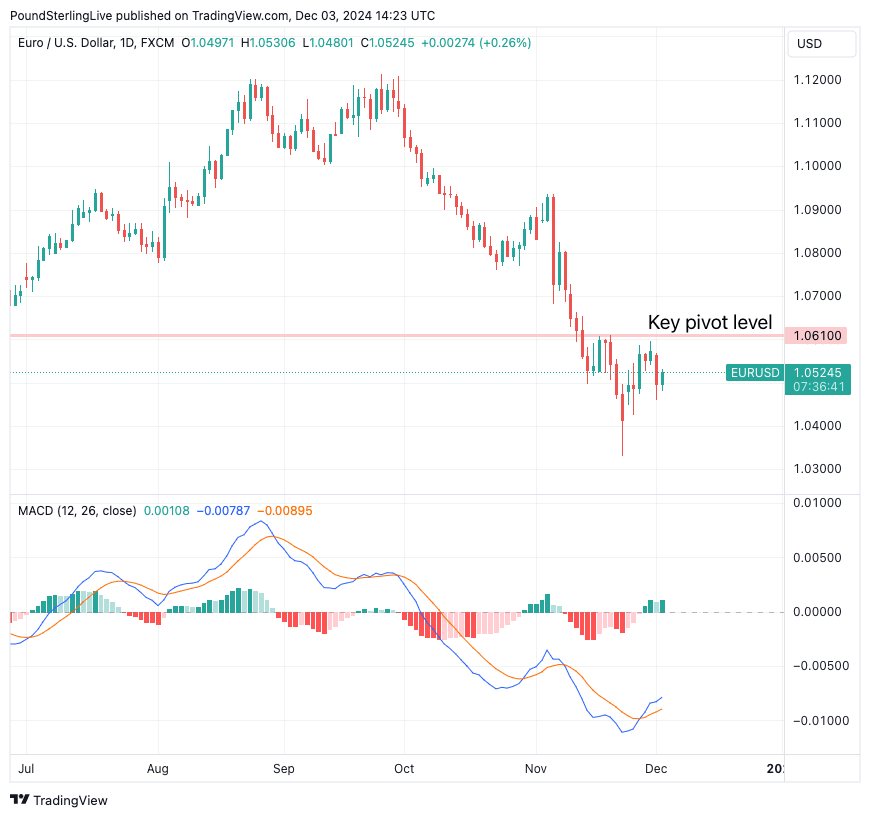

If the data undershoots, the Euro-Dollar can recover to the recent pivot high of 1.0610/1.0635.

Above: EUR/USD at daily intervals with MACD divergence in lower panel.

Tanmay Purohit, a technical analyst at Société Générale, says the daily MACD registered multi-month lows and has now crossed above its trigger line, "highlighting receding downward momentum."

He notes EUR/USD has carved out an interim low near 1.0330 last month and has staged an initial bounce.

"However, a move beyond 1.0610/1.0635 is crucial to confirm a meaningful bounce. There will be risk of continuation in decline if EUR/USD fails to overcome 1.0610/1.0635. Below 1.0330, next potential supports are located at projections of 1.0200 and 1.0070/1.0000," says Purohit.