"The Dollar is Defying its Critics, Once Again" - Corpay

- Written by: Sam Coventry

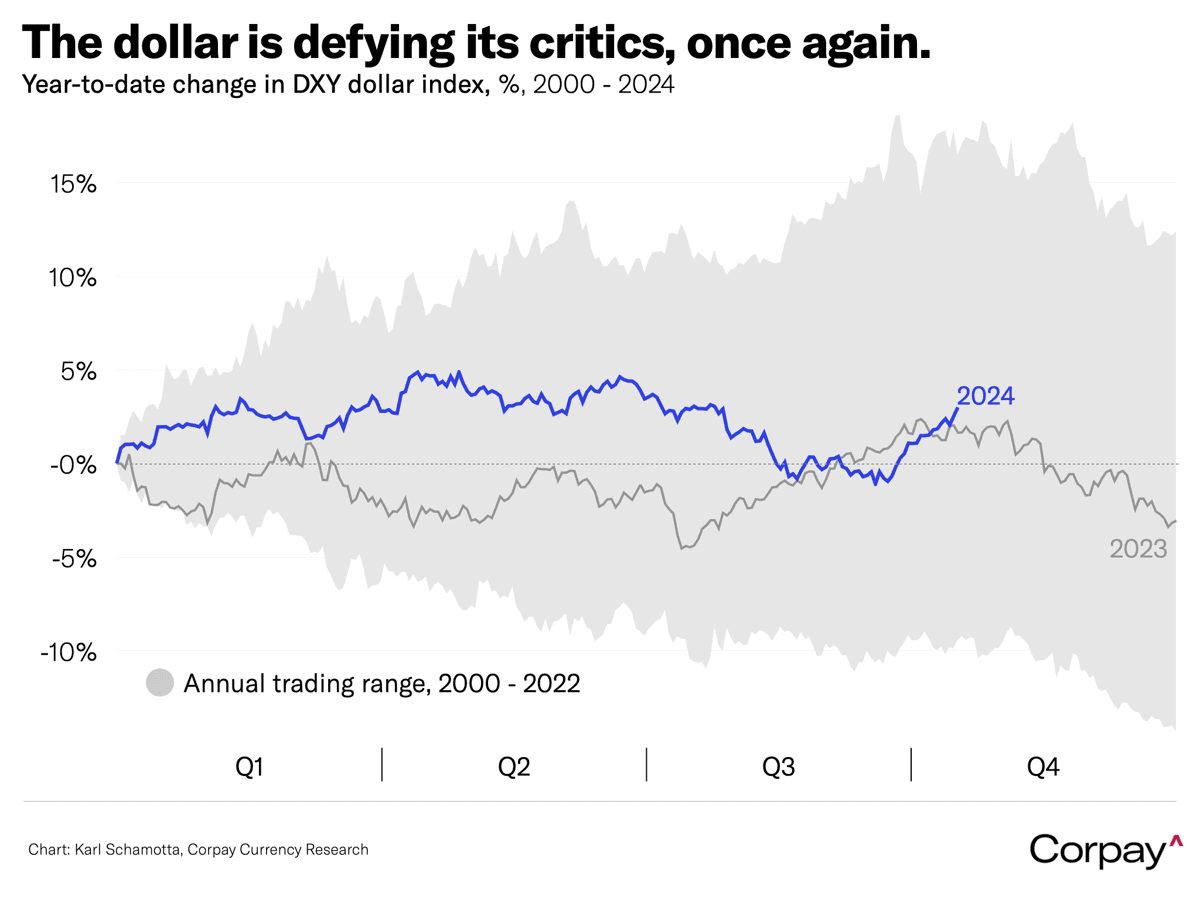

Demand for the dollar keeps climbing, says Karl Schamotta, Chief Market Strategist at Corpay.

"With less than two weeks to go before the next Federal Reserve meeting and the US presidential election, global investors are piling into the greenback, cutting wagers on an aggressive easing cycle, and betting that the next administration’s policy mix will inflict serious damage on other major economies while generating higher levels of inflation at home," he explains.

The Euro-Dollar exchange rate is trading at its lowest level since July at 1.0772, marking the extension of a run of four consecutive weekly declines.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

On the final day of September Euro-Dollar was as high as 1.12, with markets thinking at least 75 basis points of cuts were in the pipeline for the remainder of the year.

Now, markets see only one and investor nerves are growing as the prospect of a second Donald Trump presidency is seen as odds-on by betting markets.

"The DXY dollar index is up almost 4 percent from its late September low, options markets are pointing to a growing appetite for hedges against extreme moves around the polling date, and currencies that have strong trade links with the US - the euro, yen, Chinese yuan, Canadian dollar, and Mexican peso - are all trading with significant risk discounts," says Schamotta.

Looking ahead, Schamotta says a peak in the dollar could come into view once early November’s event risks are resolved.

"The Fed’s gradualist message should be well-incorporated in markets by then - and although markets may be surprised by the election’s outcome, they shouldn’t be shocked," he explains.

"In contrast with the Brexit referendum and presidential election upset in 2016, betting odds now strongly favour a Trump victory, and the noise level in the financial media has reached astounding levels, suggesting that the number of unprepared investors and unhedged organisations is diminishing quickly," he adds.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.