Euro-Dollar to Surpass 2023 Highs, Before Falling to Parity: BCA

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro has fallen against the U.S. Dollar in midweek trade, but the rally can continue a little while longer before a more concerted breakdown takes it down to parity.

This is according to BCA Research, the independent research providers, who think the Euro's recent strength is flattered by the Dollar's pre-Fed rate cut underperformance.

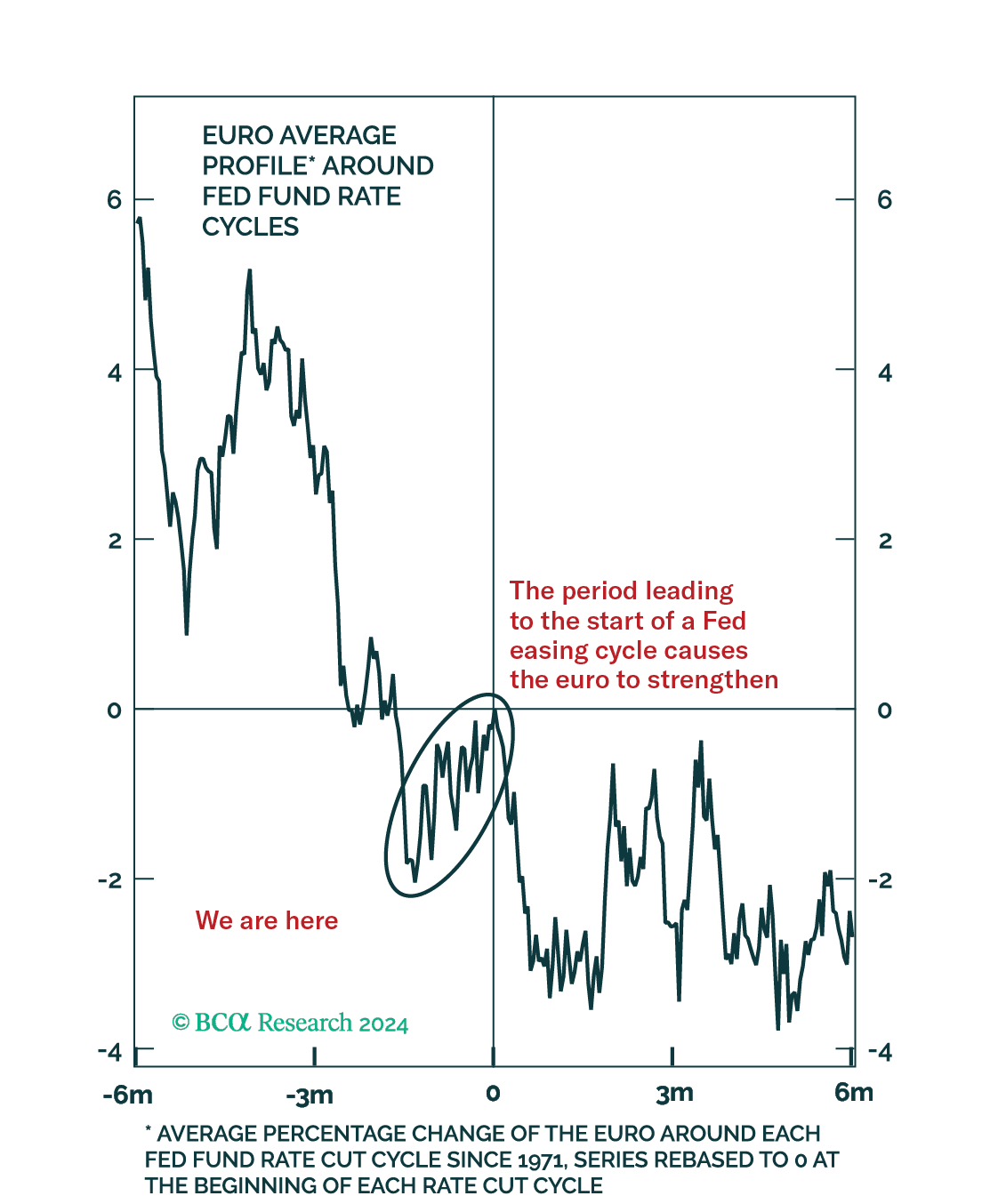

"The euro’s continued strength caught us off guard. However, it is a common pattern ahead of the start of Fed rate cuts. EUR/USD will weaken this fall," says Mathieu Savary, Chief European Strategist at BCA Research.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Euro to Dollar exchange rate is up 3.0% in August, but is coming off its peak at the time of writing. In fact, the exchange rate is down half a per cent on the day, which, if sustained into the close, would be its biggest daily loss of August.

But Savary says he is on the sidelines regarding Euro-Dollar and "will again consider selling EUR/USD closer to the Fed’s September meeting."

"Over the next four weeks, it is likely that EUR/USD will surpass its July 2023 high of 1.13. However, this level will constitute a selling point," he says.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Euro has, alongside the rest of the G10 currency complex, benefited from rising expectations that the Federal Reserve will cut interest rates in September. These expectations were turbo-boosted by Fed Chair Jerome Powell's recent speech to the Jackson Hole Symposium, where he said "the time had come" to act.

Analysts we follow point out that Euro-Dollar's advance comes despite the Eurozone's shaky fundamentals, which were confirmed by this week's German GDP figures that showed the region's largest economy shrank by 0.1% quarter-on-quarter in Q2. The German ifo survey showed current conditions deteriorated further in August, and German consumer confidence for September fell against expectations.

With Q3 survey data deteriorating relative to Q2, this raises the risk of a shallow German recession. Last week's release of Eurozone PMI data meanwhile showed a deterioration in expectations amongst Eurozone businesses, which bodes for a softening in activity over the coming months.

"EUR/USD Rallies Ahead Of Fed Easing Cycles And Then Relapses" - BCA Research.

BCA says industrial production in the Eurozone, Japan, and Sweden is weakening and, "this creates a dangerous environment for the pro-cyclical EUR/USD." (He says in a recent research note that Sweden acts as a 'canary in the coal mine' for Europe).

In addition, weakness in the employment component of the Eurozone PMI report suggests that European employment is likely to worsen in the coming months, which can prompt the European Central Bank to cut rates faster than markets currently anticipate.

Savary says, "the ECB is unlikely to lag the Fed’s pace of easing over the next 16 months, as money markets currently anticipate. Given EUR/USD has become overbought, the reward-to-risk ratio in chasing EUR/USD higher is becoming increasingly poor."

BCA Research expects the euro to test parity against the dollar early next year, "once investors begin to worry about a global recession, and the relative mispricing between the Fed and the ECB corrects."