Euro Strength Can Extend into First Fed Cut

- Written by: Sam Coventry

Image © European Central Bank

The Euro to Dollar exchange rate (EUR/USD) looks fatigued following its blistering rally, but it might not yet be ready to top out just yet.

"Momentum is showing signs of fatigue," says Ruta Prieskienyte, Lead FX Strategist at Convera. However, "the exchange rate can potentially test the 30-month range ceiling around mid-$1.12s, which would be the July 2023 high."

The Euro is up 2.62% against the Dollar in August, having peaked at 1.1174 on Wednesday following the release of the minutes of the Federal Reserve's end-July policy meeting. The minutes showed many members of the decision-making body were ready to cut rates at the meeting, bolstering expectations for a September cut and further subsequent cuts in the coming months.

"Aggressive U.S. easing bets have recently overshadowed the economic weakness in the Eurozone. The euro’s 3% rally in August has been relentless, pushing it to a one-year high against the dollar on Wednesday," says Prieskienyte.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The quantum of rate cuts expected from the Fed have grown faster than those expected from the European Central Bank over the past three weeks, creating a classic divergence in rate expectations that weighs on the Dollar relative to the Euro.

Looking ahead, those watching Euro-Dollar must ask to what extent this situation can continue. The risk for euro bulls is that the trade has run its course, which raises the prospect of a sharp pullback, especially when the focus returns to the Eurozone.

"We maintain a three-month bearish outlook for EUR/USD due to lingering political risks in both the Eurozone and the U.S., but we acknowledge that the euro’s ascent may continue leading up to the first Fed rate cut in September."

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

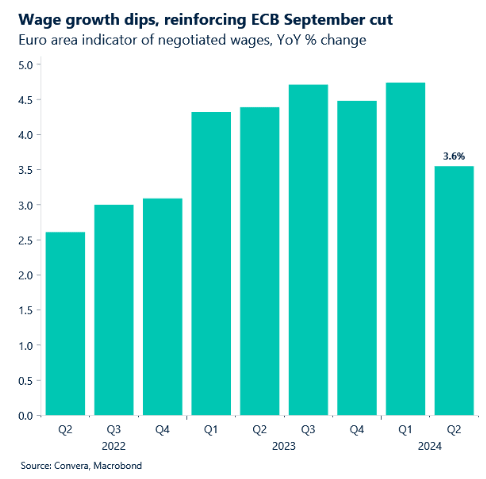

PMI data for August meanwhile revealed a subdued outlook for the Eurozone economy, and the European Central Bank's wage tracker showed a pullback that is consistent with further declines in inflation. For the Euro, this raises downside risks if it encourages the ECB to cut rates further than markets currently anticipate.

Image courtesy of Convera.

The ECB data showed negotiated wages came in at 3.6% year-on-year in Q2 2024, down from the 4.7% year-on-year observed in the previous quarter.

"This reduction eases concerns over a wage-price inflation spiral. However, the picture is not entirely straightforward, as wage growth slowed in France, the Netherlands, and Austria but accelerated in Belgium, Italy, and Spain. Nonetheless, the overall trend points towards easing price pressures, signalling a green light for monetary easing," says Prieskienyte.