Dollar Dump Pushes Euro-Dollar Through key Level

- Written by: Gary Howes

Image © Adobe Images

A selloff in the dollar following the UK inflation print looks to have contributed to a break higher in the euro to dollar exchange rate.

The dollar is under widespread pressure as FX markets navigate the midweek session, with a rally in the GBP/USD exchange rate and a potential FX market intervention by the Bank of Japan boosting the Euro's value.

Dollar selling followed the release of a firm UK services inflation figure that pared the odds of an August 01 rate cut at the Bank of England.

Traders say initial USD weakness appears to have catalysed a response by the Bank of Japan which bought yen and sold dollars in order to bolster the value of its currency.

The combined weight of dollar selling has tripped technical levels in the Dollar index - a measure of broader dollar value - which has, in turn, impacted Euro-Dollar.

"EUR/USD and GBP/USD has broken key resistance levels (at 1.0920 and 1.3000 respectively), while DXY breaks key support at 104," says Sarah Ying, Head of FX Strategy at CIBC Capital Markets.

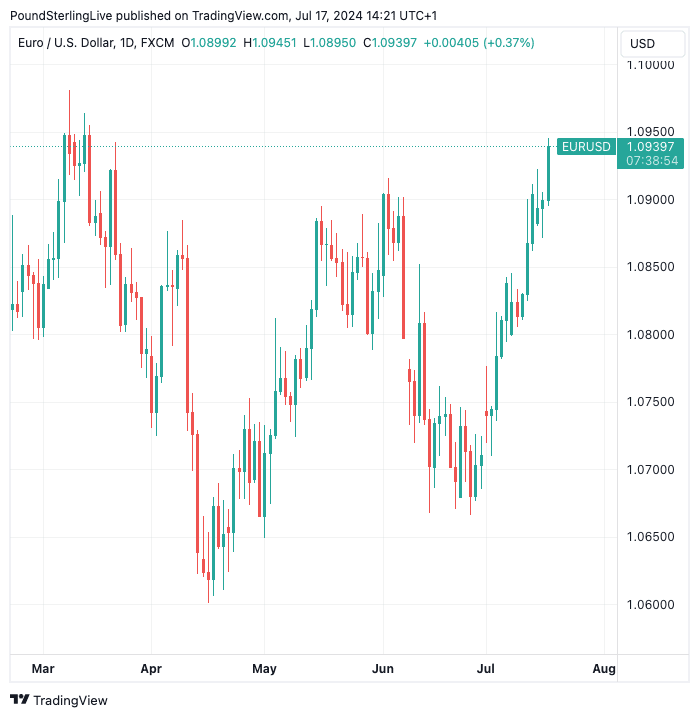

Above: EUR/USD at daily intervals. Track EUR/USD with your custom alerts; find out more here.

Euro-Dollar is 0.40% higher on the day at 1.0943, taking it to levels last encountered in March.

"EUR/USD materially breaks past resistance of 1.0910/20 this morning, though we will see if that level can hold. We suspect most of the move is driven by an aversion for the USD (for example amid Trump comments) as opposed to any positive alpha stemming from the EUR leg as final June CPI printed in line," says Ying.

Both President Donald Trump and his running mate, JD Vance, have argued that the U.S. currency should be weaker to support American exports.

The euro's gains come just hours before the European Central Bank's (ECB) Thursday decision, where it will say it is keeping interest rates unchanged.

Market interest will instead focus on whether the central bank signals it is comfortable with a second rate cut at the September meeting.

To be sure, September is already seen as odds-on for the next move (80% probability), which means the Euro will see a limited downside in the event markets move to fully price in a September cut following the upcoming meeting.