Euro-Dollar Rebounds as Anti-National Rally Bloc Firms, Eurozone Inflation, U.S. Jobs Also in Focus

- Written by: Sam Coventry

National Rally leader Jordan Bardella reacts to the initial election results.

The Euro and European assets are rising after Marine Le Pen's National Rally party didn't do as well as some had predicted in Sunday's vote, but an action-packed week lies ahead for both the Euro and Dollar.

The Euro to Dollar exchange rate is trading higher by 0.4% at 1.0755 as markets welcome signs that neither the far-left or far-right will be able to control France's legislature after the second round of voting is completed this coming Sunday.

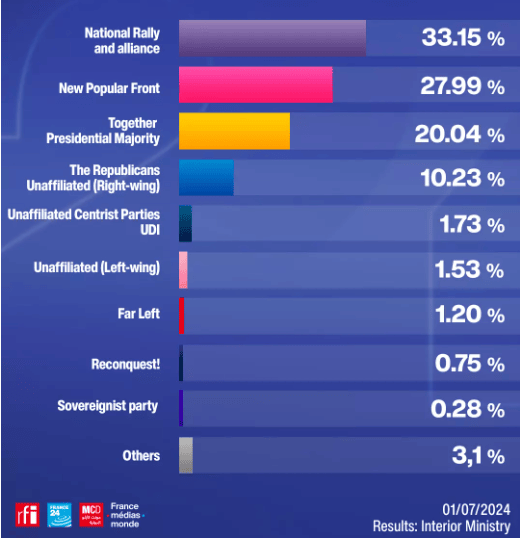

This after the first round of votes showed Marine Le Pen's National Rally didn't do quite as well as expected, securing approximately 34.2% of the vote at the time of writing, whereas the final poll of polls had it on about 36.2%.

"The first round of the French elections perhaps delivered a slightly less convincing victory for the far-right than final polls suggested and with other parties now seemingly open to form alliances in the second round, this is likely to further reduce the far-right's chance of an overall majority in parliament. This has helped the Euro to move +0.40% higher overnight to trade at 1.0756 against the dollar," says Jim Reid, a strategist at Deutsche Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The New Popular Front looks to be on about 29% and Ensemble, Macron’s coalition, on about 22%. The New Popular Front has indicated it will remove its third-place candidates, which would deny the National Rally the chance of winning seats in constituencies where a three-way showdown will occur.

Over half the 577 parliamentary seats, a historically high number, are expected to go to the second round, and much tactical voting is now likely.

"The French election results have led to a sigh of relief from financial markets, and the euro is higher at the start of this week," says Kathleen Brooks, an analyst at XTB. "Although Marine Le Pen’s party won the largest share of the vote, the second round of voting could prove tricky for the Far Right to win an outright majority."

Image courtesy of France 24.

French President Emmanuel Macron on Sunday called for a "broad" democratic alliance against the far-right after the National Rally party won the first round of parliamentary elections according to estimates.

"Faced with National Rally, the time has come for a broad, clearly democratic and republican alliance for the second round," he said in a statement. He also said that the high turnout in the first round spoke of "the importance of this vote for all our compatriots and the desire to clarify the political situation."

Looking at the calendar, numerous releases and speeches in the coming week can offer Euro-Dollar volatility.

The U.S. ISM manufacturing survey will be released on Monday, potentially offering further signs of an economic slowdown. Watch for German inflation figures, also due Monday.

Eurozone inflation figures are out Tuesday and will form the week's data highlight, although we suspect anticipation of the outcome of Sunday's French vote will keep any reactionary movements contained.

European Central Bank (ECB) President Christine Lagarde and Federal Reserve Chair Jerome Powell will speak at the ECB's central bank conference in Sintra, Portugal, on Monday and Tuesday. Lagarde's commentary will be important regarding market expectations for further interest rate cuts, with a debate underway as to whether there are one or two cuts in the bag over the remainder of the year.

Markets will be interested to hear updated views on the possibility of a September rate cut from Powell.

This theme continues through midweek when the Fed releases the minutes for its June 11-12 policy meeting. This should offer up some more colour to markets on the all-important question of interest rates. Wednesday also sees the ISM PMI survey for the services sector, another potential market-moving release.

As a reminder, should the market raise expectations for a September rate cut following these data and appearances, then the Dollar can fall. Any disappointments will boost the Dollar. The market is currently pricing in a 56% chance of a September rate cut.

The week's highlight will be Friday's non-farm jobs report. A headline figure of 180K is expected, down from 272K. Average hourly earnings are expected to print at 0.3% month-on-month in June.

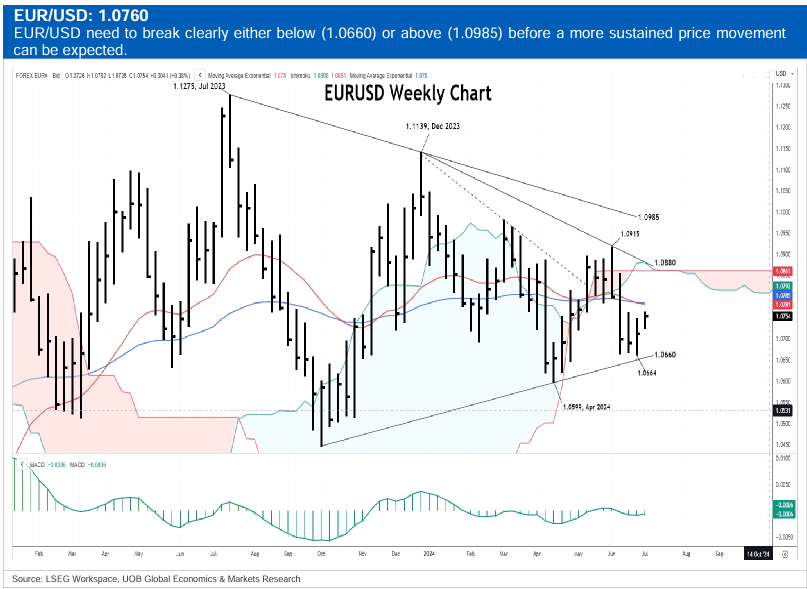

Looking further ahead, strategists at UOB say the broader Euro-Dollar setup is constructive.

"The price action appears to be part of an ongoing triangle formation. The current level of the bottom of the triangle is at 1.0640, while the top is at 1.1000. As the weekly MACD is mildly positive, the bias for EUR/USD in the third quarter of this year is tilted to the upside, towards 1.1000. At this time, it is unclear if there will be sufficient momentum for EUR/USD to break above this key resistance level," says Quek Ser Leang, Markets Strategist at UOB.

"All in all, EUR needs to break clearly either below or above the triangle before a more sustained directional price movement can be expected," adds Leang.