EUR/USD Week Ahead Forecast: Some Limited Relief With a Bearish Setup

- Written by: Gary Howes

Image © Adobe Images

What is the Euro to Dollar forecast for the week ahead? We think there is scope for a near-term rebound, although it should be shallow as the Euro will likely remain under pressure heading into the French elections.

The Euro to Dollar exchange rate is rebounding on Monday, and we look for near-term consolidation following five consecutive weekly losses.

A recent run of losses speaks of the broader pressure the exchange rate is under and is why we view any periods of strength as being short-lived, meaning those with dollar purchases in mind must be nimble.

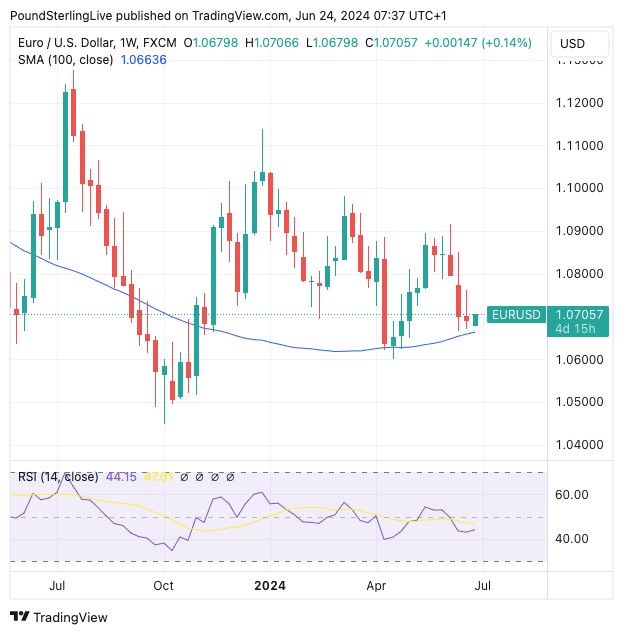

Indeed, some strength is possible in the coming days, we believe. The chart below shows the 100-day moving average coming in at 1.0663, which can potentially form the basis of a return to 1.08 in the immediate outlook.

Track EUR/USD with your own alerts, find out more here.

We warn those with payment requirements not to sit around and wait for too long, as we will need to see a couple of positive weekly closes before we would call a return to the 2024 highs.

The trend remains lower, with bounces likely to be shallow.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The ongoing French election uncertainty and the rise of far-right parties across Europe, and not to mention the recent rise in oil prices. All these factors are weighing on the euro, keeping the short-term EUR/USD outlook bearish," says Fawad Razaqzada, an analyst at City Index.

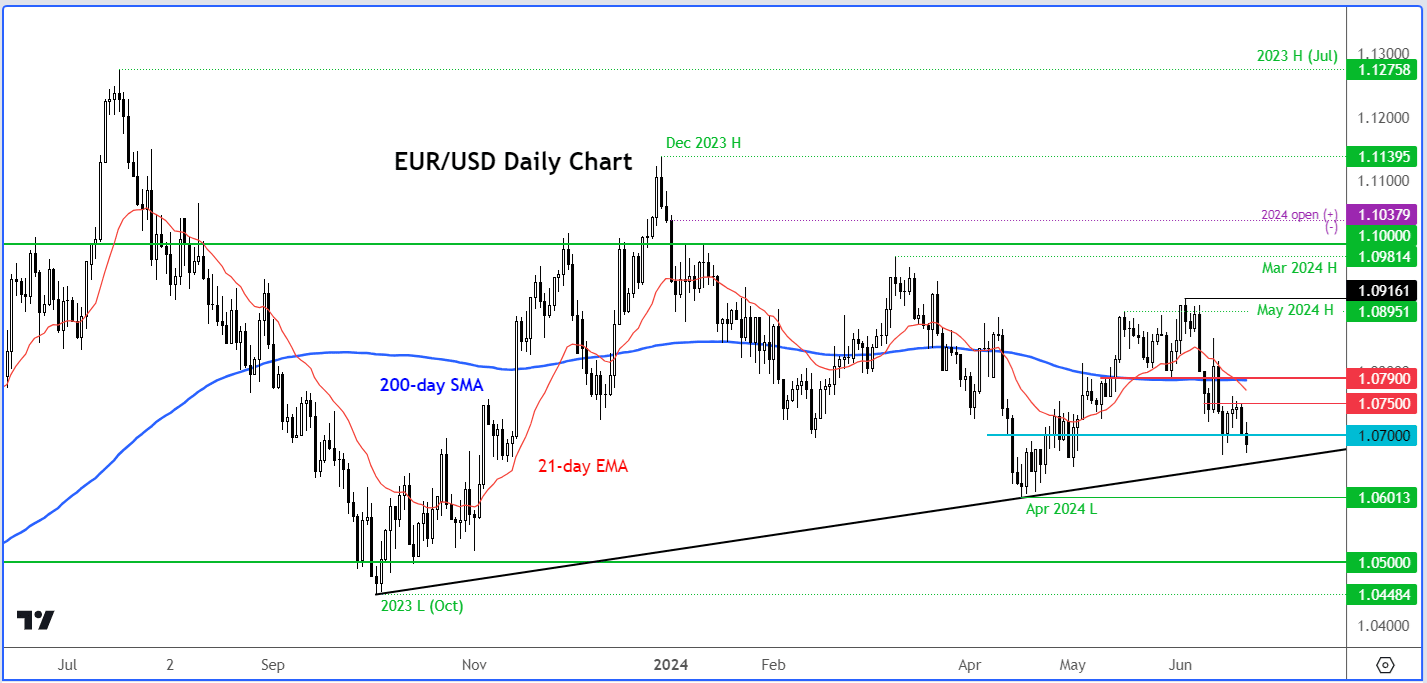

"Thanks to the renewed weakness in Eurozone data and French election uncertainty, I wouldn't be surprised if the EUR/USD continues heading lower in the short-term outlook. It may now establish a new ceiling below the 1.07 handle. The bears have already defended prior broken support levels such as 1.0750 and 1.0790 successfully," he adds.

Shaun Osborne, Chief FX Strategist at Scotiabank, says hefty losses over the latter part of the week leave the EUR testing key support again at 1.0675—76.4% retracement of the April/June rally.

"Weakness below here leaves spot exposed to 1.06, or possibly lower. A strong, positive reaction to the upper 1.06s last week suggests the EUR may be able to stabilise in the short run at least, but spot needs to regain 1.0750 quickly in order to stabilise or improve," says Osborne.

The Euro will be nervous heading into the month-end French vote, and "we expect EUR/USD to remain under pressure in sympathy with the widening OAT-Bund yield spreads, especially if we see evidence of contagion to other fiscally weak Eurozone members," says Valentin Marinov, head of FX strategy at Crédit Agricole.

Turning to the United States, the ongoing stock market rally is proving a solid source of support for the U.S. Dollar as global investors look to gain exposure to this outperformance.

Further stock market gains in the coming days and weeks can keep the Dollar on the offensive, according to forecasters.

"We think that the relative outperformance of US stocks could prove a strong enough support that could prop up the USD in the coming weeks," says Marinov.

The main data release of the coming week is Friday's PCE core inflation release, which is a key input into Federal Reserve decision-making.

Markets expect the Fed to cut later in the year. If these expectations fade, the Dollar can strengthen. But data must continue to beat expectations.

With this in mind, core PCE is expected to read at 0.1% month-on-month and 2.6% year-on-year. Dollar May expected 0.1% month-on-month, down from 0.2.

Should it beat expectations, expect the Dollar to end the week on a high, with Euro-Dollar potentially ending the week at lows not seen since mid-April (1.06).

"The mix of currency drivers could remain negative for the pair in coming months, pushing EUR/USD back towards 1.05 in 12M," says Marinov.