Euro-Dollar's Bullish Run Grows in Confidence Following U.S. Data Misses

- Written by: Gary Howes

Image © Adobe Images

The Euro is turning a corner against the Dollar as its uptrend looks increasingly sustainable.

The Euro to Dollar exchange rate rallied to a new one-month high following softer-than-expected U.S. inflation and retail sale figures that raise the likelihood of a September rate hike at the Federal Reserve.

The market is now priced for two rate cuts from the Fed in 2024 following a slowdown in headline U.S. inflation to 0.3% month-on-month, which was below the 0.4% estimate. A breakdown of the data revealed core inflation has also slowed (0.4% m/m), as has the super-core reading (0.42%).

Dollar exchange rates were softer across the board with the soft inflation docket being complemented by a disappointing 0% m/m increase in retail sales, which was far below the estimate for 0.4%.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro to Dollar exchange rate spiked to 1.0869 before paring the advance to 1.0838 by the time of writing.

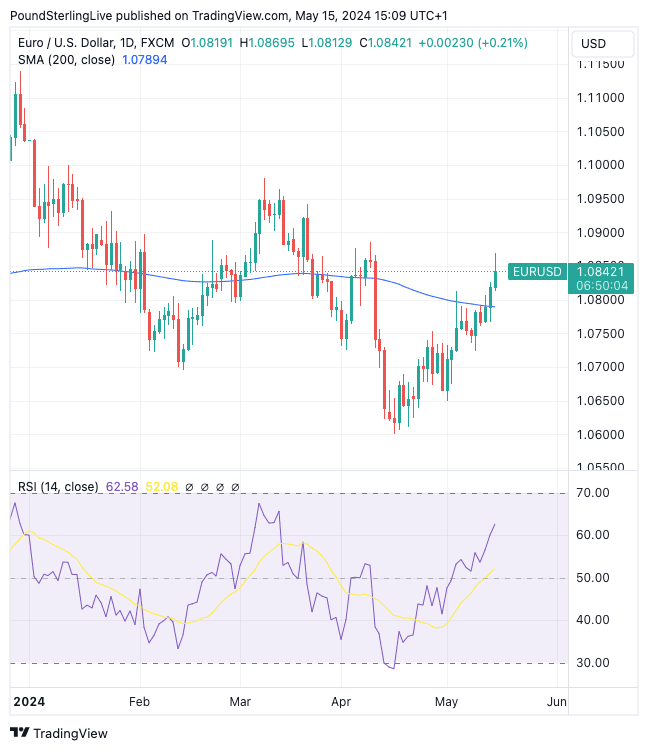

Upside momentum is firming with the RSI rising and the exchange rate breaking above the crucial 50-day and 200-day moving averages over the course of the past 24 hours:

Above: EUR/USD at daily intervals showing the RSI and 200-day moving average breach, both constructive technical signals. Track EUR/USD with your own custom rate alerts. Set Up Here

The market is increasingly confident the Federal Reserve will be in a position to cut interest rates in September, even if an earlier cut might be too much of an ask given it will take more than a month's of softer-than-expected data to convince the Fed the tide has turned in favour of disinflation once more.

The inflation and retail sales undershoots are the latest in a recent run of U.S. economic data disappointments, which are negative for the Dollar if we consider that foreign exchange movements are a function of economic surprises.

Rising stock markets and improving global sentiment have also followed the softer data surprises as forward-looking investors look to lower Fed interest rates, which are pro-growth. The Dollar is a safe haven asset that tends to fall against most of its peers in such conditions.

"We are in a period where the dollar looks vulnerable near term. Long dollar positioning has come off a touch in the past two weeks but still looks stretched," says Skylar Montgomery, an analyst at TS Lombard.

If the Euro can advance further against the Dollar, how much higher can it go? Alex Kuptsikevich, Senior Market Analyst at FxPro, says the first significant target of this rise looks like the upper boundary of the medium-term range at 1.10.

"Or even higher - to 1.1150 with a new attempt to overcome the 200-week moving average, which has turned EURUSD three times since the beginning of 2022," he adds.

But, for confirmation of a bullish reversal in EURUSD, a sustained move above 1.0860 - the April highs area - is required.

"This ability to rise further will break the downtrend that has been forming since the final days of last year," says Kuptsikevich.