EUR/USD Week Ahead Forecast: The Next Downside Targets

- Written by: Gary Howes

Image © Adobe Images

Last week's heavy losses for the Euro against the Dollar open the door to further declines in the coming days.

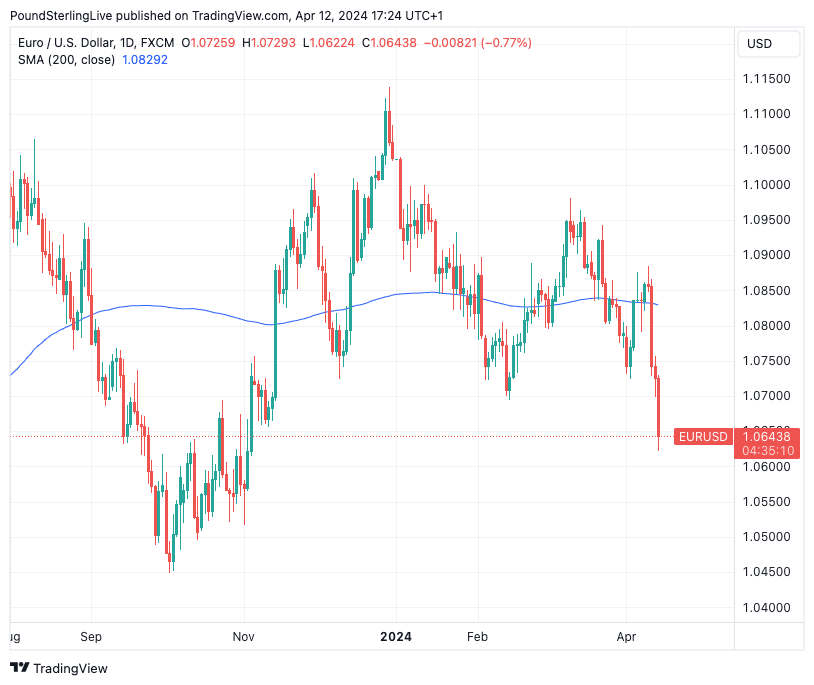

The Euro to Dollar exchange rate is exposed to further weakness after support around 1.07 failed to hold.

"A deeper retracement of the EUR Q4 rally towards 1.06, or lower still, (76.4% retracement support at 1.0611) is developing," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Above: EUR/USD at daily intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

"EUR-USD will likely remain weak below 1.07 as markets are now pricing in an earlier and deeper easing by the ECB than by the Fed this year," says Roberto Mialich, FX strategist at UniCredit Bank in Milan.

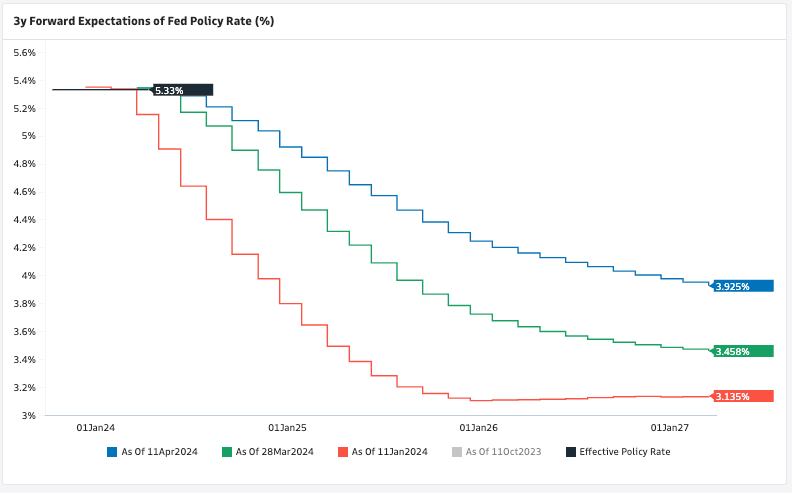

Last week the ECB validated market expectations for a June rate cut, but the significant selloff in Euro-Dollar has more to do with the rampaging Dollar. Indeed, all Dollar exchange rates have seen big moves following the massive repricing in U.S. Federal Reserve interest rate epectations.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Markets have scrapped expectations for a Federal Reserve rate hike in June and now see just between one and two hikes from the Fed in 2024 while maintaining expectations for the Bank of England and other European central banks to cut interest rates more generously.

The Dollar's strength is only reinforced by the creeping fear washing over equity markets that the rally of 2024 must bow before the realities of a higher-for-longer U.S. interest rate regime. This 'risk off' environment is proving a boon for 'safe-haven' currencies such as the Dollar, ensuring we are in a win-win setup for USD.

Mialich points out that the total amount of easing expected for this year from the Fed is around 45bp compared to the 150bp expected at the start of the year.

Above: The steady pricing out of Fed rate cuts since the start of the year has lifted the Dollar. Image courtesy of Goldman Sachs.

"On the other hand, a rate cut by the ECB in June is almost fully priced in. Markets are therefore confident that the ECB is likely to start an easing cycle before the Fed and that it will probably be heavier, as nearly 80bp of rate cuts this year are now implied by eurozone forward rates," says Mialich.

"Given this rate-cut picture, EUR-USD broke even below 1.07 and is set to remain weak for now. Even a recovery back towards 1.08 looks challenging at this juncture, unless investors return to pricing in more intense easing by the Fed than the ECB, a prospect that seems unlikely at the moment," he adds.

Alex Kuptsikevich, senior market analyst at FXPro, looks to the next possible leves Euro-Dollar can encounter, seeing 1.05 in the headlights.

"The pair will likely test the strength of this support again very soon, and the accumulating difference in Fed and ECB policy reinforces the chances that the pair will not stop there this time," says Kuptsikevich.

"If indeed EURUSD falls below 1.05 in April, the pair could fall to the next leg, finding support only near 0.95," he cautions.

Datawise, there is little on the U.S. and Eurozone calendars to concern FX markets.

That said, we will keep an eye on the U.S retail sales release on Monday: any strong reading here will only confirm solid consumer demand is driving the ongoing rise in inflation. The recent USD advance can extend should the data beat the 0.3% m/m expected by the consensus.