EUR/USD Rate Forecast: Heading for a 4th Weekly Loss

- Written by: Gary Howes

Image © European Central Bank

The Dollar surged higher at the start of the new week amidst a strong market reaction to stronger-than-expected U.S. data that has put the prospects of a June rate cut at the Federal Reserve on ice.

The Euro to Dollar exchange rate has fallen to 1.0726, its lowest level since February, after the U.S. ISM manufacturing PMI rose to 50.3 in March from 47.8 in February, comfortably beating expectations for a figure at 48.4.

The prices paid component of the report shot higher to 55.8, exceeding estimates for 52.6, suggesting that inflationary pressures facing U.S. companies are increasing again.

Following the data release, market-implied expectations for a June Federal Reserve rate cut declined, boosting U.S. yields and the Dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Technical studies confirm downside pressures on Euro-Dollar are building, with the pair now having fallen for three weeks in succession.

There is a high prospect of this being another down week, given that we are only on Tuesday and have already chalked up a 0.60% decline.

"After just one trading day, the US dollar has risen more this week than it has during the whole last one, highlighting how surprised markets were by the PMI beat," says Boris Kovacevic, Global Macro Strategist at Convera.

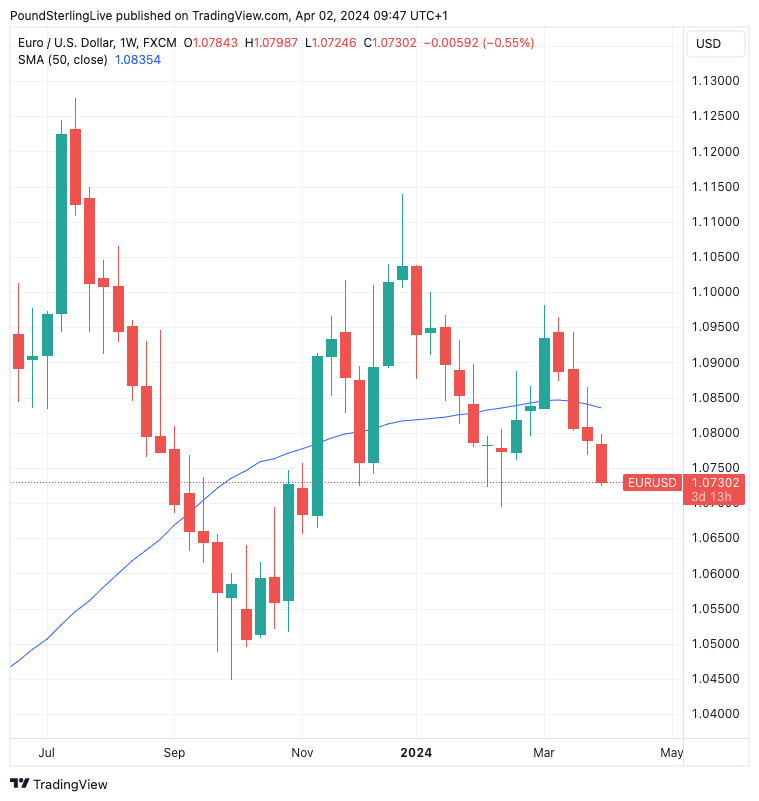

Above: EUR/USD at weekly intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

Looking ahead to this week's calendar, the ISM services PMI (Wednesday), job openings and the non-farm payrolls report will be closely watched (Friday), as will a number of Fed officials.

"EUR/USD is on track to fall for a fourth consecutive week if the data continues to come in dollar positive. This holds true especially as the incoming European inflation data is expected to put pressure on the European Central Bank to cut rates sooner than the Fed," he adds.

In the Eurozone, the midweek release of inflation figures will prove the highlight, with the single currency likely to come under further pressure if the final print undershoots the 2.6% y/y headline figure the market is anticipating.

"We expect EUR/USD to remain on a downtrend in the coming months and to hit 1.05 in Q424. A key driver of our bearish EUR/USD view is the growing policy divergence between the increasingly dovish ECB and the more conservative Fed," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Crédit Agricole thinks next week's April ECB policy meeting could add to the downside risks for the pair, especially if President Christine Lagarde 'pre-announces' a June rate cut while the updated ECB forward

guidance signals further cuts beyond that.

"The EUR could be vulnerable to any potential downside data surprises that could encourage investors to frontload their ECB rate cut expectations in the near term," says Marinov.