Euro-Dollar Higher "a Notch" As Spain and German Inflation Set to Deter ECB Rate Cut Speculation

- Written by: Gary Howes

Image © Adobe Stock

The Euro has firmed following the release of inflation figures from Spain, France, and Germany, which should keep at bay those clamouring for a Spring European Central Bank (ECB) interest rate cut.

The Euro to Dollar exchange rate held its 24-hour recovery after Germany reported a 0.4% month-on-month rise in CPI in February, up from 0.2% in January, albeit below expectations for a 0.5% gain. This took the annual rate to 2.5%, down from 2.9% and below the expected 2.6%.

The undershoot would typically be considered bearish for the Euro, but the details hint at why the single currency trades on the firmer side.

"Today's German macro data will fuel speculations about an early ECB rate cut as disinflation continues and economic activity remains weak. However, underneath the favourable headline inflation rate, there are still enough price pressures to worry about – which should deter the ECB from cutting rates too early," says Carsten Brzeski, Global Head of Macro at ING Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Brzeski says when variables like energy are stripped out, German inflation remains almost stable. "However, these favourable base effects mask a more worrying trend of monthly price increases. Particularly in the services sector, price pressure accelerated."

The ECB has expressed concerns about the reluctance of service sector inflation to decline and said it wants to see the outcome of upcoming wage settlements before deciding whether to cut rates.

Spanish CPI inflation will only embolden this wait-and-see stance as it printed at 2.8% year-on-year in February, according to the INE, down from 3.4% but above expectations for a fall to 2.7%. The annual core rate of CPI fell to 3.4% from 3.6% in January but was higher than the 3.3% expected by analysts.

"Spanish CPI, which is considered a lead indicator for the currency bloc, has risen faster than expected for February," says Kathleen Brooks, research director at XTB.

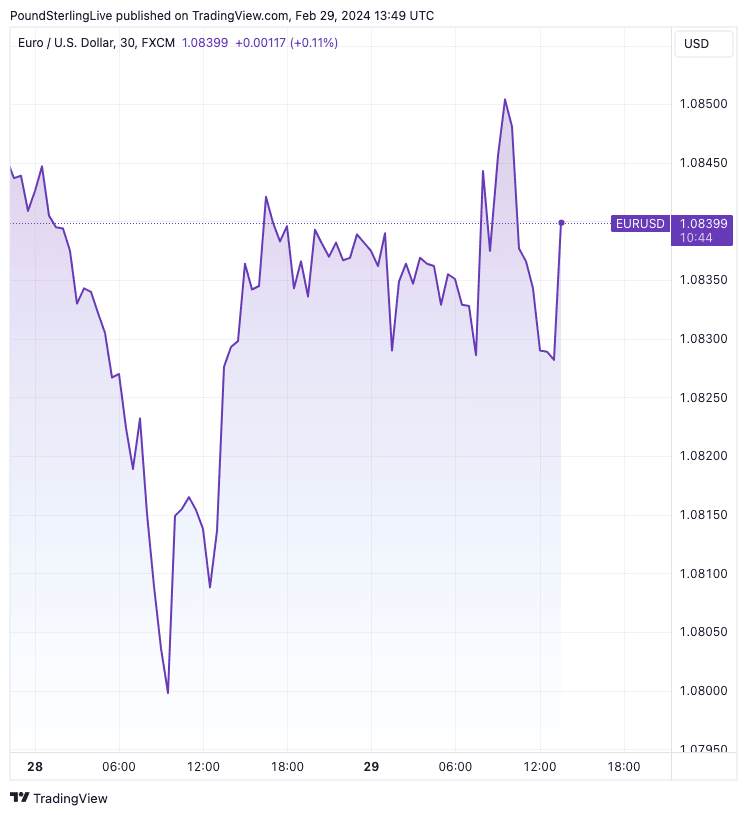

The Euro to Dollar exchange rate recovered by about a third of a per cent from midweek lows to quote at 1.0836 in the wake of the Spanish inflation data. "The stronger national CPI readings from Spain and France have pushed the euro higher by a notch," says Brooks.

Above: Euro-Dolla recovery through the course of 28-29 February. Track EUR with your own custom rate alerts. Set Up Here

Meanwhile, France recorded a 3.1% y/y increase in inflation, down on January's 3.4% but still above the consensus expectation for 3.0%.

These data suggest Friday's all-Eurozone CPI inflation figures might not provide the 'smoking gun' euro bears require for a sustained selloff. This is because the European Central Bank (ECB) says it will only cut interest rates once it is confident inflation is falling to the 2.0% target on a sustained basis.

For the Euro to fall relative to the Dollar and Pound, markets need convincing that the ECB will cut sooner and faster than peers in the UK and U.S.

Given these inflation data, there is little risk of this happening, which can underpin Euro exchange rates near current levels.